It’s been a dirty word in the gold-mining industry for the last three years, but now companies can’t stop saying it: growth.

Top executives are on the hunt for mergers and acquisitions, and focusing on exploration as the industry emerges from survival mode. Gold prices have recovered and cost cuts are taking effect, delivering profits for companies that need to remedy a shortage of new discoveries and declining reserves.

The trouble is that they have a bad history when it comes to dealmaking. In the China-led commodity boom, the entire mining industry spent heavily on deals and big projects that soured when metals prices later collapsed. Companies wrote off close to $100 billion between 2011 and 2016, according to analysts at Investec Ltd.

Gold producers say this time will be different, but the losses generated by a decade of wasteful spending during the bull market to 2011 are still fresh in investors’ memories. While gold gained 8.2 percent this year to $1,241.53 an ounce, that’s much lower than the record of more than $1,900 set five years ago.

“All of us have got one issue and that’s we haven’t much exploration in the last 10 years, and all our assets’ lives are getting shorter,” Peter Steenkamp, chief executive officer of Harmony Gold Mining Co., said in an interview at the Mining Indaba conference in Cape Town. “Everybody is looking to replace the ounces that they’re mining.”

“Beyond the next three to five years, there’s a significant drop-off in the gold industry’s production profile,” said Arnold Van Graan, an analyst at Johannesburg-based Nedbank Capital. “Most companies are struggling to fill the gap that’s emerging and that’s why you’re seeing a resurgence in exploration and M&A.”

For example, in the past year:

- Acacia Mining Plc said it’s in early-stage talks with Endeavour Mining Corp. about a possible merger.

- Gold Fields Ltd. is spending A$350 million ($270 million) for projects in Australia.

- Sibanye Gold Ltd. agreed to pay $2.2 billion for Stillwater Mining Co., a Montana-based platinum and palladium producer.

- Harmony said it’s looking to buy an in-production asset that will offset declining output in South Africa.

“There’s going to be a feeding frenzy over assets that come up for sale,” Gold Fields CEO Nick Holland said in an interview. “There are going to be big prices on these assets.”

Strategy Turnaround

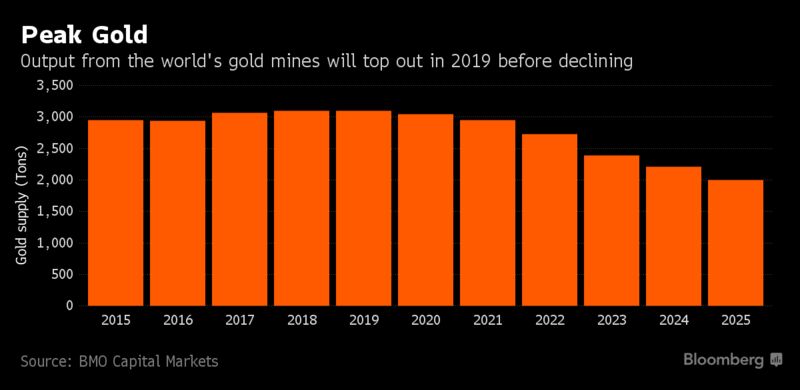

It’s a dramatic change in strategy from recent years when the biggest priority was to survive the downturn in metal prices by cutting costs and paying down debt. As a result, less money went into exploration and investment in existing operations. Gold mine supply will peak in 2019 and keep falling through at least 2025, according to BMO Capital Markets.

Due to fewer and smaller discoveries, reduced mine life and a lower gold price since 2013, the amount of economically viable gold in the world is declining. Major producers’ reserves have fallen 40 percent since 2011, according to Bloomberg Intelligence.

“Not one of the big guys has a growth story because no one has invested in the future of this industry,” said Mark Bristow, CEO of Randgold Resources Ltd., which has never impaired its assets. “Since 2000, the industry hasn’t replaced the ounces it has mined. It’s completely ex-growth, so there has to be consolidation.”

AngloGold Ashanti Ltd., the world’s third-largest producer, said there’s still room for the company to grow organically. It’s investing in brownfields projects, or areas near existing mines, in Tanzania, Brazil, Guinea and the Democratic Republic of Congo, rather than buying up other companies.

“We have enough in our own back yard” to avoid acquisitions, said CEO Srinivasan Venkatakrishnan. “One has to be very careful when making M&A decisions because normally what happens in three years’ time are impairments.”

Source: Bloomberg.com