Union finance minister Arun Jaitley will head a panel that will oversee and speed up Oil and Natural Gas Corporation’s acquisition of Hindustan Petroleum Corporation.

Steps will be taken to ensure that the “cultural uniqueness” and “brand identity” of HPCLBSE -0.73 %, India’s third-largest oil refiner, are maintained after ONGCBSE -0.36 % takes over, the Cabinet Committee on Economic Affairs headed by Prime Minister Narendra Modi was briefed on Wednesday evening.

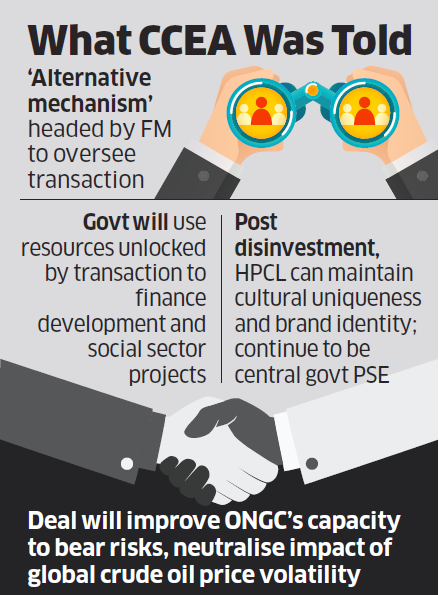

ET has reviewed the broad points of the briefing. The ONGC-HPCL union will “give enhanced capacity to ONGC to neutralise” global oil price volatility, the committee was told.

CCEA accorded “in-principle approval” to the strategic sale of the government’s 51.1 per cent equity shareholding in HPCL “along with transfer of management control” to ONGC. Both ONGC and HPCL are state-owned enterprises.

The cabinet decided at the meeting that the panel, described officially as an “alternative mechanism”, headed by Jaitley would oversee the transaction and take “quick decisions” on the timing, price and other related terms and conditions. Roads minister Nitin Gadkari and oil minister Dharmendra Pradhan will assist Jaitley in the exercise.

ET reported on Thursday that the deal size is estimated at .`30,000 crore and the proceeds are expected to cover a little over 40 per cent of the government’s disinvestment target of Rs 72,500 crore for 2017-18.

The government will use the funds unlocked from the stake sale to finance social sector and development programmes in public interest, CCEA members were told. The resources will be part of the Budget and their use will be open to public scrutiny, government officials said about the CCEA deliberations.

HPCL will maintain its cultural uniqueness and brand identity, distinct from ONGC. Still, ONGC will gain enhanced capacity to bear higher risks, take bigger investment decisions and “neutralise the global crude oil price volatility”, CCEA was told.

Analysts said HPCL’s refining business will help cushion ONGC against volatility in earnings caused by a fall in oil prices because refining margins tend to increase at such times.

CCEA was told the planned acquisition will create a “vertically integrated public sector oil major” with a presence across the “entire value chain” — from exploration to refining and distribution.

ET, while first reporting the impending deal on February 27, had mentioned that the government’s intention was not to create a huge oil company but a vertically integrated entity akin to international giants Royal Dutch Shell, BP and ExxonMobil.

CCEA was informed that the acquisition will also result in significant synergies such as optimisation of logistics costs, economies of scale in purchase of crude oil and optimisation of refinery operations and research & development activities.

The 12-member CCEA includes the prime minister, Jaitley, home minister Rajnath Singh and foreign minister Sushma Swaraj.

In his February 1 Budget speech, Jaitley said the government proposes to create an “integrated public sector oil major which will be able to match the performance of international and domestic private sector oil and gas companies”.

The Department of Investment and Public Asset Management in the finance ministry handles the sale of the government’s equity holdings in public sector enterprises.