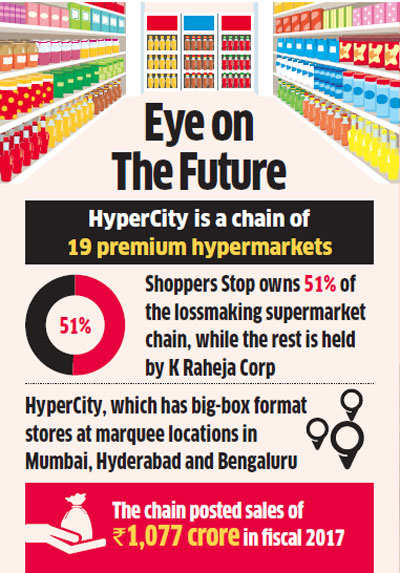

Kishore Biyani is out shopping again, for the fifth time in as many years. Future RetailBSE 1.95 % is set to acquire HyperCity, a premium chain of 19 hypermarkets from Shoppers Stop for Rs 700 crore through a combination of cash and shares to further consolidate his footprint in western India, said multiple sources aware. A formal announcement is expected tomorrow after the board meeting of Future Retail.

The loss-making supermarket chain that opened its first store in 2006 is a subsidiary of Shoppers Stop, which owns a 51 percent stake while parent K Raheja Corp holds the rest.

The transaction will be similar to the Heritage transaction. Shareholders of Hypercity will get shares of Future Retail. Part of the company’s debt is also likely to get transferred.

“Both sides have been in negotiations for a while. The acquisition will give Big Bazaar access to a premium brand and great locations in metros,” said an official aware of the ongoing talks on condition of anonymity. ” It will complement Future Retail’s hypermarket operations under Big Bazaar.”

|

ET was the first to break the news of the impending deal in its September 13th edition.

Biyani though have pivoted from a pure play retailer to a consumer goods player, has been using inorganic means to grow his national footprint. So if his merger with Bharti Retail and Big Apple strengthened the presence in north with over 250 stores, it gained in south through the acquisitions of Nilgiri’s and Heritage.

As part of a strategy to more than treble its revenue to Rs 75,000-1 lakh crore by 2021, Future Group has also been aggressively adding stores, though mainly in the smaller or convenience store formats. Over the years, Kishore Biyani, who was forced to sell the Pantaloons department store chain in 2012 to the Aditya Birla Group, has also managed to exit non-core businesses such as financial services and office product retailing. Today, Big Bazaar is its flagship brand with 259 stores in 124 cities covering around 12 million sq. ft.

According to Euromonitor data, Big Bazaar, is already India’s market leader, with a 22.4 percent share of the organised store-based retail market in 2016.

The HyperCity deal, once consumanted will add about 1.4 million square feet of retail space to Future Retail, taking the total store count to more than 900 outlets.

It now operates around 13.8 million square feet of retail space in 221 cities, with annual sales of Rs 17,075 crore. Consolidation in the grocery space will help Future Group push its private label consumer products, which earn higher margins than other items.

THE PREMIUM LAGGARD

For Shoppers Stop, which opened its first department store over 25 years ago, the food and grocery business was a relatively new one and was dragging down its overall profitability with a net loss of Rs 40 crore in the last fiscal. The format has also been struggling with top management exits with two CEOs quitting over the past two years.

In FY17 Hypercity reported sales growth of 17% but the gross margin declined sharply, impacted by slow-moving inventory provisions. Higher other costs such as new office costs, employee costs and e-commerce development cost resulted in a loss of Rs 20 cr for Hypercity.

According to a report by Edelweiss released in the end of September, the Hypercity sale will be positive for Shoppers Stop. “Consequently we expect SS to sharpen focus on its departmental business and also utilise the sale proceeds to pare debt, ” said Abneesh Roy, it’s analyst in the report.

Shoppers Stop recently announced a 5% stake sale in the company to Amazon NV Holdings LLC, the investment arm of the world’s largest online retailer Amazon Inc, for Rs 179.25 crore. The partnership with e-commerce major was meant to help Shoppers Stop tap customers from non- metro markets and scale up its financial performance. The company’s stock surged 6% on Wednesday in anticipation of the deal.

Around 65 percent of HyperCity’s business comes from its food portfolio, with garments accounting for 16-17 percent and the rest from other categories. For Big Bazaar, 65-70 percent of sales are from higher-margin, non-food categories like fashion and homeware. Even within food, 30 percent of sales is from private labels. Future Group is, therefore, looking to introduce higher merchandise mix, especially in value fashion, to boost Hypercity’s profitability going forward, said analysts covering the sector.

“The acquisition will add about 8% to the revenue of Big Bazaar. If the acquisition is done at Rs 700 crore, it will mean EV/sales of 0.65x. Hypercity has a debt of about Rs 397 crore. The valuation is reasonable given the rising significance of modern retail in India and the consolidation in the modern retail industry leading to reduction in the number of hypermarket players. Globally, organized retailers trade at .8-1.4x FY17 sales,” Abhijit Kundu, VP, Research, Consumer and Retail, at Antique.

Fashion contributes about 15-16% of Hypercity’s revenue against Big Bazaar’s 37% contribution from fashion (including FBB). It has been a fast growing and focus area for Biyani. In May, he announced he was taking fbb, the group’s mass fashion retail chain, to Oman, through a joint venture. In the same month, he also transferred ownership of Lee Cooper, one of Future Group’s biggest fashion brands, to a separate entity. Integrating fashion and tweaking with other high margin product mix in Hypercity will also be a key strategy going forward.

“Future Group will get more coverage for hypermarket stores as well as better brand positioning, ” said Ruchi Sally, Director, Elargir Solutions, a retail consultancy firm. “Further, Hypercity operates many product categories like furniture sports furnishings that Future doesn’t have. Overall, they would be market leaders in the super and hypermarket chains segment.”