One of the first things Samsung Electronics Co. President Young Sohn said when talking about the South Korean company’s $8 billion deal to buy Harman International Industries Inc. is that the electronics giant has no intention of building a car.

The emphasis was intentional. Samsung’s target customers are carmakers who’d love to give their vehicles smartphone-like capabilities but are leery of surrendering unfettered access to their dashboards. They’ve largely kept a distance from Google, which could mine driver data for its own uses, or Apple Inc., which until recently had designs on building its own car.

Samsung wants to marry its consumer electronics expertise and the fast 5G cellular network it’s developing with Harman’s presence in dashboards all over the world. If it works, they can offer carmakers a lightning-quick connected system for infotainment, mapping, concierge services and autonomous driving — and all without the worry that the automakers would be helping a future competitor.

“This is not about building a car,” Young said in an interview. Several automakers “came to us and asked us to help with technologies like 5G, or artificial intelligence or memory. We can harness technologies to provide a better experience to automakers.”

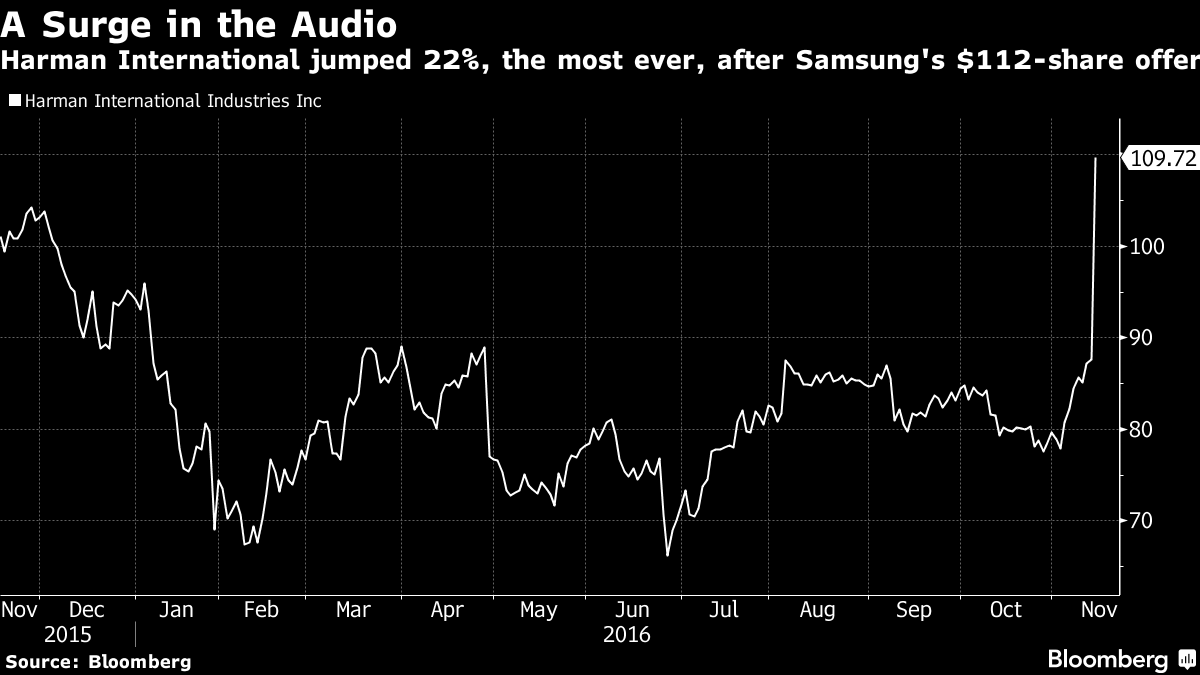

Samsung offered $112 a share in cash for Harman, which was 28 percent above the Stamford, Connecticut-based company’s closing price of $87.65 in New York on Friday. The stock closed up 22 percent to $109.72, the biggest gain since its 1986 initial public offering.

Samsung’s own shares rose on the deal, which was announced after the market closed Monday. The stock climbed as much as 1.8 percent as of 9:45 a.m. in Seoul.

The acquisition reverberated through the car business, with Wells Fargo analyst David Lim saying in a research note that the deal could “ignite additional mergers and acquisitions of higher technology auto suppliers.” The shares of automotive electronics maker Visteon Corp. jumped 9.6 percent — the most since August 2012 — and larger rival Delphi Automotive Plc gained 2.2 percent.

Deals like Samsung’s for Harman could be welcome by automakers, who want to control the revenue from connected car services and the customer data it generates as much as possible, said Jim Hines, a research director at Gartner.

‘Competitive Dynamic’

“There is definitely a competitive dynamic that has emerged between the established automotive industry and these large tech companies that are looking to get a piece of that market opportunity,” Hines said.

As automakers have rolled out connected services in their cars, they have been very careful in how they work with Google and Apple. General Motors Co. allows its customers to connect their smartphones into the dashboard through Apple’s Car Play and Google’s Android Auto — but only with selected apps, and the phones cannot access a car’s data. Toyota Motor Corp. doesn’t allow its cars to connect to either system.

The fear among carmakers is that Apple and Google could either mine the data inside the car, tracking everything from driving patterns to engine performance, to either become a new face to the consumer or to help them build cars. The fact that Harman is already a supplier and that Samsung doesn’t have a system that competes with the in-car connected services sold by carmakers could make them a more attractive partner, Hines said.

Partner or Threat?

“They might be viewed as less of a threat in terms of tech partner for some of these leading automotive brands,” Hines said.

Samsung wants to become a high-tech supplier capable of building connected systems. Its expertise is making the hardware, like microprocessing units, and a faster 5G network to deliver more data to cars faster. Harman sells — among other technologies — 3D navigation, apps for integrating other devices into the car, active safety systems and audio systems that can access the cloud.

There are a lot of opportunities once the companies combine, Harman Chairman and Chief Executive Officer Dinesh Paliwal said in a phone interview. Imagine a car that that can read a driver’s daily schedule and automatically dial into a conference call, Paliwal said. Autonomous driving will only give drivers access to more connected capabilities for work or entertainment, he said.

“We’ll be in the best possible position because we have all the capabilities,” Paliwal said.

Overcoming Weaknesses

Assuming the merger goes through, Samsung will need to develop other capabilities, especially in software, said Cyrus Mewawalla, lead analyst at CM Research. Like Google and Apple, Samsung wants to own and provide the servers, the hardware that’s doing all the computing and the memory storage for connected cars. They also want to own the platform that runs the apps, in the way that Apple’s iOS and Android do now. While they have expertise in some things like microprocessors, they don’t have all of those capabilities, Mewawalla said.

“They’d need more than just this acquisition,” he said. “The two key weaknesses Samsung has is the software ecosystem and cloud infrastructure, and that’s where it needs to be acquiring.” Artificial intelligence, in which Samsung has recently made a deal, should be a particular area of focus in the near future, he added.

If it chooses, the company could also have the resources to develop such capabilities on its own once Harman’s 8,000 software engineers and join Samsung, which spends $13 billion a year on research and development and $23 billion in capital expenditures.

“Imagine the scale of our R&D,” Paliwal said.

Recent Articles on M&A

Source: Bloomberg.com