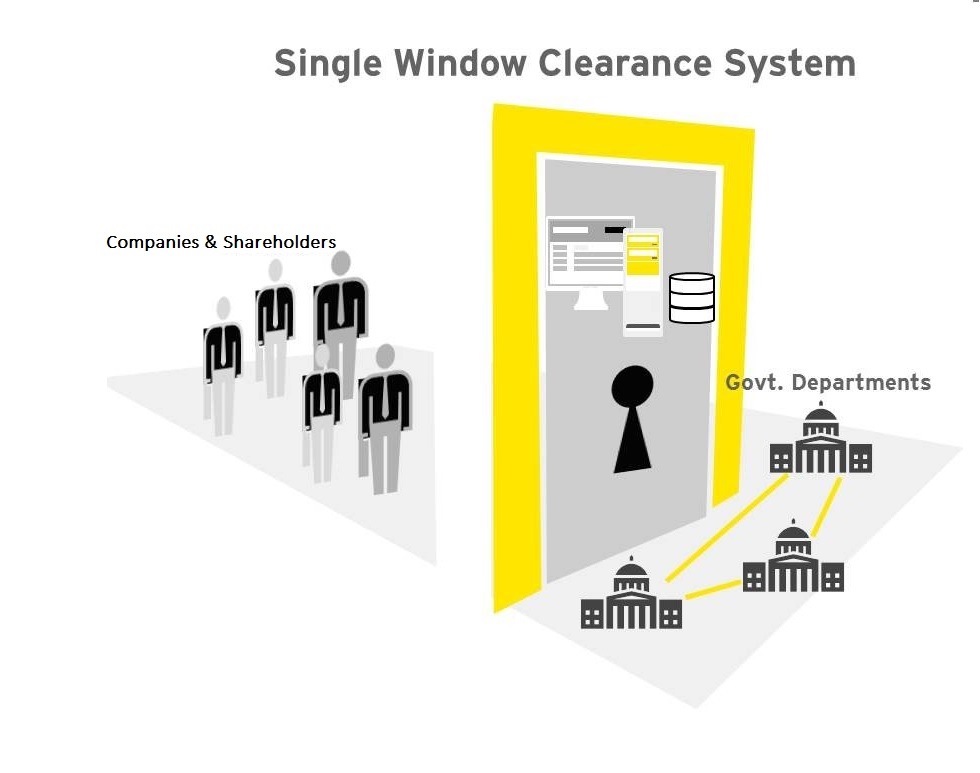

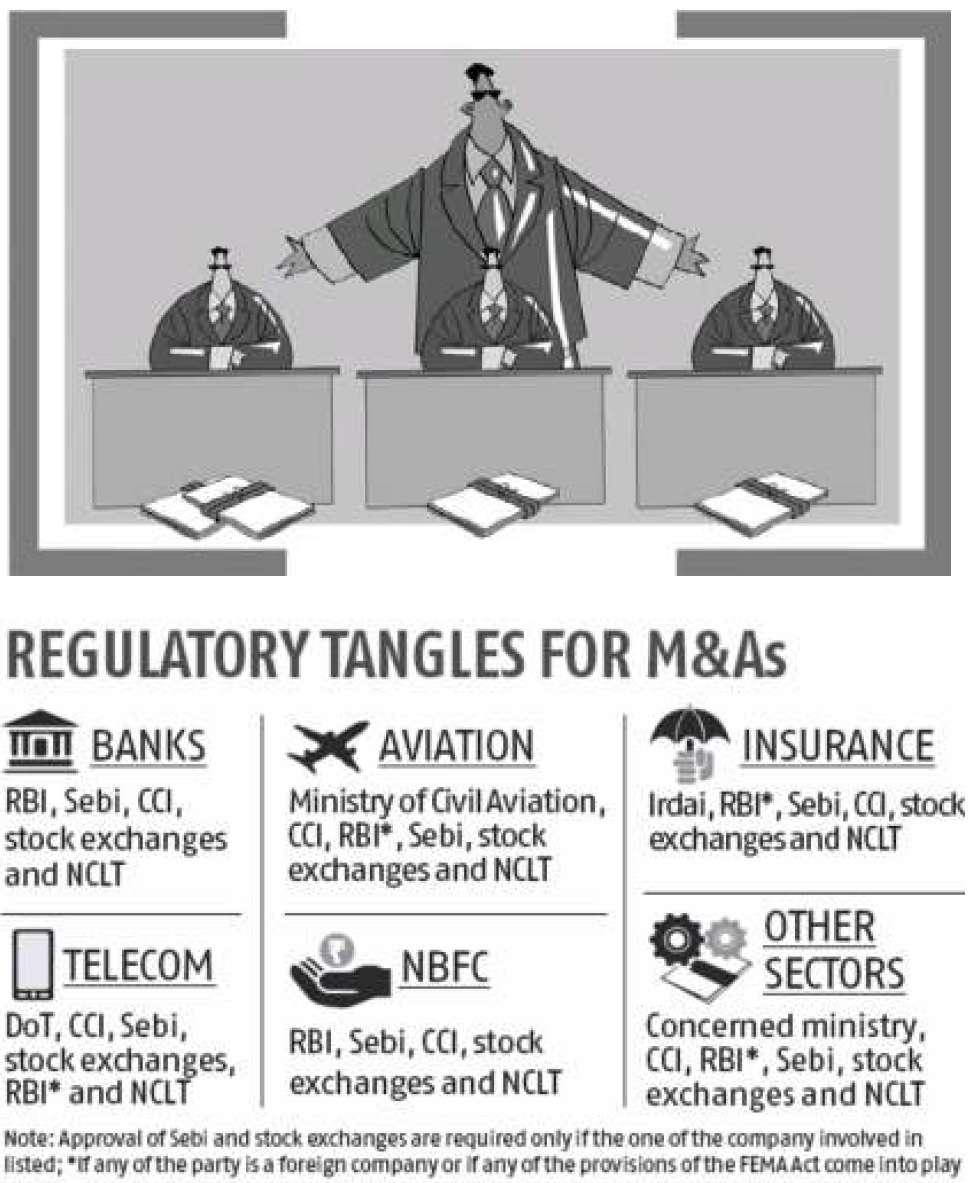

With many merger and acquisition (M&A) deals getting caught in a cross regulatory web, there is a call for single-window clearance. Delay in such approvals is said to have hit several such deals in the recent past. When it involves listed companies, this would hit the interest of minority Shareholders. Sources say the Securities and Exchange Board of India (Sebi) is among those suggesting an umbrella body for (M&A) clearance. The aim is to smoothen the process, making it time-bound.

In the past year, a proposed merger between H D F C Standard Life and Max Financial Services had to be called off after it failed to get approval from the Insurance Regulatory and Development Authority of India (IRDAI). A proposal to merge Orient Green Power’s wind power business with IL&FS Wind Energy hasn’t materialised, with tax implications delaying regulatory approval. Also, the Cabinet Committee on Economic Affairs is said to have rejected Chinese firm Shanghai Fosun Pharmaceutical’s proposed acquisition of Hyderabadbased Gland pharma.

The idea, they add, is to have a coordination agency between regulators, cases being cleared in a time-bound manner,” said Lalit Kumar, partner, J Sagar Associates. A designated nodal agency would also help in reducing the time line for completion, experts say. Typically it takes eight months for completing an M&A deal, compared to three months globally. If it is a cross-border deal, the time line surges to 18 months, provided none of the regulators come up with objections or queries. Shortening of the time line would help in reducing the risk of volatility for shareholders, especially in listed entities. According to Riaz Thigna, director at consultants Grant Thornton, the activity in M&A is expected to gather more momentum and the complexity of deals is also expected to increase. “From a regulatory clearance perspective, there should be a sound mechanism in place, to ensure smooth sailing,” Thigna added.

News Source : Business Standard Newspaper.