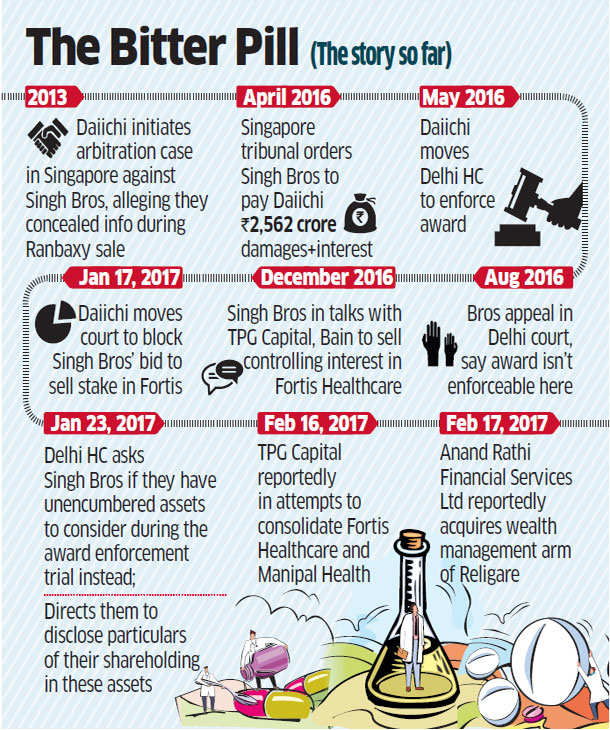

Japanese pharmaceutical firm Daiichi Sankyo has again asked the Delhi High Court to block any stake sales by former RanbaxyBSE 5.63 % promoters Malvinder and Shivinder Singh as it battles to recover more than Rs 2,500 crore from an arbitration award. It has filed an application to this effect and the matter is expected to be heard on Tuesday, according to people with knowledge of the matter. EThas reviewed a copy of the application.

The move by Daiichi Sankyo comes as the Singh brothers are reportedly in talks to sell a large stake in their company Fortis HealthcareBSE -0.36 % — a move that Daiichi has argued would lead to dilution in the assets it seeks to recover as part of the award.

Daiichi alleges that the Singhs haven’t followed the court’s order to disclose details about unencumbered assets that can be considered during the award’s enforcement trial. The brothers have denied these allegations, arguing that they have complied with the orders.

|

ET reported on February 16 that global investor TPG Capital was attempting a possible consolidation of Fortis Healthcare and Manipal Health Enterprises in what would be the biggest M&A deal in the Indian healthcare industry.

Justice S Muralidhar is expected to hear the case today (February 28).

Daiichi had first moved an application for an injunction on the sale of these assets on January 17. The court has so far not blocked the Singh brothers from selling stakes in Fortis Healthcare and Religare Finvest.

However, Justice Muralidhar had, during an earlier hearing, asked whether the brothers and 17 other respondents in the case had any unencumbered assets that could instead be considered during the award’s enforcement trial. The judge had further directed the respondents to file an affidavit detailing the value of all of their shareholding in such unencumbered assets.

“Not later than 8th February 2017, the particulars and assurance in the manner sought by the court will be furnished on an affidavit by any one of the respondents on behalf of the rest of the Respondents,” reads a January 23 court order.

According to Daiichi’s latest application, the affidavit filed on behalf of the ex-Ranbaxy promoters and other respondents is “not in terms” and “inconsistent” with the judge’s order.

The Japanese firm alleges that the respondents have neither particularised their unencumbered assets nor provided any assurance that the assets, to the extent of the award amount, won’t be encumbered or alienated until the award is enforced.

Daiichi’s application states that the respondents have also not detailed the method used to determine the fair value of the assets — the amount at which they can be bought or sold.

The application adds that it is important for Daiichi to know these particulars to determine whether the respondents have adequate assets to pay the award when it’s enforced.

Apart from seeking an injunction once more on any sale of assets by the Singh brothers and other respondents in the case, Daiichi has also sought an order to secure the award amount — Rs 2,562 crore plus interest.

It wants this to be deposited with the Delhi court’s registrar or an escrow account.

“It is submitted that, in absence of specific information about the nature, quality and value of the unencumbered assets held by the respondents, the respondents be restrained from alienating or disposing of any assets,” Daiichi Sankyo said in its application.

“All directions of the honourable court stand complied with,” said a spokesperson for RHC Holding, the holding company of the Singh brothers in reply to a query. There was no response to an email sent to Daiichi’s lawyers.

Daiichi and the Singh brothers have been locked in an arbitration dispute over the sale of Ranbaxy, once India’s largest drugmaker.

ASingapore tribunal had in April 2016 given its order in favour of Daiichi by a 2-1 majority. It ordered the Singh brothers to pay the Japanese drugmaker Rs 2,562-crore in damages for concealing information regarding wrongdoing at Ranbaxy while selling it for $4.6 billion in 2008. Along with interest and legal fees, the total liability was last pegged at Rs 3,500 crore.

The Singh brothers have appealed against the order in both Delhi and Singapore, arguing that “substantive objections” exist under India’s arbitration law to make the order unenforceable.

Source: Economic Times