Torrent Pharmaceuticals Ltd, the flagship company of the Torrent Group was incorporated in the year 1972, is one of the leading pharmaceutical companies having presence in Indian and global markets. The company is a dominant player in the therapeutic areas of cardiovascular (CV) and central nervous system (CNS) and has achieved significant presence in gastro-intestinal, diabetology, anti-infective and pain management segments. The company has their presence in 50 countries and has nine wholly owned subsidiaries in markets of Europe, United States, Latin America and Asia Pacific. The Market Share of Torrent Pharmaceutical Limited is 3% with respect to total Revenue of India Pharmaceutical Sector which is US$ 36.7 Billion for FY 16-17.

The company has the world class manufacturing facilities located at Indrad in Gujarat and Baddi in Himachal Pradesh and other locations include Sikkim Plant, Zyg pharma at Pithampur, (Indore), Dahej Plant situated in Dahej SEZ, near Bharuch, Gujarat. The company’s key areas are Formulations, API (Active Pharmaceutical Ingredient), Drug Discovery, Marketing and Sales of Drugs. The Market Capitalisation of the company is Rs 21,154 Crores. The Company’s revenues are mainly from manufacture and sale of branded as well as unbranded generic pharmaceutical products.

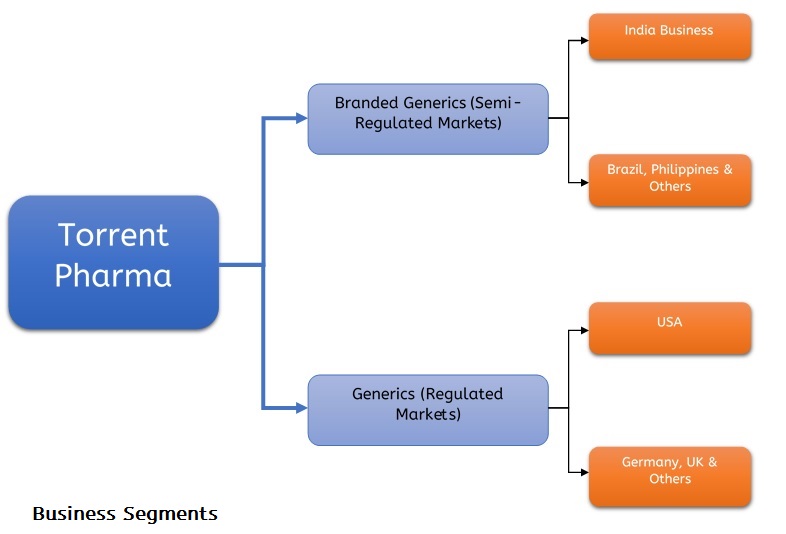

Figure 1: Torrent Pharma Business Segments

During the financial year 2015-16, the Company reported revenues of RS 6,687 crores, a growth of 43% compared with Rs 4,653 crores in the previous financial year.

NOVARTIS AG

Generics Medicines and Biosimilars: Sandoz Division of Novartis AG is a global leader in generic medicines and biosimilars, offering more than 1,000 different types of high-quality, affordable products across a broad range of therapeutic areas. It pioneers new ways to help people around the world access high-quality medicines.

ABOUT SANDOZ DIVISION OF NOVARTIS

- In 1996 Ciba-Geigy merged with Sandoz, with the pharmaceutical and agrochemical divisions of both staying together to form Novartis. Other Ciba-Geigy and Sandoz businesses were sold.

- Sandoz is in generic drugs business and it was the first generics pharmaceutical company to receive approval for some various biosimilar products.

Novartis

- Novartis was weighing options to divest part of its non-core brand portfolio globally.

- Sandoz business of Novartis had two product portfolios which were available for sell:

- Women’s Health Care (Regestrone and Pregachieve brands).

- Anti-Infective

- It is said that Anti-Infective is also on the block to be sold and this could also conclude shortly. Due to Anti-infective sales (including partner label and finished dosage form sales) were USD 356 million (0% cc) *, reflecting the discontinuation of low-margin products.

- This will enable Novartis to focus on manufacturing and marketing of its higher revenue generating Biopharmaceuticals.

- The women healthcare portfolio of Novartis in India is around Rs 75 crore. Regestrone Tablet is usually used for irregular, painful or heavy periods.

(Novartis-Interim Financial Report- Net Sales Q4-2016) *

TRANSACTION

On May 8, 2017, Torrent Pharmaceuticals Limited announced that it has acquired two of the popular brands for women healthcare- Regestrone and Pregachieve brands from global pharma player Novartis AG, Switzerland through Asset Sale Agreement. These brands are widely prescribed by gynaecologists for the management of abnormal uterine bleeding, Peri and Post-menopausal symptoms and Infertility. These two brands will form part of therapeutic segments of Torrent Pharmaceuticals Ltd., thereby increasing the product portfolio of Torrent Pharmaceuticals. The said drugs are generic drugs which come under the category of generic pharmaceutical products and it is understood that it will have market all over India as well as outside India. The transaction has been approved by CCI on the 20th April 2017.

VALUE OF THE DEAL

Although the consideration details of the transaction have not been disclosed but both the companies have signed Assets Sale Agreement. The Rough Estimate of the deal value would be around Rs 400 crore.

FINANCIALS

Table 1: Torrent Pharma (All Figures in Rs. Crores)

| Particulars | 2016 | 2015 | 2014 |

| NET CASH FROM OPERATING ACTIVITIES | 2,713.23 | 810.2 | 599.42 |

| CASH FLOW FROM INVESTING ACTIVITIES | |||

| Acquisition of Business | -231 | -1,960.00 | – |

| Purchase of fixed assets | -604.03 | -242.57 | -400.08 |

| Proceeds from fixed assets sold | 23.91 | 6.14 | 1.9 |

| Proceeds from sale / (Purchase) of long-term trade investments | 53.33 | – | – |

| Profit on sale of current investments | 50.1 | 15.97 | 10.55 |

| Interest received | 6.26 | 18.16 | 31.82 |

| NET CASH USED IN INVESTING ACTIVITIES | -701.43 | -2162.3 | -355.81 |

| CASH FLOW FROM FINANCING ACTIVITIES | |||

| Proceeds from long-term borrowings | 589.5 | 1,660.39 | 426.74 |

| Repayment of long-term borrowings | -654.35 | -144.27 | -84.87 |

| Net proceeds / (repayment) of short-term borrowings | -318.87 | 90.04 | 72.26 |

| Government grant | 0 | 0.64 | 0.68 |

| Dividend paid | -839.7 | -199.69 | -267.39 |

| Finance cost paid | -211.73 | -194.86 | -61.02 |

| NET CASH USED IN FINANCING ACTIVITIES | -1,435.15 | 1,212.25 | 86.4 |

| NET INCREASE / (DECREASE) IN CASH AND CASH EQUIVALENTS | 576.65 | -139.85 | 330.01 |

| Effect of exchange rate changes on foreign currency cash and cash equivalents | -42.29 | 49.75 | -62.37 |

| Amount transferred consequent to Amalgamation | 8.01 | – | – |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR | 864.95 | 955.05 | 687.41 |

| CASH AND CASH EQUIVALENTS AT END OF YEAR | 1,407.32 | 864.95 | 955.05 |

Observations

- During the year 2017, the Company issued Non-convertible debentures aggregating to Rs 1000 Crores secured by way of first pari passu charge on certain specified immovable and movable assets and identified trademarks of the company.

- During the year 2016, addition to fixed assets includes intangibles acquired during the year amounting to Rs 117 crores.

- The net profit after taxes for the financial year 2015-16 was Rs. 1,722 crores compared with Rs. 751 crores during the previous financial year, an increase of 129%, primarily because the launch of a new product in US market with limited competition.

- The interest expenses are higher because the full year impact of the acquisition-related borrowings done during the previous financial year.

- Sales in India have increased by 18.72% for FY 2015-16.

- Sales outside India have increase by 58.74% for FY 2015-16. And major share of revenue of 40 % comes from sales to USA which has Generics market(Regulated).

- During the year 2015, the company had long-term borrowings to the tune of Rs 1660.39 Crores in 2015 to fund its acquisition of 100% stake in formulation facility of Zyg Pharma Private Limited on 17th July 2015 and accounted for Goodwill of Rs 193.63 Crores.

Figure 3: ROCE for Torrent Pharma

Post Announcement Market Capitalization

| Particulars | Pre-Acquisition (Market Cap on 5th May 2017) | Post Announcement (Market Cap as on 30th May 2017) |

| Market Capitalisation (Rs. in Crores) | 21902 | 20898 |

Advantages

- Torrent Pharmaceutical which is a No:2 player in the women’s healthcare segment, will become a formidable player in this segment after the said acquisition of this two main women healthcare brands from Novartis

- Through acquisitions, Torrent Pharma has strengthened its position in the nutraceuticals, women healthcare and dermatology segments.

- They already have 11 Brands in Top 500 Brands of Indian Pharmaceuticals Market, plus they launched two biosimilars in India, to increase focus on specialty.

- This acquisition proves to be in line with Government’s initiative to encourage the market for generic drugs, which will give Torrent Pharma a competitive edge.

Since the strategy of Torrent Pharma has been to enter new therapies and geographies, creating resources to match the exacting demands of markets, making Torrent Pharma one of India’s fastest growing pharma majors.

In last 5 years, there has been no dilution in the Equity Capital of Torrent Pharmaceuticals. It has established a strong presence in the cardiovascular, neuropsychiatry, diabetology, gastroenterology segments and has also ventured into new segments like pain management, dermatology, gynaecology, oncology and nephrology through organic and inorganic growth.

Recent acquisitions in generic drugs segment

- Acquisition of domestic formulations business of Elder Pharma by Torrent Pharma: In 2014, Torrent Pharma acquired the branded domestic formulations business of Elder Pharma in India and Nepal on a slump sale basis for all cash consideration of Rs. 2,004 crores (around USD 324 million). The formulations business comprised basically of two divisions of Elder with the portfolio of about 30 brands, in market segments as Women’s Healthcare, Pain Management, Nutraceuticals, etc. This was one of the biggest domestic merger and acquisitions in India. The business was sold as a going concern on a slump sale-bases, and the transaction also involved the transfer of 1100 employees who are engaged in the sales and marketing of this business. Almost 3,000 stockiest which were handling this business were also taken over which will help Torrent to reach in Class-2 and Class-4 town and widen our reach across the country, for this business as well as for our existing operations. The deal was being funded mainly via borrowings and partly by internal accruals

- Dr. Reddy’s Laboratories acquisition of UCB: In 2016, Telangana based Dr. Reddy’s Laboratories acquired a select portfolio of Belgium-based pharma company UCB in India for Rs 800 Cr ($128.38 million) on a slump sale basis.

- Cipla’s acquisition of two US-based pharma companies: In 2016, Cipla, one of the biggest pharma companies in India acquired two US-based generic companies InvaGen and Exelan, worth $550 million in an all cash transaction.

Conclusion

Torrent Pharma has been building its product portfolio in the generic segment with parallel filings of the company’s products in the cardiovascular, central nervous system, oral antidiabetic drugs, and other therapies. The global pharma majors have been selling out their low-profile brands in a bid to focus more on core areas. However, Indian companies are seeing this scenario as a big opportunity and buying established brands at a low cost. Torrent had earlier acquired the home formulations business of Elder Pharmaceuticals in India and Nepal for Rs 2,000 crore. This type of acquisition is Bolt-On acquisition to support the acquisition of domestic formulations business of Elder Pharma which comprised of two divisions having portfolios of about 30 brands and having one of the market segment brands as women’s health care segment. The transaction also involved the transfer of 1100 employees who are engaged in the sales and marketing of this business. And this acquisition brings optimal deployment of these employees. With the acquisition of Novartis Sandoz, Torrent Pharma would become the number one brand in the women healthcare sector.