KKR, one of the largest private equity (PE) investors in the world, is competing with homegrown Everstone Capital to buy a significant minority stake in Radiant Life Care, a company that runs two hospitals in New Delhi and Mumbai and is looking at consolidating the fragmented industry through acquisitions, said people familiar with the matter.

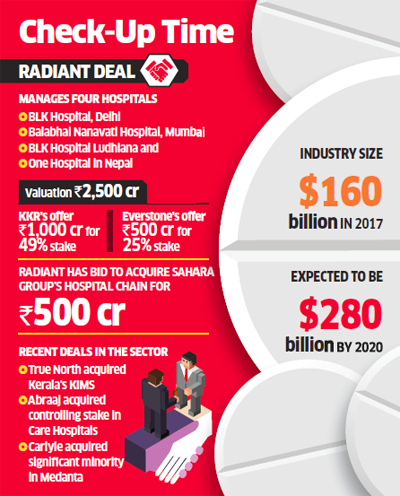

KKR is engaged in due diligence to acquire up to 49% stake in the company and infuse Rs 1,000 crore with an eye on creating a healthcare platform. KKR had already lent Rs 550 crore to the company and is expected to be the frontrunner of the two bidders.

Everstone is looking at infusing Rs 500 crore for a 25% stake. A final decision is expected soon. Radiant will use the funds to scale up operations through greenfield and strategic buyouts.

Radiant is close to acquiring Sahara Group’s hospital in Lucknow for Rs 500 crore from its cash-strapped founder Subrata Roy.

The Lucknow hospital, built on 27 acres, has 350 operational beds, which can be scaled up to 550. The hospital is a venture of Sahara India Medical Institute, a subsidiary of Sahara Prime City. The company has a huge land bank, which could be used for expanding into Bihar, Jharkhand, the rest of UP and adjoining areas.

In emailed responses, spokespersons for Everstone and KKR declined to comment. Abhay Soi, managing director of Radiant Life Care, said, “we hope you appreciate we can’t comment on market speculation.”

“The asset-light model that the company follows is very attractive as PE investors are looking for less capital-intensive assets that can generate good returns over the medium term,” another person with knowledge of the matter said.

Radiant, the brainchild of banker-turned-entrepreneur Soi, successfully turned around two hospitals in the country — Nanavati Super Specialty Hospital in Mumbai and BLK Super Specialty Hospital in New Delhi.

Recognising the need to reform the healthcare sector through modern management techniques and adherence to global best practices, Soi, an alumnus of St Stephen’s College, took over the reins of both and transformed them into super specialty hospitals of international standards.

Radiant’s entry into healthcare commenced with the redevelopment of BLK at a cost of Rs 350 crore in 2009. It is today among the largest standalone private hospitals in the National Capital Region.

Over the next four years, with expansion plans in New Delhi, Mumbai, Ludhiana, and Nepal, Radiant envisages commissioning an additional 2,500 beds, taking the total to 4,000 beds. In the past, it had explored taking over the Hiranandani Hospitals in Thane, near Mumbai.

The company clocked revenue of about Rs 600 crore and earnings before interest, tax, depreciation and amortisation (EBITDA) of about Rs 100 crore in FY17, according to people with knowledge of the matter. Healthcare has always attracted financial investors. Apax had earlier invested in Apollo Hospitals. Funds including Everstone have significant experience in the sector. Some like Abraaj or True North have made bigger bets taking over chains like CARE and KIIMs hospitals in the south. More recently, TPG and General Atlantic tied up to compete against peers Bain and KKR to take over Fortis Hospitals from the Singh brothers Malvinder and Shivinder, in a potential multibillion-dollar transaction.

The healthcare industry is growing at a tremendous pace due to its strengthening coverage, services and increasing expenditure by public as well private players, as per a May 2017 report by Indian Brand Equity Foundation. The total industry size is expected to touch $160 billion by 2017 and $280 billion by 2020.

“The hospital and diagnostic centres attracted foreign direct investment worth $4.09 billion between April 2000 and September 2016, according to data released by the Department of Industrial Policy & Promotion,” the report said.

Source: Economic Times