Paisalo Digital Limited

Paisalo Digital Limited (Paisalo) is a Non-Deposit Taking Systemically Important Non-Banking Finance Company (ND-SI-NBFC) engaged in lending to individuals, SSIs, SMEs and other manufacturing, trading and service sector entities/ organisations for income generation activities.

The shares of the company are listed on BSE, NSE and Depository Receipts on Luxembourg Stock Exchange.

Earlier this year, the company changed its name from S.E. Investments Limited to Paisalo Digital Limited.

Agarwal Meadows Private Limited

Agarwal Meadows Private Limited (AMPL) is Delhi based company, engaged in the business of renting of commercial property. Substantial stake of AMPL is held by promoter entity of Paisalo.

Proposed Transaction

The Board of Directors of the company in their meeting held on February 23, 2018 approved the scheme of Amalgamation of AMPL with Paisalo. Appointed date for the transaction is closing hours of December 31, 2017.

Swap Ratio

Paisalo will issue 5918 equity shares of Rs 10 each for every 100 equity shares of Rs 100 each held in AMPL.

Shareholding Ratio

Paisalo Digital Limited

*:- Not clear

The equity shares of AMPL is held by two shareholders, one is Bhavya Electronics & Network Pvt. Ltd. (Promoter entity) & Eastern Star Infradev Private Limited holding 67.54% & 32.46% stake respectively in the company. It is not clear how much promoter stake will be increased post-transaction. As in one document submitted by the company to stock exchanges, it is showing 46.07% increase of 1.57% and in other document it is showing increase of 3.17%.

Accounting Treatment: –

Upon coming into effect of this scheme, the amalgamation of the Transferor Company with the Transferee Company shall be accounted for as per the “Accounting Standard 14: Accounting for Amalgamations” as prescribed in the Companies (Accounting Standards) Amended Rules, 2016 issued by the Ministry of Corporate Affairs.

The Transferee Company shall, record all the assets at its fair value as agreed between the transferor company and transferee company and liabilities as appearing in the books of the Transferor Company on the Appointed Date.

Hence, post-amalgamation, the company will record the fixed asset held by the AMPL at its fair value.

Ind-AS are applicable to NBFC companies from 1st April 2018. There could be a regulatory reason for choosing appointed date as closing hours of December 31, 2017.

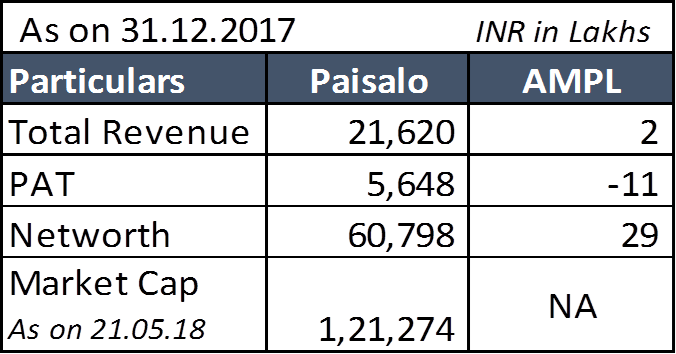

Financials & Valuation

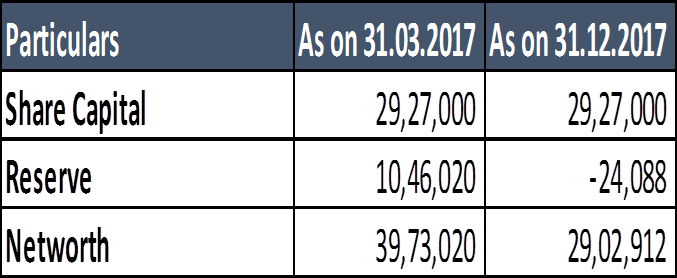

The significant asset of the AMPL is the building situated at Pocket 52, EPDP colony, Chitranjan Park. Kalkaji, New Delhi with the total area of the Building is 665.15 square meter. The book value of the said building as reflecting in the books of AMPL is Rs 4.23 crore. For valuation of AMPL, the adjusted net assets value is used and the building is valued at Rs 54.3 crore.

Till previous reporting period, the said building in the books of AMPL was classified as the stock-in-trade. On December 31, 2017, the company changed its classification from stock-in-trade to capital asset.

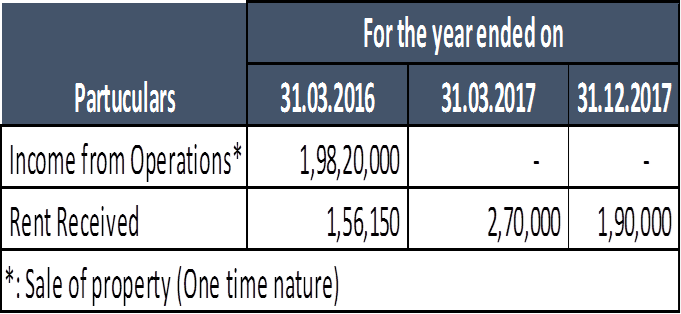

The rent received from the renting of the above building: –

Please note that it is not clear that whether whole property is leased or in parts.

Further, the valuation of Paisalo is based on the financials as on December 31, 2017 however, the valuation of AMPL is derived using financials as on December 31, 2017. (The financials of AMPL as on December 31, 2017 is provided in the scheme & in annexures)

Conclusion: –

The registered office of the Paisalo is situated in the same area in which AMPL owns the building. It is not clear whether the register office is owned or leased by the Paisalo and whether the property owned by the AMPL is rented out to Paisalo or to any of the related entities. Going ahead, the property can be used by the Paisalo for its own use. However, the rent received by AMPL from renting of the property is very low. Diluting 4%-5% of the equity stake for such low yield property need to be evaluated by the management and the shareholders.

Further, the company will record the building at its fair value which in turn will increase its net worth post amalgamation. However, the increased net worth can be beneficial for taking incremental leverage but will not result in incremental capital adequacy ratio.