Gujarat Fluorochemicals Limited (GFL) is a part of INOX Group, a family owned, professionally managed business group, with market leadership in diverse businesses including Industrial Gases, Refrigerants, Chemicals, Cryogenic Engineering, Renewable Energy and Entertainment. Further, through investments in its subsidiaries, the Company is also engaged in Wind Energy, Wind Farming, Entertainment and other businesses. GFL along with Its subsidiaries operates in the chemicals business along verticals such as refrigerant gases, fluoropolymers, commodity chemicals and speciality Fluro intermediates. It is engaged in manufacturing of chloromethanes, refrigerants and Polytetrafluoroethylene (PTFE) in India and caters to clients across the globe.

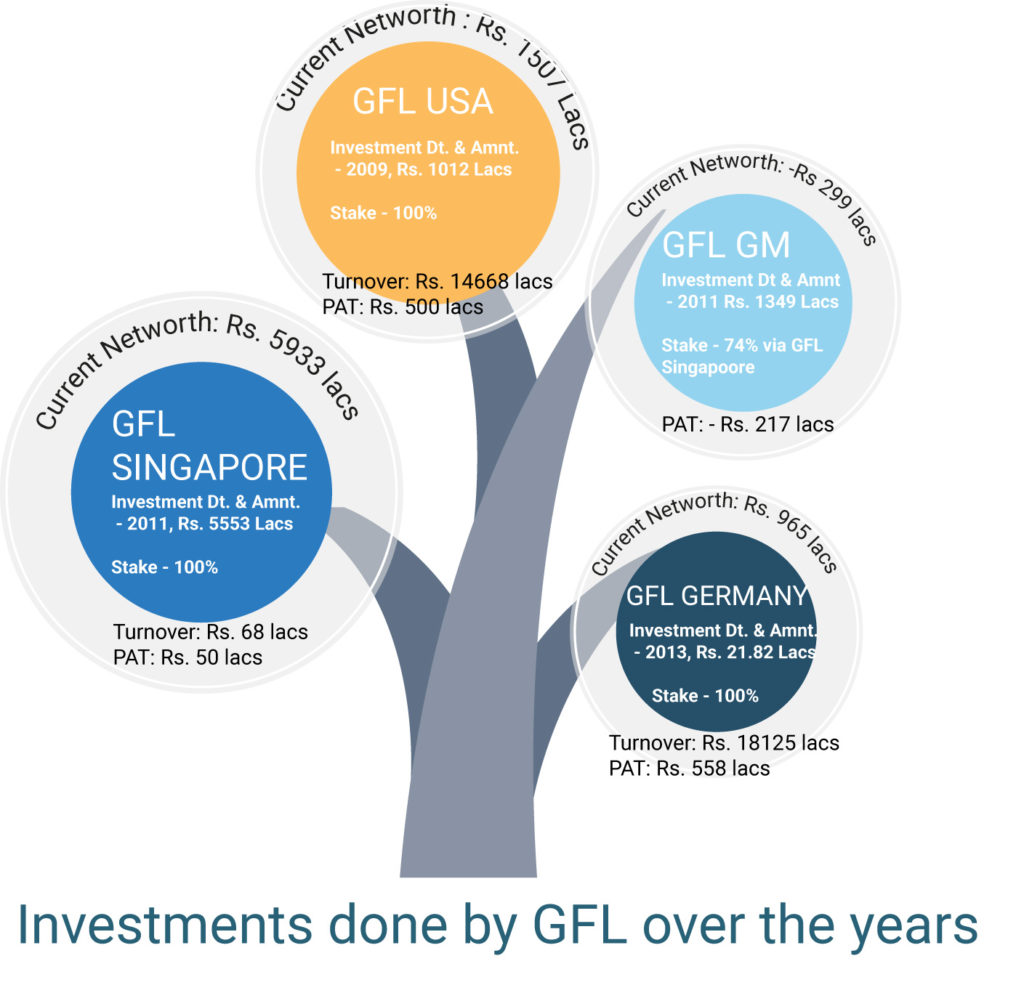

GFL USA operates in the US market and is primarily engaged in the manufacture, trading and sale of Post Treated PTFE Compounds. GFL Singapore has been set up to carrying the group’s investment activities. GFL Germany operates in the European markets and is primarily engaged in trading of polymer compounds specially, post-treated PTFE. GFL GM Fluorspar SA (“GFL GM”) is a joint venture company established for the purpose of mining of fluorspar in Morocco. GFL GM is venture between GFL Singapore and Global Mines SARL.

Investment related to Chemical business is as follows (Rs. in Lakhs):

Transaction

Demerger of chemical business undertaking from GFL into Inox Fluorochemicals Limited from appointed date 1st April 2019 with swap ratio as 1: 1 equity shares. Chemical Business Undertaking comprises, business, activities and operations pertaining to business of chemicals of GFL, together with the equity shares held by GFL in GFL USA, GFL Singapore, GFL Germany and GFL GM. The remaining undertaking mainly consists of invest in subsidiaries and surplus assets

Name Change post approval of transaction is as follows:

- Gujarat Fluorochemicals Limited as GFL

- Inox Fluorochemicals Limited as Gujarat Fluorochemical Limited

Rationale

- The scheme will allow the management to have a focused growth strategy for each of the business as independent legal entity

- Segregating different business having different risk and return profiles

- Providing investors with better flexibility to select investments

- Unlocking value of chemical business for all stakeholders

Financial Statements on consolidated basis (Rs. In Lakhs)

| Revenue | FY 2018 | FY 2017 |

| Chemicals(Demerged Undertaking) | 2,15,253 | 1,56,952 |

| Wind Energy Business | 48,303 | 3,40,976 |

| Power | 18,575 | 22,144 |

| Theatrical Exhibition | 1,34,807 | 1,22,066 |

| Total Segment Revenue | 4,16,938 | 6,42,139 |

| Demerged Undertaking as percentage of Total | 51.63% | 24.44% |

Chemical business has grown substantially (approx. 50%) in FY 2018 whereas Wind energy business declined (almost to 15%) substantially due to industry downturn. For Current Financial Year Chemical business is growing at similar rate whereas the wind energy business has shown exponential growth (over 300%) in current year on 80% declined in FY2018.

| Results | FY 2018 | FY 2017 |

| Chemicals(Demerged Undertaking) | 43,890 | 16,243 |

| Wind Energy Business | -18,080 | 49,227 |

| Power | 5,787 | 9,670 |

| Theatrical Exhibition | 12,098 | 6,142 |

| Total Segment Result | 43,694 | 81,282 |

| Less: Un-allocable Income (net of un-allocable expenses) | 13,127 | 10,840 |

| Less: Finance cost | 27,922 | 27,899 |

| Total Profit before tax and exceptional items | 28,900 | 64,223 |

Please Note: Even though finance cost is in the books of the GFL is loans are utilised to make investment in subsidiaries not related to the Chemical Business. Major finance raised as loan has been used in wind energy and Power business and whether going forward fund required by this businesses will have to be raised on individual basis.

| Segment Capital Employed | FY 2018 | FY 2017 |

| Chemicals | 3,15,614 | 2,74,226 |

| Wind Energy Business | 2,84,650 | 3,30,436 |

| Power | 37,889 | 1,22,345 |

| Theatrical Exhibition | 85,882 | 80,453 |

| Others, Un-allocable and Corporate | -1,28,066 | -2,47,488 |

| Total Segment Capital Employed | 5,95,968 | 5,59,972 |

| Demerged Undertaking as percentage of Total | 52.96% | 48.97% |

The Chemical business from the current year has started to contribute more than 50% of revenue consolidated basis and the capital employed by the company is more than 50%.

The details of remaining undertaking on standalone basis:

| Sr. No. | Investment in subsidiaries | Amount (Rs in lakhs) |

| 1 | Inox Leisure Limited | 9,012 |

| 2 | Inox Wind Limited | 2,529 |

| 3 | Inox Infrastructure Limited | 5,000 |

| 4 | Inox Renewables Limited | 12,896 |

| 5 | Other Investment (Mutual Fund, Alternate Investment Fund and Venture Capital Funds) | 45,450 |

| 6 | ICD to subsidiary Companies (mainly Inox Renewables) | 39,943 |

| 7 | Total Capital Employed other than Chemical business on standalone Basis | 1,14,831 |

Capital Employed and return in chemical business on standalone Basis

| Capital Employed on Standalone | ||

| 1 | Capital and reserves and Surplus | 3,47,912 |

| 2 | Borrowings | 74,971 |

| 3 | Total Capital Employed | 4,22,884 |

| 4 | Capital Employed in Chemical Business | 3,08,053 |

| 5 | ROCE of Chemical Business | 14.25% |

Valuation

Since it is Demerger with mirror image no valuation has arrived for the transaction.

Accounting

Accounting as book Value as per Indian accounting standards (IND AS) 103 Business Combination prescribed under section 133 of the companies as applicable as this is common control business combination.

Conclusion

Demerger transaction will unlock value for Chemical business and the present Company will be now holding company for Inox Wind, Inox Leisure, Inox renewables and Inox infrastructure which will trade at discount as in the case of all holding companies. Till date surplus free cash flow of the chemical business used to fund other businesses done through subsidiary. Now on all the businesses will be required to take care of its own cash flow requirements.

Add comment