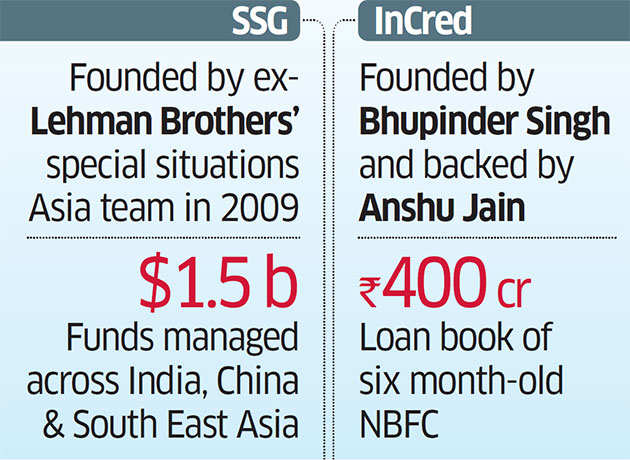

SSG Capital Management, a Singapore-based pan-Asian private equity investor, is in a race with former Deutsche Bank co-CEO Anshu Jain-backed In-Cred Finance to buy up to 15% stake in Kerala-based Catholic Syrian Bank after the latter’s talks with Canadian billionaire Prem Watsa-controlled Fairfax was called off on valuation differences.

Fresh negotiations would be for a secondary block from some of the shareholders wanting to exit the bank, as against the previously negotiated deal, which was for a controlling holding in the company, multiple sources said.

The bank’s shareholders are expecting a valuation of Rs 1,700 to Rs 2,000 crore. An earlier deal with Fairfax fell through mainly because the Canadians only offered Rs 1,300 crore.

“The deal looks interesting for SSG mainly because of value-investing. It ensures a firm entry into Indian banking system and will automatically make the firm eligible for a right of first refusal if any transaction for a controlling holding happens in the future,” said one of the sources, close to SSG.

If the SSG snaps up 15% in CSB, stake dilution may happen in tranches, one of the sources said. SSG did not respond to ET’s mail sent on Saturday seeking comments till press time on Monday evening. Neither did Catholic Syrian Bank and Incred.

“Incred is looking for a controlling stake, but they are being offered only 5-10%. Incred does not seem keen on that,” said an executive aware of the matter. The person declined to be identified.

Headquartered in Thrissur, Kerala, the 97-year-old bank’s shareholding is widely distributed across individual and institutional investors. Insurance companies such as HDFC Standard Life and ICICI Prudential, private equity funds Siguler Guff, AIF Capital and Agnus Capital are among the shareholders each with 3-5%, the bank’s 2016-17 annual report said.

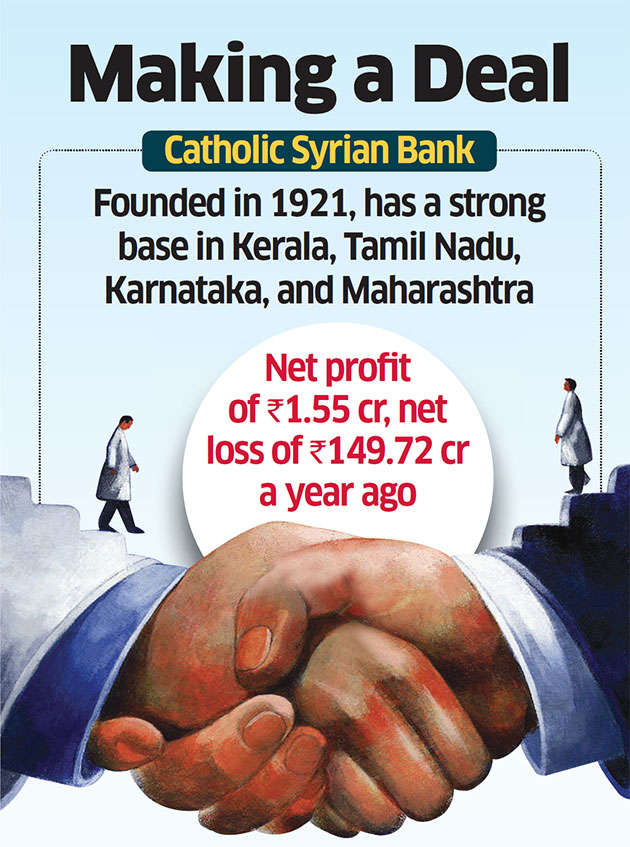

Founded in 1921, CSB has a strong base in Kerala and a significant presence in Tamil Nadu, Karnataka, and Maharashtra. With more than 1.5 million customers, its key focus areas are small and medium enterprises, retail clients, and non-resident Indians (NRIs).

CSB reported an operating profit of Rs 151.71 crore against operating loss of Rs 3.75 crore the year ago, and notched a net profit of Rs 1.55 crore against net loss of Rs 149.72 crore a year ago. The CASA mix improved to 25% from 20% with YoY growth of 28%. Capital adequacy ratio improved to 12.15% from 10.55%, its annual report showed. However, the stress on corporate and SME book continued in FY17 as well, taking the bank’s gross NPA to 7.25% from 5.62% and net NPA to 5.51% from 4.40%.

Founded in 2009 by Edwin Wong, Andreas Vourloumis and Shyam Maheshwari, former top officials of bankrupt US firm, Lehman Brothers’ special situations team in Asia, SSG manages $1.5 billion across Asia. The firm focuses on China, India and South-East Asia.

The former co-head of Deutsche Bank’s corporate banking business in the Asia Pacific set up the non-banking, new-age financial services company Incred about six months ago with the support of Jain.

Manipal Group’s managing director and CEO Ranjan Pai and Gaurav Dalmia, founder and chairman of Landmark Holdings (Dalmia Group), have also backed the firm with strategic investments.

Source: Economic Times