Valiant Organics Ltd. (VALIANT) was established in the year 1985 under the name of Valiant Chemical Corporation, with a single product, viz., meta chloroaniline. The company was the major manufacturer of the same in India till 1999. Later, the company expanded its product range to include chlorophenols, a chemical mainly used as intermediates in pharmaceuticals, pesticides, disinfectants, anti-bacterial and veterinary. Currently, Valiant Organics Ltd. is one of the major suppliers of chlorophenols in India and abroad. Valiant Organics’ production site is situated at Sarigam Industrial Estate in Gujarat.

Amarjyot Chemicals Limited (ACL) is one of the leading manufacturers and suppliers of speciality chemicals. It is headed by first generations of technocrats. Amarjyot plants are located at Vapi, Jhagadia and Ahmedabad in Gujarat. ACL produces Ammonolysis, Hydrogenation, Nitration, Sulphonation, Acetylation reactions at it units. Some of the products are as:

- Dye intermediate: Para Nitro Aniline, Ortho Chloro Para Nitro Aniline, 6 Acetyl, OAPSA, Ortho Anisidine, Para Anisidine and OTSSA

- Intermediates for pigments: 2B Acid, 4B Acid, 6B Acid, ONAPSA

- Agro Intermediates: N-Isopropyl, Para Chloro Aniline, Meta Chloro Aniline, Para Fluoro Aniline, etc.

- Dyes: Acids Dyes, Reactive Dyes, Direct Dyes.

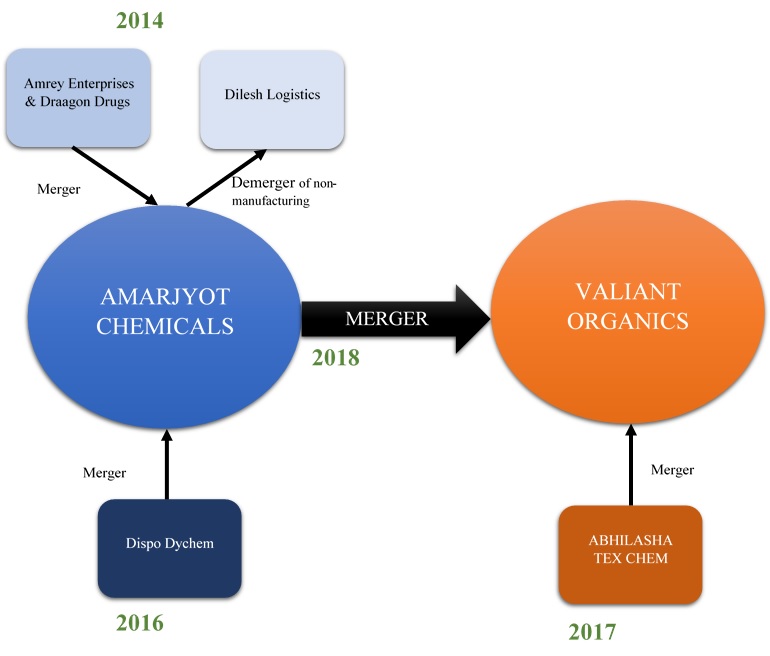

Recent Transactions by the Companies

Valiant

The company also acquired business through merger of Abhilasha Tex Chem Limited with Appointed Date July 1, 2016. The NCLT sanctioned the same on January 1, 2018.

ACL

Merger of Amrey Enterprises and Draagon Drugs and Demerger:

- It acquired business through merger of Amrey Enterprise Private Limited which had land and building facilities and merger of Draagon Drugs Private Limited which is engaged in the business of manufacturing of chemical business. However, it also demerged business of non-manufacturing from the company to Dilesh Logistics (India) Private Limited.

- Appointed date: December 1, 2014

- Swap ratio: For merger of Amrey and Draagon was 46:1000 and 554 :1000 for every equity shares, respectively.

- Products: Draagon Products Line Amino Compound, PNTOSA, NMQD, Meta Toluedine, Pure O A, DABA, CAT1, IPPCA, ORTHO TOLUENE, DDS, 2.5 Dymethoxy Aniline, DNS, PARA Toluedene L1Q, PEA. Whereas the Amrey has immovable property only and which is rented out.

- Valuation: Amrey was valued based on adjusted Net Asset value and whereas for Draagon and Amarjyot Net asset value and Price Earning Capacity value with appropriate Weightage. However, lower weightage to PECV for Draagon as compared to Amarjyot was given considering sale of its Tarapur unit resulting in substantial part of operation of Draagon and fluctuation in profit trend of the company over the years.

Amrey was valued at Rs 1.89 crore and Amarjyot at Rs 34.37 crore and Draagon at Rs 15.29 crore.

Merger of Dispo Dyechem

- It also acquired through merger of Dispo Dyechem Private Limited which is engaged in the business of Dye and Dyes Intermediates.

- Appointed Date: January 1, 2016

- Swap ratio: For merger of Dispo is 140 equity shares and 1 Redeemable Preference share for every 100 equity shares. Terms of Compulsory Redeemable Non-Cumulative Preference Shares

- Face Value: Rs. 100 each

- Redemption: Redeem at par within 36 months from the date of allotment

- Rate of Dividend: Zero

- Cal Option: Amarjyot will have an option to redeem at any time after the end of the months from the date of allotment.

- Valuation: Dispo was valued at Rs 7.87 crore with negative net worth of Rs 8.09 crore after capturing adjustment for Appreciation in value of assets net of taxes. Whereas Amarjyot was valued at Rs 100 crore weight of 33.33% NAV of Rs 48.35 crore and 66.67% to PECV of Rs 126.43 crore.

- Post-merger Shareholding

Table 1: Equity Shares

| Name of Shareholders | No of Shares | % Holding |

| Promoters | 44,20,832 | 50.56% |

| Public | 43,23,548 | 49.44% |

| Total | 87,44,380 | 100.00% |

Please note: this considering even Bonus issue in 2:3 post-merger of Dispo

Table 2: Compulsory Redeemable Non-Cumulative Preference Shares

| Particulars | No of Shares | % Holding |

| Name of Shareholders | 21,055 | 53.44% |

| Promoters | 18,345 | 46.56% |

| Public | 39,400 | 100.00% |

TRANSACTION:

Merger of Amarjyot with Valiant Organics Limited from the appointed dated 1st Oct 2017. Swap ratio for merger for Amarjyot was 72 equity shares for every 100 equity shares and 21 Optionally Convertible Preference Share (OCPS) for every 100 equity shares and 1 Redeemable Preference Shares for every 1 Redeemable preference share of Rs. 100 each.

The terms of Redeemable Preference share are same as allotted by Amarjyot. Whereas the terms for OCPS are as follows:

- It will be listed on SME Platform of BSE Limited

- Convertible at the option of the holder within 18 months from the date of listing approval.

- Ratio for Conversion: 1:1

- Non-Converted OCPS after 18 months will be converted into equivalent number of redeemable preference share

- Dividend rate Zero

- Tenure of Redeemable Preference Shares 7.5 years

- Redemption terms of RPS: At Rs. 812 per share with 4% annualized return till it is repaid.

- Redemption: the company can redeem but not before 66 months.

RATIONALE:

- Consolidation of Business

- Acquisition of infrastructure at fair value

- Consolidation of Infrastructure at nearby for each facility viz. Vapi, Tarapur and Ahmedabad.

- Exit options to group of shareholders including promoters

VALUATION

Amarjyot has been value at Rs 661 crore and whereas for Valiant is at Rs 477 crore. Valuation of Amarjyot at every stage is as follows:

Table 3: Increase in ACL Valuation in Every Transaction

| Particulars | Amarjyot (Rs. In crores) |

Situation |

| Dec-14 | 34.37 | Merger of Amrey & Draagon |

| Jan-16 | 100.40 | Merger of Dispo |

| Oct-17 | 661.08 | Merger with Valiant |

We have shown growth in business of Amarjyot over the years

Table 4: Financials Amarjyot (All Figs in INR Crores)

| Particulars | Amarjyot considering merger of Dispo (2016-17) | 2015-16 | 2014-15 | 2013-14 |

| Sales | 175.01 | 155.84 | 100.99 | 69.48 |

| EBITDA | 29.13 | 23.98 | 13.09 | 8.97 |

| Interest | 3.40 | 2.97 | 0.90 | 0.02 |

| EBTDA | 25.73 | 21.02 | 12.18 | 8.95 |

| Depreciation | 6.44 | 3.15 | 2.05 | 1.29 |

| PBT | 19.28 | 17.87 | 10.13 | 7.67 |

| PAT | 13.10 | 14.56 | 9.48 | 5.22 |

| NP Margin | 7.49% | 9.34% | 9.39% | 7.51% |

The revenue and profit has been almost by 2.5 times whereas the valuation by almost 20 times.

ACCOUNTING

Accounting is done at fair value to capture the appreciation in the value of assets.

FINANCIALS

Table 5: P&L pre-post-Merger (All Figs in INR Crores)

| Particulars | Amarjyot considering merger of Dispo (2016-17) |

Valiant (2016-17) |

Post-Merger (2016-17) |

| Sales | 175.01 | 58.74 | 233.75 |

| EBITDA | 29.13 | 16.48 | 45.61 |

| Interest | 3.40 | 0.24 | 3.64 |

| EBTDA | 25.73 | 16.24 | 41.97 |

| Depreciation | 6.44 | 1.06 | 7.50 |

| PBT | 19.28 | 15.18 | 34.46 |

| PAT | 13.10 | 9.83 | 22.93 |

| NP Margin | 7.49% | 16.73% | 9.81% |

| Cash Profit | 19.55 | 10.89 | 30.44 |

| Cash Profit margin | 11.17% | 18.54% | 13.02% |

| EPS | 15 | 27.01 | 18.86 |

| Interest Converge | 7 | 64 | 10 |

Please Note:

- Lower net profit and cash profit margin of merging business will affect profit margin in the coming years.

- Since the merging business is debt heavy it will affect Interest Converge Ratio.

Table 6: Financials Positions Pre- & Post Merger

| Particulars | Amarjyot considering merger of Dispo | Valiant | Post-Merger |

| Net worth (INR Crores) | 71 | 29.05 | 99.65 |

| RONW | 18.56% | 33.84% | 23.01% |

| Book Value | 81 | 79.81 | 81.95 |

| Borrowing (short + Long) | 49 | 0.22 | 49.38 |

| Number of Share | 87,44,372 | 36,40,320 | 1,21,60,304 |

| Debt Equity Ratio | 0.70 | 0.01 | 0.50 |

Please Note: Now the company will not be debt free and with a higher paid up equity capital of Rs. 12.16 crores

SHAREHOLDING

Table 7: Pre-Post Transaction Shareholding of Valiant Organics

| Particulars | Current | Allotment on Merger | Post -Merger | ||

| Name of Shareholders | No of Shares | % Holding | No of Shares | % Holding | |

| Promoters | 27,92,250 | 47.61% | 31,82,999 | 59,75,249 | 49.14% |

| Public | 30,72,100 | 52.39% | 31,12,955 | 61,85,055 | 50.86% |

| Total | 58,64,350 | 100.00% | 62,95,954 | 1,21,60,304 | 100.00% |

Please Note: Now the company will have compulsory redeemable preference share and Optionally Convertible preference share. Merger has also increased promoters stake by 1.53%.

Even though the other than promoters are considered in Public shareholding for above working of post-merger. There might SEBI requirement to classify them also as promoters then in that case the promoters holding will be 71.56% instead of 49.14%.

There can be further dilution if OCPS are converted into equity otherwise there will be minimum cash outflow of Rs. 150 crores on redemption of preference share payable to shareholders of Amarjyot (promoters and non-promoters group almost equal)

Table 8: Shareholding Pattern in case of OCPS converted to Equity

| Particulars | No of Shares | % Holding |

| Promoters | 69,03,624 | 49.32% |

| Public | 70,93,000 | 50.68% |

| Total | 1,39,96,624 | 100.00% |

PRICE MOVEMENT

The market price post announcement gained almost 20% but not is stable at 10% gains

CONCLUSION

The company wants to consolidate all its infrastructure and business into one listed company. However, at the much higher valuation which might be considering Valiant is also quote at much higher premium on BSE SME platform. There is also an exit option given to promoters and non-promoters by way OCPS of Rs 150 crore. So, it is consolidation with no immediate value creation for public shareholders.