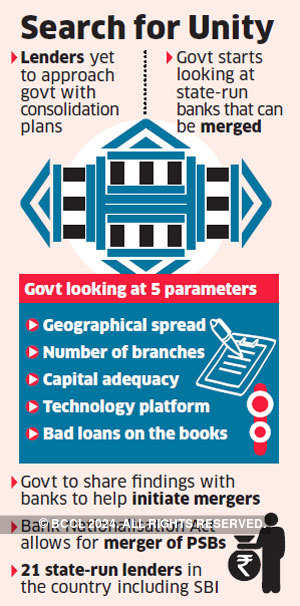

The central government has started an internal exercise to ascertain merger candidates from among the public sector banks (PSBs). The move comes as state-run lenders are yet to approach the finance ministry with their consolidation plans.

A senior government official, while confirming the internal exercise, said the final decision will be taken by banks after commercial considerations. At present, there are 21 state-run lenders including the State Bank of IndiaBSE -0.02 %, the country’s largest.

“We are just looking at all the options and their viability. If banks ask us, we will suggest to them what our findings have been but it is for the banks to initiate the process,” he said, adding that that the exercise will also help identify any other impediments or legal issues that may delay the process.

Under the Bank Nationalisation Act 1969, there are provisions allowing such mergers. However, such decisions must be approved by Parliament.

To speed up the process, the government had announced in August an alternative mechanism, comprising a panel of ministers, for inprinciple approvals to merger proposals. The finance ministry had then sent a letter to all state run banks informing them about the process. “There have been some informal discussions but no bank has yet shared any concrete plans,” said a finance ministry official.

The government has also exempted the consolidation among PSBs from the scrutiny of the competition watchdog, the Competition Commission of India.

The government has also exempted the consolidation among PSBs from the scrutiny of the competition watchdog, the Competition Commission of India.

The exemption will cover all cases of reconstitution, transfer of the whole or any part of nationalised banks, and the exemption will be available for a period of 10 years.

Some of the factors the government is looking at while making its own assessment include geographical spread, branch numbers, capital adequacy, technology platform on which the banks are operating, and bad loans on the lenders’ books. A senior bank executive said that merger within banks will only go through if the combined entity takes on a new name.

“It is imperative that the new merged entity has a new name because it has been seen in the past that the employees of the bank, whose identities are lost, are short-changed in the long run,” he said.

In April, the State Bank of India absorbed five of its associate lenders and the Bharatiya Mahila Bank, creating a larger bank that accounts for a quarter of all outstanding loans.

Source: Economic Times