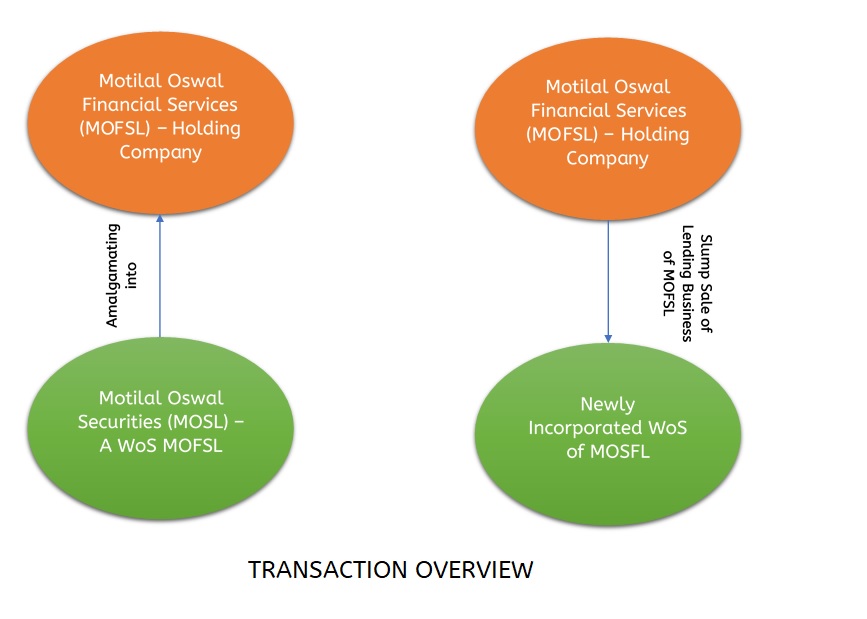

The Board of Directors of Motilal Oswal Financial Services Ltd (MOFSL) have approved the Draft Scheme of Amalgamation for merger of Motilal Oswal Securities Ltd (MOSL) with MOFSL and have also approved the slump sale of its existing lending business to its wholly owned subsidiary, which is in the process of being incorporated.

Motilal Oswal Financial Services Ltd (MOFSL) is non-deposit taking systematically important non-banking financial company registered with the RBI under Section 45-IA of RBI Act, 1934 and engaged in lending and investment related activities. It is a well-diversified financial services company focused on wealth creation for all customers, such as institutional, corporate, HNI and retail. The company’s services and product offerings include investment activities, loan against shares, wealth management, retail broking and distribution, institutional broking, asset management, investment banking, private equity and commodity broking. The current market cap of MOFSL is Rs 18,909 crore.

Motilal Oswal Securities Ltd (MOSL) was incorporated on July 5, 1994. It is a member of BSE Limited (BSE), National Stock Exchange of India Limited (NSE) and Metropolitan Stock Exchange (MSE) acts as a stock broker and executes stock trade on behalf of its clients which include retail customers (including high net worth individuals), mutual funds, foreign institutional investors, financial institutions and corporate clients. Besides stock broking, it also offers a bouquet of financial products and services to its client base like distributors of portfolio management schemes, mutual funds, private equity and systematic investment plans (SIPs). It is registered with SEBI in the capacity of Depository Participant, research analyst and investment advisor and with various other authorities like AMFL, CERSAI, KRA Agencies (CVL, Dotex, NDML, CAMS and Karvy). MOSL is a WoS of MOFSL.

Business Verticals of MOFSL

| Category | Business | Primary products and services |

| Capital Market businesses | Broking & Distribution | Equity (cash and derivatives), commodity broking and currency, distribution of financial products, depository services, financing (though MOFSL) |

| Institutional Broking | Equity (cash and derivatives) broking, advisory | |

| Investment Banking | Capital raising, M&A advisory, domestic IPOs, private equity placements, corporate finance advisory, restructuring, FCCBs and GDRs | |

| Asset-based businesses | Public Market Equities | Portfolio management services, mutual funds, offshore funds |

| Private Equity | Private equity investment management and advisory, real estate investment management and advisory | |

| Wealth Management | Professional money managers, trading, alternate assets, credit solutions, wealth transmission, specialized and ancillary advisory services | |

| Housing Finance | Aspire Home Finance | Affordable housing finance |

| Fund-based businesses | Fund Based Activities | Loan against shares book, sponsor commitments into our own mutual funds, private equity funds and housing finance entity |

Business activity of MOSL

- Stock Broking (Institutional & Retail)

- The brokerage business activity of MOSL accounts for 77.28% of total revenue of MOSL.

Transaction

- Appointed date is April 1, 2017

- As this is a WoS merger there is no consideration involved

- As reported as part of the outcome of the board meeting, the lending business of MOFSL is valued at Rs 50 crore as per valuation report issued by independent chartered accountant.

MOSL has 10 subsidiaries, and following is the financial performance of all 10 WoS of MOSL.

Financials

Table 1: Financial Overview of All Business Verticals (All Figures in INR Crores as on 31.03.2017)

| Name of the Company | % Stake | Turnover | EBT | PAT | PAT Margin |

| Motilal Oswal Capital Markets Private Limited (MOCMPL) |

100% | 4.18 | 2.08 | 1.45 | 35% |

| Motilal Oswal Asset Management Company Limited (MOAMC) | 100% | 341.35 | 75.89 | 49.76 | 15% |

| Motilal Oswal Trustee Company Limited (MOTC) | 100% | 0.10 | 0.05 | 0.03 | 35% |

| Motilal Oswal Wealth Management Limited (MOWML) | 100% | 72.05 | 20.53 | 13.23 | 18% |

| Motilal Oswal Securities International Private Limited (MOSIPL) | 100% | 1.89 | -0.07 | -0.16 | -9% |

| Motilal Oswal Capital Limited (incorporated in 19.09.2016) | 100% | NA | -0.01 | -0.01 | NA |

| Aspire Home Finance Corporation Limited | 100% | 570.78 | 125.67 | 82.11 | 14% |

| Motilal Oswal Capital Markets (Hong Kong) Private Limited (MOCMPL(HK)) | 100% | 0.00 | -0.88 | -0.88 | – |

| Motilal Oswal Capital Markets (Singapore) Pte. Limited. (MOCMPL(SP)) | 100% | 1.81 | 0.24 | 0.26 | 14% |

| Motilal Oswal Asset Management (Mauritius) Private Limited | 100% | 0.05 | -0.67 | -0.67 | – |

Table 2: Financials of MOSFL and MOSL (All Figures in INR Crores as on 31.03.2017)

| Particulars | MOFSL | MOSL | Combined |

| Turnover | 118 | 487 | 605 |

| Networth | 704 | 945 | 1,650 |

| Total Assets | 1,090 | 3,188 | 4,278 |

Slump sale of lending business of MOFSL

MOFSL shall enter into a business transfer agreement with its WoS (To be incorporated) for slump sale of its lending business for the lump sum cash consideration of Rs 50 crore. MOFSL will intimate the stock exchanges once the business transfer agreement is executed and though executed simultaneously but will not be part of the scheme of demerger

| Particulars (As on March 31, 2017) | Amount (Rs in crore) | % Contribution |

| Turnover of lending business | 43.69 | 24.78 |

| Net Worth of the Lending Business | 43.82 | 6.55 |

Reason for slump sale of lending business

- As per the extant regulatory framework, post-merger of MOSL with MOFSL, the stock broker-MOFSL cannot engage in any fund based business in its own name though it can carry on fund based business through its subsidiary.

- Thus, MOFSL is transferring its lending business to its newly incorporated WoS in order to comply with the regulatory requirements.

Tax Implications on Slump Sale

- The transfer of any capital asset by a Holding Company to its 100% Indian Subsidiary Company is exempted from tax under Section 47(iv).

- However, as per Section 47A MOFSL should not transfer any shares in it newly incorporated WoS for 8 years from the date of slump sale.

- The transaction of lending business being transferred to the newly incorporated WoS of MOFSL, through a business transfer agreement raises the question- “will the newly incorporated WoS company have funds to pay the consideration to MOFSL”?

- Does this mean that there is going to be consideration in the nature of shares against undertaking to be transferred under slump sale? If yes then this will be treated as slump exchange and one can make reference to the case CIT v R.R. Ramkrishna Pillai (66 ITR 725) in which the Supreme Court made the clear distinction between sale and exchange, held that transfer of assets in consideration for the allotment of shares of that company is an exchange and not sale. Slump Exchange is not taxable under section 2(42C) of the Income Tax Act.

Accounting Treatment

The amalgamation of the Transferor Company shall be accounted for in the books of account of the Transferee Company in accordance with “Pooling of Interests Method” of accounting as per the Accounting Standard (AS) 14, ‘Accounting for Amalgamations’ as prescribed under Section 133 of the Act read with Rule 7 of the Companies Act (Accounts) Rules, 2014.

Our Observation

Even though the Networth of MOFSL have crossed Rs 500 Crores, Ind-AS will be applicable to MOFSL from 1st April 2018 because it comes under NBFC category.

On March 30, 2016 MCA came up with amendment, so as to increase the scope of applicability of Ind-AS to certain entities by way of Companies (Indian Accounting Standard) Amendment Rules, 2016. Pursuant to the same, sub-rule (1) in rule (4) has been inserted to include NBFCs as well within the fold of Ind-AS. Hence Ind-AS will be applicable to MOFSL from the accounting periods beginning on or after April 1, 2018 with comparatives for the periods ending on March 31, 2018.

Why this merger work?

- Consolidation of operational business holdings within MOFSL leading to greater operational flexibility and business synergy across the subsidiaries.

- Strong balance sheet with combined net-worth at the parent company level (MOFSL) to meet capital needs in subsidiaries for future growth/expansion needs.

- Facilitates free flow of funds and ease limits of investments/loans by MOFSL for expansion of business activities.

- MOFSL board to have greater oversight over business operations of subsidiaries

- Consolidation of immovable property, Motilal Oswal Towers into one entity. As on March 31, 2017, Motilal Oswal Tower’s Net Block is Rs 72 crore and the said immovable property is mortgaged by MOSL to HDFC Bank Ltd.

- Merger of the Fund based investment activities into one entity

- Direct access to shareholders of MOFSL to some larger business activities of Flagship Broking and related business activities of the group in the parent company.

- Consolidation of one-layer structure to avoid multi-layering.

Conclusion

This is nothing but a simple merger. At the later stage the lending business of MOFSL which has Rs 719.58 crore (As per Annual Report for FY 2017) of revenue will be transferred to a newly incorporated WoS, from tax point of view this business will be locked therein for a period of eight years, that means the newly incorporated WoS will not have any strategic partner for eight years. The consolidation of the businesses into one company will make MOFSL as a stronger player and unlock the value for shareholders.