In the corporate sector, consolidation is finally gaining momentum as many companies are bringing their businesses under one umbrella. In line with the trend, Aditya Birla group’s Aditya Birla Nuvo Limited (ABNL) has consolidated its branded apparels businesses under its listed subsidiary called Pantaloons Fashion & Retail Limited (PFRL).

The Boards of Directors of ABNL, PFRL and Madura Garments Lifestyle Retail Company Limited (MGLRCL) – a wholly owned subsidiary of ABNL have approved the consolidation of branded apparels businesses under PFRL, through a composite scheme of arrangement.

[rml_read_more]

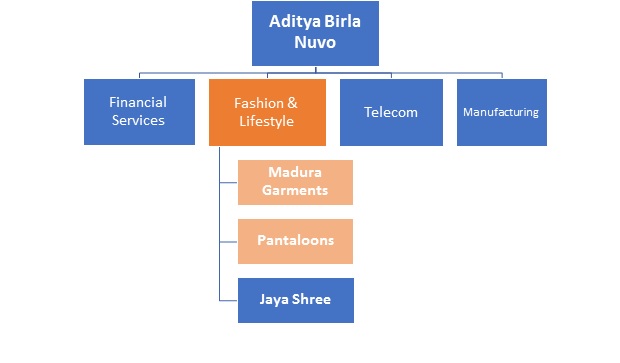

ADITYA BIRLA NUVO LIMITED:

Aditya Birla Nuvo is part of the Aditya Birla Group, a conglomerate operating in manufacturing and services sectors. Its manufacturing businesses comprise of Agri, Rayon and Insulators businesses and the service businesses comprises of financial services (life insurance, asset management, NBFC, housing finance, private equity, broking, wealth management, online money management and general insurance advisory); Fashion & Lifestyle (branded apparels & Textiles) and Telecom.

Existing Structure of Aditya Birla Nuvo

Madura Garments & Pantaloons are into branded garments

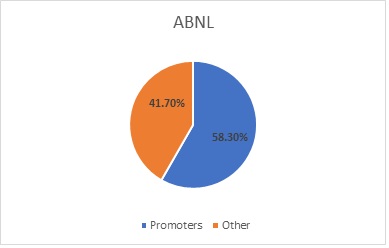

Current shareholding Pattern

Source:- Company Data

The journey so far…

| Year | Particulars |

| 2000 | Foray in fashion & lifestyle business by acquiring Madura garments |

| 2001 | Foray in life insurance business through JV with Sun Life, Canada |

| 2005 | Merger of agri and other financial services in ABNL |

| 2006 | Became the largest shareholder in IDEA |

| 2012 | Acquisition of Pantaloons |

ABNL’s Fashion & Lifestyle business, comprising Madura, Pantaloons, and Jaya Shree, is the largest branded apparel player in India, selling two branded apparels every second. Presently, the apparels retail businesses of the Aditya Birla group are housed under separate entities including ABNL, MGLRCL, and PFRL. It is also the largest Indian manufacturer of linen yarn and linen fabric.

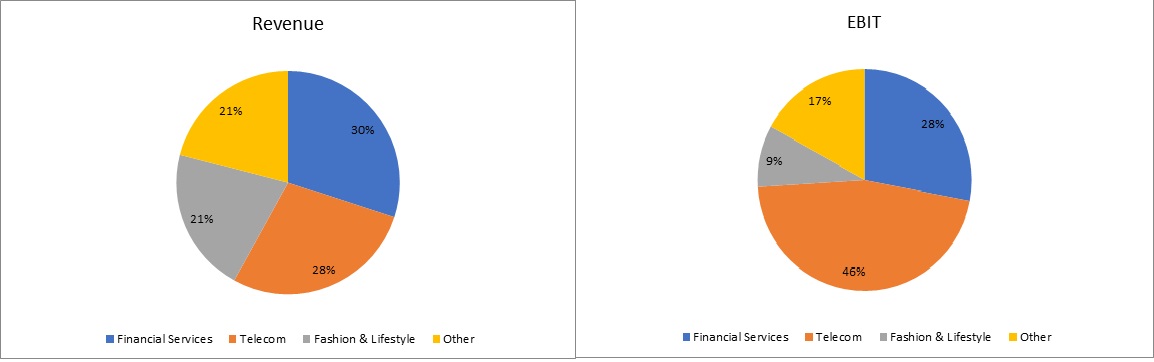

Segment-wise break-up of ABNL’s Revenue & EBIT

Source:- Company Presentation

ABOUT PANTALOONS:

Pantaloons Fashion & Retail Limited is among the top 3 large format fashion retailers and the largest branded womenswear retailer in the country. Pantaloons’ customer reach spans 104 stores and 30 factory outlets across 2.3 million sq. ft. in 49 cities as on March 31, 2015.

Aditya Birla group during the financial year 2012-13 acquired the Pantaloons Fashion business post its demerger from Kishor Biyani-led Future Retail Limited. Currently, Aditya Birla Nuvo holds its 72.62% stake in Pantaloons through its wholly owned subsidiary Indigold Trade And Services Ltd.

Current shareholding pattern

ABOUT MADURA FASHION AND LIFESTYLE:

Madura Fashion & Lifestyle (Madura) is the largest premium branded apparel player in India. Its premium brands – Louis Philippe, Van Heusen, Allen Solly and its popular brand – Peter England, are leaders in their respective categories. Louis Philippe and Van Heusen are the best-selling apparel brands in India. Madura also retails international brands like Armani Collezioni, Hugo Boss, Versace Collection, and many more under one roof ‘The Collective’. It has also launched Hackett’s mono-brand stores. Madura has also launched an online shopping portal www.TRENDIN.com, which is a one-stop online shopping destination for Madura brands, catering to both men and women.

On a combined basis, Madura Fashion and Madura Lifestyle reach out to customers through a pan India network of 1,735 exclusive brand outlets spanning 2.5 million sq. ft. and 6000+ additional points of sales as on 31st March 2015.

THE TRANSACTION:

The consolidation of retailing business will be in two steps

Step 1: Aditya Birla Nuvo’s Madura Fashion will get demerged into PFRL.

Step 2: Madura Lifestyle, a retailing division of MGLRCL will get demerged into PFRL.

Swap Ratio

- Shareholders of ABNL will get 26 new equity shares of PFRL for every 5 equity shares held in ABNL pursuant to the demerger of Madura Fashion,

- Shareholders of MGLRCL will get 7 new equity shares of PFRL for every 500 equity shares held in MGLRCL pursuant to the demerger of Madura Lifestyle,

- Preference shareholder of MGLRCL will get 1 new equity share of PFRL.

To reflect the enhanced scope of the operations post consolidation, the Board of PFRL has approved PFRL to be renamed as ‘Aditya Birla Fashion & Retail Limited’ (ABFRL).

The company’s net debt of Rs 473 crore will be transferred along with the businesses into PFRL.

While the appointed date of the scheme will be April 1, 2015, the transaction is expected to be completed in the next nine months.

Shareholding pattern of PFRL/ABFRL after proposed transaction

Source:-Company Data

In the new entity promoter of Aditya Birla Group will directly hold 51.10% and through ABNL they will hold 5.28%. Effectively their holding in the new entity will be approximately around 56.38%.

RATIONALE:

Pure- Play Fashion Lifestyle Company

On consolidation of branded apparel business under one roof, ABFRL will become India’s largest pure-play fashion lifestyle company.

India’s organised retail market is expected to grow at 18% CAGR over next few years. In FY2014 Apparel segment share in organised retail was about 28%, largest among other segments. Expansion in the size of the upper middle class and massive brand promotion has led to high brand consciousness and greater spending on luxury products. By consolidating its retail business ABRFL will be well poised to exploit this growth opportunity.

The Spectrum of Fashion

Madura is Powerhouse of India’s leading fashion brands like Louis Philippe, Van Heusen, Allen Solly, Peter England etc. while Pantaloons is the one of India’s largest big-box affordable fashion retailer. Madura garment retails some of the international luxury & super premium brands while Pantaloons is more into premium and sub premium brands. On combining both of them ABRFL will offer the entire spectrum of fashion to customers from high class to middle class.

Madura is heavily skewed towards Men’s wear. Women’s wear business accounts for just about 10% of the business. In Pantaloons, Women’s business share is 45% and Men’s is about 35% and balance 20% is of kids and accessories. On combination, Madura will get exposure to women wear.

Retail Network

Currently, Madura’ retail channel comprise 1735 exclusive brand outlets while Pantaloons having 134 stores. On combining, ABRFL will have a largest retail network with 1869 stores spanning 5 million sq.ft.

Unlocking value

This consolidation of lifestyle business under one roof would provide direct access to the shareholders to play on the efficient and promising fashion lifestyle business directly through ABFRL.

Apart from above, there will be multiple operating synergies such as experienced management team, infrastructure, supply chain & IT.

VALUATION:

On completion of the transaction and issuance of new stock, the existing base of 92.8 million shares of Pantaloons Fashion will expand to more than 770 million. That means roughly Madura was valued 7 times than that of Pantaloons. The main reason for this could be Madura is contributing to ABNL’s chunk of profit while Pantaloons is still a loss making entity and the massive network of Madura’s stores.

Estimated Value of both undertakings:-

| Division | Estimated No. of shares to be issued by PFRL | Share price of PFRL as on 30.04.2015 | Valuation |

| Madura Fashion, a division of ABNL | 67,67,30,475 | 114 | 77,145 million |

| Madura Lifestyle , a division of MGLRCL | 1,26,60,915 | 114 | 1,444 million |

Current market cap of Pantaloons is around INR 1595 crore. After consolidation estimated market cap of the new entity will be about 14,000 crores.

FINANCIA:

INR in crore

| Particulars | Pantaloons | Shoppers Stop (Standalone) |

| FY 2014-15 | ||

| Total Revenue | 1851 | 3042 |

| EBIT | (108) | 121 |

| EBIT Margin | – | 3.97% |

| Net Profit | (228) | 40 |

| No. of stores | 134 stores | 72 stores |

| Market Cap as on 26.05.2015 | 1782 | 3297 |

INR in crore

| Particulars | ABNL (Consolidated) | Branded apparel Business of ABNL (Standalone) | Branded apparel Business of ABNL (Consolidated) |

| FY 2014-15 | |||

| Revenue | 26,516 | 3548 | 5450 |

| EBIT | 4095 | 400 | 261 |

| EBIT Margin | 15.44% | 11.27% | 4.78% |

| Capital Employed | 25,006 | 531 | 2,811 |

Madura Garments contributes significantly in ABNL’s chunk of profit against loss making Pantaloons. Creating pure-play in fashion by consolidating its branded apparel business will help Pantaloons in making a profit and to increase its number of stores significantly. Currently, Pantaloons peer competitor Shoppers Stop is far ahead of Pantaloons. Consolidation may change the game by Pantaloons being a strong competitor to Shoppers Stop.

CONCLUSION:

Aditya Birla group is known for its Mergers and Acquisitions. Earlier this year, they consolidated their chemical business under ‘Grasim’. Now Birla’s are betting on retail business. Madura Garments is cash generating while Pantaloons is seeking cash to grow. In terms of profitability, Pantaloons is far behind its competitor Shoppers Stop. This bold move is likely to help Pantaloons to generate enough cash for its growth plans.

Retail business works on thin margins with volumes largely driving growth. Significant competition is now the entry of online retailers. Apparel E-tailing is gaining increasing transaction volume on the back of increasing time-poverty, changing lifestyles, convenience and flexibility of shopping from home. Consolidation seeks to both counter the competition as well as be more focused on bringing all its apparels under one roof. Such a move will also enable Birla’s expanding their network in tier II and tier III cities where e-commerce is rapidly expanding.

Time will tell whether the restructuring will lead to unlocking value for the shareholders of ABNL.