Daiichi Sankyo has objected to Religare Enterprises’ decision to sell its stake in Religare Health Insurance, a move the Japanese company claims violates a Delhi High Court order in its legal tussle against former Ranbaxy promoters Malvinder and Shivinder Singh.

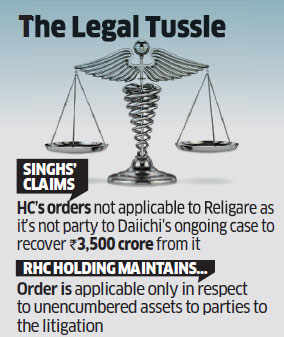

The Singh brothers, on the other hand, said court orders are not applicable to Religare as it is not party to the Japanese drug maker’s case to recover Rs 3,500 crore from them as part of an arbitration award.

Religare Enterprises, promoted by the Singh brothers, agreed last week to sell its entire 80% stake in Religare Health Insurance to a group of investors led by private equity firm True North. The transaction values RHI at Rs 1,300 crore, Religare Enterprises said in an April 9 stock exchange filing.

During a hearing on Monday, Daiichi counsel CA Sundaram alleged the brothers had “brazenly” violated the court’s March 6 order in moving ahead with Religare Enterprises’ stake sale. According to the order, respondents would first apply to the court if any change was proposed in the status of any of the unencumbered assets whose details were to be furnished as part of the proceedings. RHC Holding Pvt Ltd, the holding company for the Singh brothers, maintained that the respondents have complied with all of the court’s orders.

During a hearing on Monday, Daiichi counsel CA Sundaram alleged the brothers had “brazenly” violated the court’s March 6 order in moving ahead with Religare Enterprises’ stake sale. According to the order, respondents would first apply to the court if any change was proposed in the status of any of the unencumbered assets whose details were to be furnished as part of the proceedings. RHC Holding Pvt Ltd, the holding company for the Singh brothers, maintained that the respondents have complied with all of the court’s orders.

According to an RHC Holding spokesperson, the order is applicable only in respect of the unencumbered assets of the parties to the litigation – RHC Holding and Oscar Investments Ltd.

“There is no order on any of the operating companies of the group, including Religare, which continues to run their businesses in normal course as separate listed entities. Daiichi Sankyo is moving applications only to delay hearing of the main matter and to prejudice the facts,” the spokesperson told ET.

A Singapore tribunal last year ordered the Singh brothers to pay Daiichi damages for concealing information on wrongdoing at Ranbaxy while selling it for $4.6 billion in 2008. The brothers are contesting the arbitration award at the Delhi High Court.