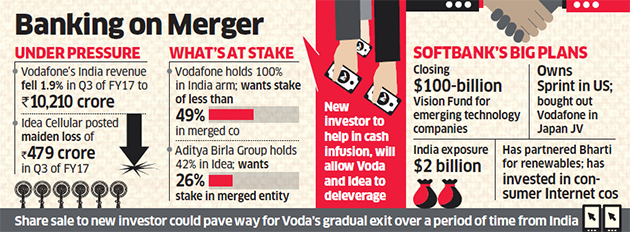

Masayoshi Son’s Softbank, which is about to close its mega $100 billion Vision Fund, could emerge as a new investor in the proposed Idea-Vodafone combine, according to four people aware of the development.

Softbank is learnt to be in talks with Vodafone Plc to buy a minority stake in its Indian unit which is likely to be merged with Idea Cellular. While discussions are still on and there is no guarantee about the outcome, people familiar with the situation say it is possible that the Japanese investor may end up with 15-20 % in the merged entity.

When contacted, Softbank, Vodafone Plc, and Idea Cellular declined to comment.

Sale of shares to a new investor will enable Vodafone Plc to reduce its shareholding in the merged company to below 50%, thereby allowing it to deconsolidate its debt-ridden Indian operations from its books. It could also pave the way for Vodafone’s gradual exit over a period of time from India. The UK company’s $28 billion India bet has yielded no profits so far.

A new investor will also help bridge the gap between the shareholding of Vodafone and Idea as well as its promoter—the Aditya Birla group in the merged company. While the Birlas have publicly said they want equal rights with Vodafone, most analysts have pegged the valuation of Vodafone India at $3 billion more than Ideas.

A new investor can also infuse capital in the business to combat other deep pocket rivals like Reliance Jio and also help to deleverage. The combined entity will end up having around Rs 100,000 crore debt.

People close to Softbank had told ET last month that its Vision Fund, which is being helmed by Indian-born Rajeev Mishra, could scout for buyout deals in the country, including in the telecom sector. A stake in the Idea-Vodafone combine will give the fund a strong foothold in what will be India’s largest telco, both by subscribers and by revenue market share.

Last month, Vodafone and the Aditya Birla Group confirmed that they are in talks to explore an all-share merger of Vodafone India (excluding Vodafone’s 42% stake in Indus Towers) and Idea. Any merger would be effected through the issue of new shares in Idea to Vodafone and would result in the UK company deconsolidating Vodafone India.

There have been some media reports that the two companies may announce further progress on merger talks this month, but this could not be confirmed.

MERGER OF EQUALS

An official with knowledge of the ongoing discussions said a key challenge was to bring about a ‘merger of equals’ when the shareholding and operations are of different size and scale.

Vodafone India’s operations are larger than Idea Cellular both in terms of revenues and subscribers. Moreover, while Vodafone Plc owns 100 per cent of its Indian arm, the Aditya Birla group owns just 42% of Idea Cellular.

Most analysts have given a higher valuation number to Vodafone India as compared to Idea Cellular. But some top telecom industry executives say that as Vodafone’s stake in Indus Towers will not be part of this transaction and after adjusting for Vodafone’s debt, it is possible that the two companies may arrive at a 1:1 merger ratio.

Even in such a scenario, the Aditya Birla group’s shareholding in the merged entity will be around 21%, much less than Vodafone Plc’s 50%.

One option would be for the Aditya Birla group to substantially increase its shareholding in the merged company to match that of Vodafone by buying over existing shareholders as well as by subscribing to fresh shares of Idea Cellular. Analysts have estimated that this would involve the Birlas pumping in somewhere between $2.39 billion and $3.72 billion, in order to raise their holding to 37-39% in the merged company.

An induction of a significant minority investor, who buys a portion of Vodafone’s holding will make it easier for the Birlas who may need to infuse only an additional Rs 4000-Rs 5000 crore. Vodafone’s shareholding will come down, making it possible for the Birlas to invest less.

People familiar with the situation say Aditya Birla group chairman Kumar Mangalam Birla would want a minimum 26% stake in such a scenario. But this could not be independently verified.

VODAFONE’S WOES

Senior telecom industry executives say Vodafone Plc is keen to divest as much as it can. The company started with a $11 billion investment in 2007-08 when it bought out Hutchison to enter the country. On that investment, it was slapped with a $2 billion tax fine, which it continues to dispute.

To expand operations it has further invested Rs 119,100 crore in India but profit seems to be elusive. Institutional shareholders of the parent company, who are focussed on cash profits, have often questioned investments in India that have given negligible returns.

Reliance Jio’s entry and the ensuing price wars have compounded matters and made the company even less enthusiastic about India.

“Vodafone wants to dilute as much as possible the company is tired of fighting the Indian system and believes an Indian promoter will have greater sway to compel fair regulation,” said an industry official, who did not wish to be named.

Last November, Vodafone Group slashed the value of its India unit by 5 billion euros (Rs 36,448.53 crore) due to increased competition sparked by the entry of Jio, leading to a price war that hurt revenue and profit and clouded growth prospects.

There is already an existing relationship between Vodafone and Softbank. A little over a decade ago SoftBank bought Vodafone’s operations in Japan to challenge local champions NTT Docomo and KDDI Corp. It has also learnt that the Japanese company has invited Vodafone to be an investor in the Vision Fund.

Softbank is also active in the telecom space in the US where it has invested in Sprint and is in talks to merge this with T-Mobile.

Softbank’s Son has been a big backer of Internet and communications services. The company has invested in Indian consumer internet startups such as Snapdeal and Ola and an investment in what will be India’s largest telco will deepen its presence in the country.