All new handsets may not have a panic button yet, but hundreds of telecom executives are already making distressed calls to exit an industry where huge pressure on profits and revenues amid a brutal price war has triggered consolidation drive.

Recruiters say there is 35-40% on year increase in the number of resumes coming in from employees in the telecom sector, and several of these executives are willing to take a significant salary cut even as many telcos are heading for shutdowns and mergers.

Premier search firm Heidrick & Struggles said more than 15 CXO and top management officials, drawing salaries of between Rs 1.5-3.5 crore, have reached out to the firm for placement.

“The market right now is such that there aren’t enough opportunities for them in the telecom sector,” said Vikram Chhachhi, principal, global consumer markets, at Heidrick & Struggles. So, more than 90% of the job seekers are looking at other sectors such as retail, e-commerce, transport, logistics and FMCG.

“Some are moving at the same salaries; others are open to taking a cut,” said Chhachhi. Recruiters said such as the influx of resumes from the telecom industry is unprecedented.

“Employees’ salaries make for just 5% of an operator’s expenses, but now even this hurts,” said Kris Lakshmikanth, chairman of search firm Headhunters India.

The telecom sector, which is reeling underestimated debt of Rs 5 lakh crore, has been on a consolidation spree since last year’s entry of Reliance Jio Infocomm, which upended the market with its free voice and initially free and now ultra-cheap data.

The country’s second and third largest mobile operators Vodafone India and Idea Cellular are on track to merge. Market leader Bharti Airtel has announced its intentions to pick up the wireless business of Tata TeleservicesBSE 4.83 %, having already bought Telenor India, Videocon’s and Aircel’s 4G airwaves. Reliance Communications, which is merging Sistema Shyam Teleservices with itself, is on the verge of closing a major part of its wireless operations as ET reported on Thursday.

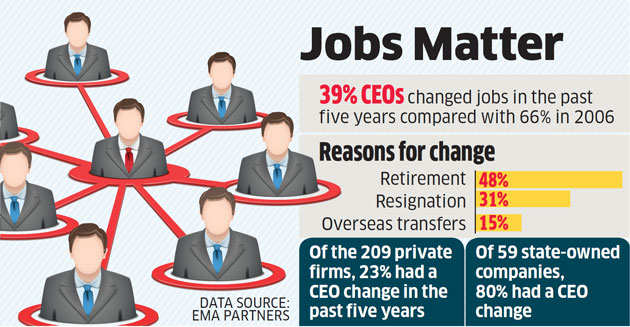

Analysts said smaller telcos will continue to face the heat while larger ones will run an extremely tight ship to sustain. In the last one year, search firm EMA Partners said there has been 40% jump in candidates who have 15 years of experience in the telecom sector and now want to move out. With telcos under debt, severance packages have come down and therefore the urgency of another job is higher than ever, experts said.

PeopleStrong is getting candidates who have 2-5 years of work experience and are largely from sales and customer service.

Singh said there has been just about a 5-7% increase in such telecom jobs, so people are more than open to move to other sectors. “There is a lot of interest in retail and e-commerce,” he said.

Staffing firms like TeamLease that deploy contract employees too have seen a spike in feelers from the industry.

Rituparna Chakraborty, executive vice president at TeamLease Services, said there has been a 20% uptick in candidates who want to be redeployed in marketing and sales positions for e-commerce sector than the telecom industry. Chakraborty expects more spike now with consolidation speeding up in the industry and more operators looking for an exit.

The latest development is a far cry from 2005-2007 when the sector was on a hiring spree on the back of entry of new players and rapid expansion of the industry with incoming calls becoming free and handset prices falling.

Then, operators had ignored the rising salaries of employees since margins were good in business, said Lakshmikanth of Headhunters India. But the scenario has changed post-Jio – with margins shrinking, the salaries have ebbed and hiring has been plugged.