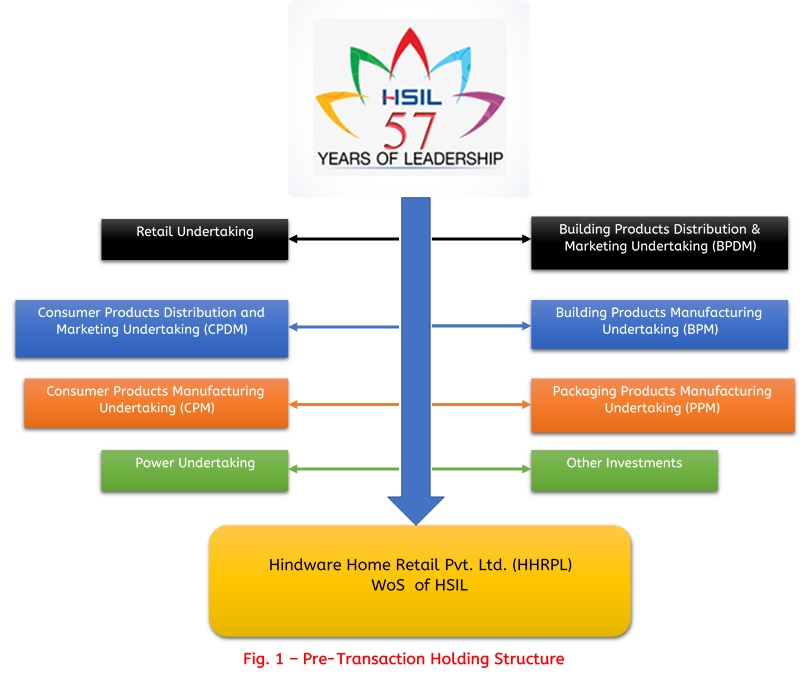

HSIL Limited (HSIL) is widely recognised by its brand ‘Hindware’, a household name in India. Set up in 1960 as Hindusthan Twyfords Ltd, with a technological collaboration with Twyfords UK. In March 2009, the company’s name was changed to HSIL Limited. HSIL became the first sanitary-ware company to be featured in the‘Fortune India 500’ 2014 list – a ranking of the top 500 corporations in India. Its Products include Water Closets, Faucets, Wash Basins, Showers, Cisterns, Special Series, Accessories, New Launches and Urinals. HSIL enjoys collaborations with leading global brands, namely Groupe Atlantic, VENTS and Sekisui Chemical Co. Ltd., etc which enables it to add unique products and novel designs to our expansive product portfolio. Currently, the company has a market cap of Rs 3,403 crore as per BSE.

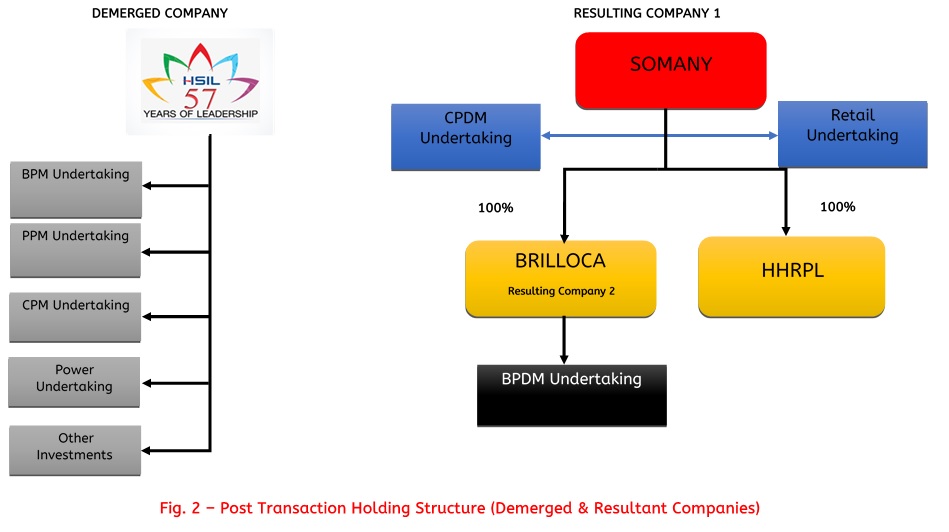

Somany Home Innovation Ltd (SHIL) is a wholly owned subsidiary of HSIL, it is incorporated on 28th September 2017. Post sanction of the scheme, SHIL will apply for listing on BSE and NSE respectively.

Brilloca Ltd (Brilloca) is a wholly owned subsidiary of Somany Home Innovation Ltd and is incorporated on 2nd November 2017. Brilloca will remain unlisted as WoS of SHIL.

Demerger Structure

Transaction

- Appointed Date is 1st April 2018.

- Somany Home Innovation Ltd. on behalf of itself and its wholly owned subsidiary, Brilloca Ltd will issue and allot equity shares, without receipt of any cash, to the shareholders of HSIL on the record date, in the ratio 1 equity share of Rs 2 of SHIL for every 1 equity share of Rs 2 of HSIL.

- Post Demerger Somany Home Innovation Ltd will cease to be WOS of HSIL and shareholders of HSIL will directly hold share in SHIL and SHIL will be listed on BSE and NSE.

- Brilloca Ltd is WOS of Somany Home Innovation Ltd. it will remain unlisted as WOS of SHIL.

Valuation

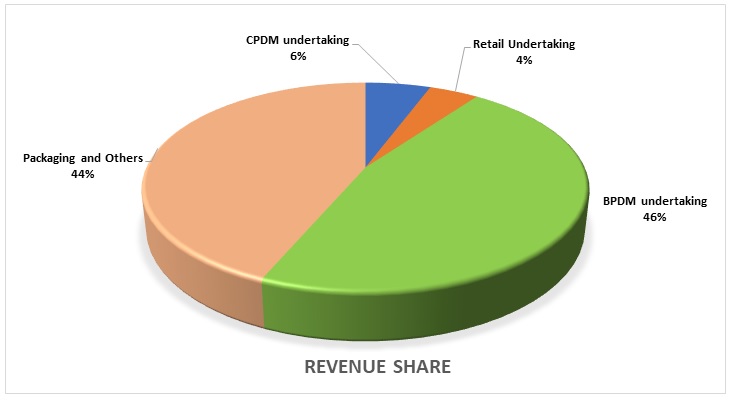

Packaging division’s enterprise value amounted to Rs 1,625 crore, whereas Building Products Division’s (BPDM) enterprise value amounted to Rs 4,751 crore based on enterprise value multiple arrived at after comparable company analysis.

While arriving at EV Multiple, following assumptions were made:

- *EBITDA multiple and EBIT multiple are discounted by 10% for BPDM.

- The ratio arrived from dividing the total borrowings by total assets is used to calculate proportionate borrowings of Packaging and Building Products Division. (Asset base is used for arriving at proportionate debt of divisions)

Observations:

- Packaging Division EBIT margin is growing year on year, only if we ignore current year i.e. 2017 EBIT margin as packaging products business could not maintain the growth momentum during the latter part of the year owing to external factors like a continued subdued demand from major soft drinks & liquor manufacturers, demonetisation and the Hon’ble Supreme Court’s order banning liquor vending on national highways that affected sales of the packaging products.

- Building products division’s revenue growth is very slow, with increase in revenue ranging between Rs 25 crore to Rs 80 crore every year.

- One can say that BPDM’s growth is stagnated and its enterprise value is overvalued, hence it is sensible to demerge the business into Brilloca ltd and keep it unlisted until the business starts showing growth signs.

Financials

Financial Performance (All figs. in INR Crores)

| Division | Particulars | FY 2014 | FY 2015 | FY 2016 | FY 2017 |

| Building Products | Net Revenue | 881 | 936 | 961 | 1038 |

| EBITDA | 197 | 203 | 196 | 192 | |

| Depreciation | 14 | 25 | 25 | 27 | |

| EBIT (Before unallocable expenditure) | 183 | 178 | 171 | 165 | |

| Segment Assets | 1029 | 1120 | 1147 | 1181 | |

| Segment Liabilities | 400 | 415 | 418 | 506 | |

| Net worth | 629 | 705 | 728 | 675 | |

| Packaging Products | Net Revenue | 864 | 920 | 997 | 969 |

| EBITDA | 98 | 180 | 204 | 173 | |

| Depreciation | 88 | 96 | 79 | 74 | |

| EBIT (Before unallocable expenditure) | 10 | 84 | 125 | 99 | |

| Segment Assets | 1486 | 1376 | 1316 | 1486 | |

| Segment Liabilities | 1086 | 962 | 844 | 951 | |

| Net worth | 400 | 414 | 472 | 535 |

Retail division is identified as a primary business segment only from the year 2017 and accordingly the following information is given as per Ind AS

| Division | Particulars | FY 2015 | FY 2016 | FY 2017 |

| Retail | Net Revenue | 87 | 97 | 93 |

| EBITDA | -16 | -14 | -11 | |

| EBITDA % | -18% | -14% | -12% | |

| Depreciation | – | – | 5 | |

| EBIT(Before unallocable expenditure) | -16 | -14 | -16 | |

| Segment Assets | – | 69 | 46 | |

| Segment Liabilities | – | 57 | 44 | |

| Networth | – | 12 | 2 |

HSIL entered into consumer products business in 2015.

| Division | Particulars | FY 2016 | FY 2017 |

| Consumer Products* | Net Revenue | 57 | 128 |

| EBITDA | -16 | -23 | |

| Depreciation | 0 | 1 | |

| EBIT (Before unallocable expenditure) | -16 | -24 | |

| Segment Assets | 39 | 114 | |

| Segment Liabilities | 22 | 62 | |

| Networth | 17 | 52 |

*Source: Investor presentation dated Aug 2017

Rationale

- Post demerger the remaining business in HSIL and the demerged business will attract interest of such investors and strategic partners having the necessary ability, experience and interests and shall provide an opportunity to the investors to select investments which best suit their investment strategies and risk profile.

- All the stakeholders will be benefited, leading to growth and value creation in the long run and maximising the value and return to the shareholders, unlocking the intrinsic value of the assets, achieving cost efficiencies and operational efficiencies.

- The scheme will result in dedicated and specialised management focus on the specific needs of the respective business.

Our observation:

- 108 registered trademarks of BPDM undertaking, 3 registered trademarks of CPDM undertaking and 37 registered trademarks of Retail undertaking are being transferred to the respective resulting companies.

- Post demerger, HSIL will use trademarks that are transferred to resulting company by way of license agreements as agreed between them.

Conclusion

In an era of creating strategic and transparent structure of consolidation, HSIL is demerging brands of its core business into the subsidiary (Brilloca Ltd) of the proposed new listed company i.e. Somany Home Innovation Ltd. carrying on insignificant loss making and newly started businesses. These intangible businesses have insignificant or no book value. It is also stated that the present company will pay royalty for the use of these brands and in the process, impact its profitability. No doubt market cap of new listed company will be quite low as its businesses will be loss making to start with, though it may have good prospect going ahead. The structure may lead to finally delisting of the newly listed company, than small shareholders will feel cheated. The rationale of the scheme portrays something else but in the real sense is it a trick or treat to the shareholders?