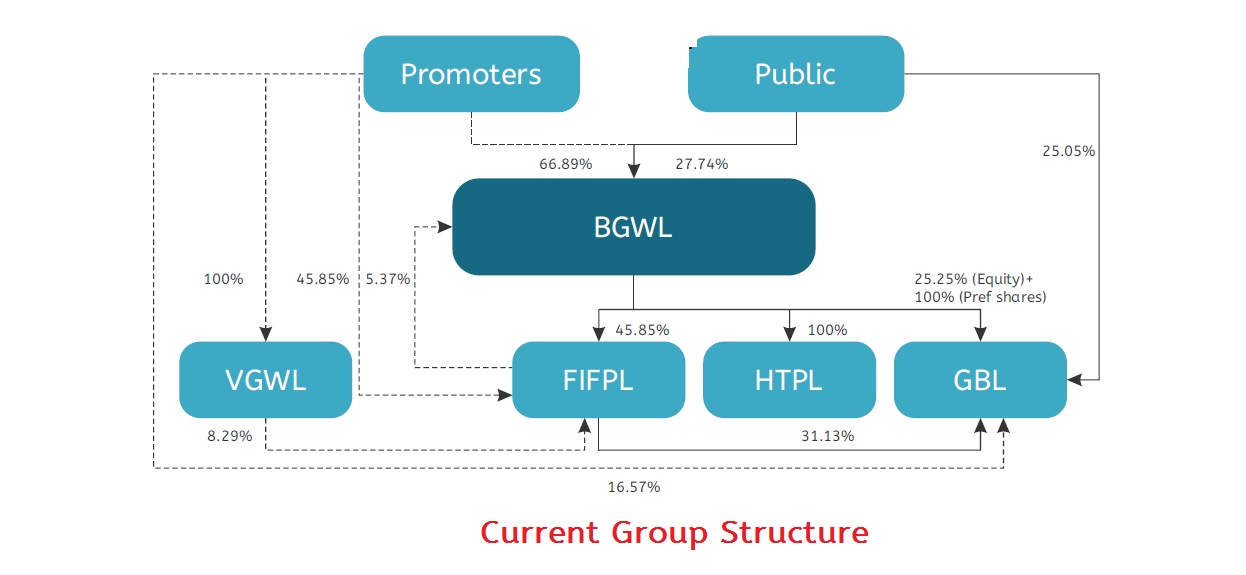

The Board of Directors of the Borosil Glass Works Limited (BGWL) has approved the consolidation of its various group entities i.e. Hopewell Tableware Private Limited (HTPL), Vyline Glassworks Limited (VGWL) Fennel Investment and Finance Private Limited (FIFPL) with the company.

BGWL, a listed company on BSE, is in the business of laboratory glassware, microwavable kitchenware and other consumer ware items.

In 2016, BGWL acquired HTPL for INR 50 crore and further enters primary pharma glass packaging business by acquiring 60.3% stake in Klasspack Private Limited. Further, during the last financial year, the company offered to buyback 6,96,000 equity shares of the company at INR 2500 per share. The company has utilised INR 174 crore for buyback of shares.

HTPL is a 100% subsidiary of BGWL and is engaged in business manufacturing and marketing of Opal tableware items.

VGWL is engaged in the business of manufacturing of glass and glass products. It mainly supplies its product to BGWL.

FIFPL is an investment company which holds 5.37 % in BGWL and 33.13% in Gujarat Borosil Limited. BGWL holds 45.85% stake in FIFPL.

Gujarat Borosil Limited (GBL), a listed company on BSE, is the first and only manufacturer of solar glass in India. Though GBL is not directly involved in the consolidation, the company is important to consider.

Current group structure

Swap Ratio

- In the case of VGWL, BGWL will issue 10 equity shares against 143 equity shares of VGWL.

- In the case of FIFPL, BGWL will issue 10 equity shares against 206 equity shares of FIFPL.

Rationale

-

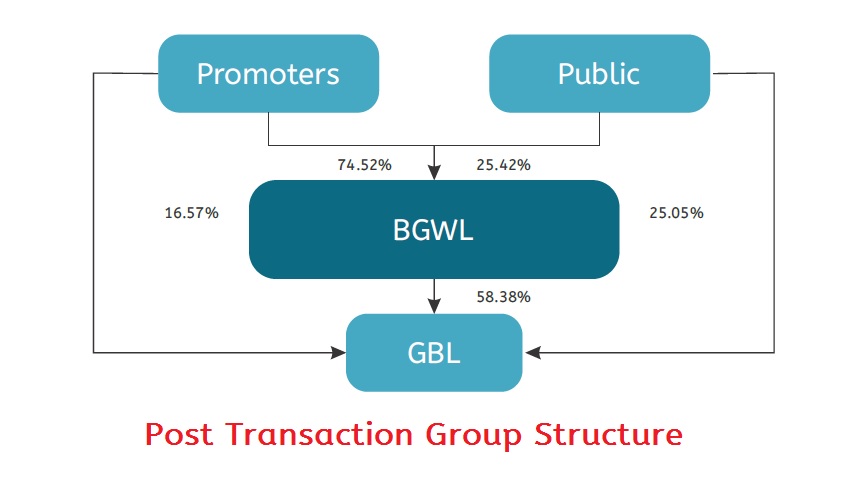

Simplification of group structure

As on date, the group holds its stake through different entities and cross-holdings. The proposed transaction will help the group to simplify its structure.

-

Operational Efficiencies

As on date, VGWL’s whole revenue comes from BGWL. Further BGWL sells flasks of various shapes to VGWL on regular basis. Since VGWL operates as BGWL’s main upstream supplier, consolidation will result is integration of operations for BGWL.

Some intercompany transactions: –

Table 1: Intercompany Transactions – DealParticulars Amount (In Rs crore) Purchases made during FY 16 76.21 Loan/ICD’s given to VGWL (outstanding) 34 Loan/ICD’s given to HTPL (outstanding) 4 Rent received from VGWL during FY 16 0.99 Interest Income from VGWL during FY 16 3.61 -

Gujarat Borosil Limited

As on date, BGWL & FIFPL holds 25.25% & 33.13% equity stake respectively in GBL.As a result of the merger of FIFPL into BGWL, GBL will become subsidiary of BGWL.

Further, BGWL has also subscribed to INR 90 crore preference shares of GBL on which GBL has not paid any dividend till date. In 2015, the terms of the preference shares were hanged from cumulative to non-cumulative. The dividend in arrears from 2012 to 2015 amounts to INR 27.91 crore. These preference shares are due for redemption in March, 2019.

-

Expansion

GBL: – The company is planning to expand its capacity from 1 GW to 2.5 GW. According to the management, the capital expenditure for expansion will be around INR 270 crore. (Market cap of the company as on date is INR 580 crore). This will be funded by internal accruals as well as some equity raising.

HPTL: – The company is planning to upgrade the furnace to a larger capacity as well as upgrade some of the machinery which will cost around INR 45 crore.

-

Increase in promoters holding

As a result of the merger, the paid up capital of BGWL will get increase to INR 25.20 lakh from existing INR 23.10 lakh. VGWL being a 100% promoter-owned entity and 45.86% promoter’s stake in FIFPL, the promoter’s stake in BGWL will increase marginally. Post-consolidation, promoters will hold 74.58% stake in BGWL against their current holding of 72.26%.

Valuation

Table 2: Valuation of FIFPL

| Particulars | Amount |

| No. of shares outstanding | 90,49,000 |

| No. of shares will be issued during the merger | 4,39,272 |

| Per share value of BGWL | 6,558 |

| Value assigned | 2,88,07,44,757 |

| Market value of investment made by FIFPL as on 25.11.16:- | |

| BGWL | 81,35,65,806 |

| GBL | 1,73,34,20,000 |

| Other equity investments* | 1,65,00,000 |

| Current investment in mutual funds as on 31.03.16 | 1,44,61,859 |

| Short term advances to Gujarat Fusion Glass LLP | 3,25,06,639 |

| Total | 2,61,04,54,304 |

| Premium paid | 10% |

| * Based on investment as on 31.03.16 multiplied by market value as on 25.11.16 | |

Table 3: Valuation of VGWL

| Particulars | Amount |

| No. of shares outstanding | 19,50,000 |

| No. of shares will be issued during the merger | 1,36,364 |

| Per share value of BGWL | 6,558 |

| Value assign | 89,42,72,727 |

| Less:- Value of stake in FIFPL | 23,88,13,740 |

| Core Business Valuation | 65,54,58,987 |

| PAT of VGWL | 2,31,25,720 |

| Assigned P/E Multiple | 28.34 |

| Book Value Premium* | 8.74 |

| *Excluding book value of investment in FIFPL. | |

Financials

Table 4: Segment-Wise Breakup (On Standalone Basis)

| Particulars | Scientific-ware | Consumer-ware |

| FixedRevenue (In crores) | 119 | 102 |

| FixedEBIT % | 24.6% | 9.2% |

| FixedRoCE | 81.4% | 34.6% |

Table 5: Financials (All figs. in INR Crores as on 31.3.2016)

| Particulars | BGWL(Consolidated) | VGWL |

| Revenue from operations | 414 | 70 |

| EBIT | 82 | 7 |

| EBIT % | 19.9% | 10.2% |

| PAT | 55 | 2 |

| PAT % | 13.2% | 3.3% |

| Networth | 572 | 9 |

| RoNW | 9.6% | 25.7% |

| Loans | 78 | 14.15 |

| Capital Employed | 650 | 23 |

| RoCE | 12.7% | 30.8% |

| Total Assets | 787 | 58 |

| Operating cash flow | 32.36 | 3.41 |

Table 6: Snapshot of HTPL’s Financials (All fig. in INR Crore)

| Particulars | Amount |

| Net worth | 29 |

| Total Assets | 93 |

| Revenue | 13 |

| PAT % | 0.5% |

Conclusion

The consolidation will simplify the group structure, address corporate governance and transparency issue and resolve conflict of interest between various group entities. The consolidation will simplify compliances and procedures particularly arising out various new rules and regulations and GST. Post-fundraising by GBL from other than promoters, most likely GBL will not be the subsidiary of BGWL. Both the companies will be able to operate independently and follow its own growth path and most importantly GBL will not drain financial and other resources of BGWL as it used to be till date. Overall, the consolidation is likely to strengthen balance sheet and make both companies ready for accelerated growth.