The Prime Minister’s Office has sought details from the telecom department of the process being followed in the proposed Idea Cellular-Vodafone India merger amid delays in deal closure, people aware of the development said.

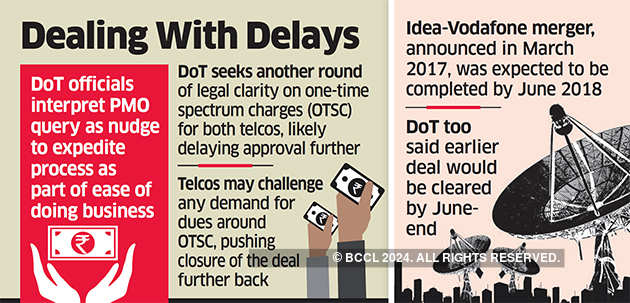

The development comes even as initial approval to the deal looks set to get pushed back further, with the department of telecommunications (DoT) seeking more clarifications from its legal experts on the dues to be claimed from the two telcos.

The two companies, and even DoT, had previously said they expect the deal to be cleared by June-end.

According to people aware of the development, senior officers of DoT had recently given an in-person explanation to PMO on the present status and the process being followed before approving the sector’s biggest merger deal, which will create the country’s largest mobile phone operator.

“The PMO has been apprised of the issues at hand, and DoT has explained that it is proceeding as per legal opinion,” a second government official said on condition of anonymity.

A government official said PMO’s query is being interpreted as a nudge “for the process to be expedited”, more so since the government wants to showcase the mega merger as an example of ease of doing business in the country.

Industry insiders said PMO’s query may have been a result of some senior group officials of the merging telcos raising the issue with authorities in the top office.

Vodafone did not elicit responses as of Sunday press time. The progress of the merger is being keenly followed by overseas investors and multinational companies, especially as UK’s Vodafone — which has had a long-standing tax dispute with the Indian government — is involved.

Also, the government’s policies around ease of doing business would come into question if procedural delays become a mainstay in as high-profile a merger as this, sources said.

Telecom minister Manoj Sinha last week asserted that there was no delay from DoT or the government’s side, adding that it was important to follow due process.

However, with the department seeking another round of clarifications from the assistant solicitor general (ASG) on the dues, even the initial conditional clearance is set to take more time, people aware of the matter said.

LEGAL OPINION

In his opinion, ASG had said merger of Vodafone’s six subsidiaries with Vodafone Mobile Services (VMSL) in 2014-15 must be completed and balance amount of one-time spectrum charge (OTSC) be paid.

DoT has approached ASG again to clarify if demands related to the merger of six units with VMSL are to be raised, along with those related to the present merger between Idea and Vodafone.

DoT had raised claim for more than Rs 8,100 crore including OTSC, of which VMSL has paid Rs 2,450 crore. The balance remains as the case is pending in the telecom tribunal.

Divergent views within the department have emerged on the mode of seeking dues. One side argued that all dues on VMSL must be sought in cash, while the other section said only dues around OTSC till 4.4 MHz of spectrum allocated to VMSL be raised in cash, and the rest in bank guarantees as applicable.

Another issue sent for clarification is on the date from which bank guarantee for OTSC from Idea be sought on airwaves beyond 4.4 MHz in 11 circles, sources said.

OTSC dues are based on DoT rules that require a telco holding more than 6.2 MHz in a circle between July 2008 and December 31, 2012 to pay a one-time market-linked price for the excess spectrum held. Likewise, the telcos may be told to pay the market price for airwave holdings beyond 4.4 MHz/circle between January 2013 and the expiry of their respective licences.

LEGAL BATTLE

People familiar with the development said that despite the delay, Idea and Vodafone are likely to challenge any demand for dues by the

DoT itself will also exhaust all legal options to enforce the dues, they said. This could well lead to further delays of months in concluding the mega deal, delaying the benefits from the $10 billion synergies that Vodafone and Idea were hoping to reap, besides losing customers and revenue to rivals in the interim period of transition.

Still, the merged entity, which has been the result of continuous pressure on tariffs and profitability due to free voice and cheap data offers from new entrant Reliance Jio, will be better positioned to fight out in the intensely competitive Indian telecoms market, sector watchers said.

Source: Economic Times