Bharti Airtel is in talks with Warburg Pincus to raise as much as $1.5 billion by divesting up to 15% in its holding company for African operations, Bharti Airtel International (Netherlands) BV (BAIN BV), two people familiar with the matter told ET.

This will be followed by a listing that will help the company repay some of its debt and fend off competition in the Indian market.

“The proposed transaction is a precursor to its planned listing of the African business in the overseas market in which Bharti Airtel aims to raise a similar amount,” said one of the persons. The proposed deal between India’s largest telecom company and US private equity firm is expected to value Bharti Airtel’s Africa unit at $8-9 billion, the person added.

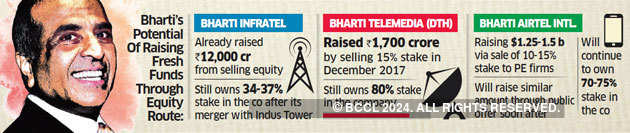

The two are discussing a sale of 10-15% stake for $1.25-1.5 billion, said the two people cited above. Both transactions are likely to be completed by December, said the second person.

Warburg was Bharti’s first marquee investor in the early 1990s. The success of that investment kicked off the private equity boom in India.

More recently, it also picked up a minority stake in Bharti’s direct-to-home (DTH) operation.

The money raised will help Bharti Airtel pay down some of its Rs 95,000- crore debt at the end of March this year.

It had a debt of over Rs 91,000 crore a year ago. The proceeds will also help bolster the telco’s efforts to stay competitive in the Indian market, where Bharti Airtel declared its first quarterly loss in the January-March period in contrast with profits in Africa.

The telco is in the midst of a prolonged price war that intensified with the entry of Reliance Jio Infocomm in September 2016, hurting revenue and profitability. “Since the African business has turned profitable, it does not need capital for investment,” said the second person cited above. Bharti and Warburg declined to comment.

The Netherlands-based, wholly-owned unit of Bharti Airtel is the holding company of telecom operations in 14 African markets—Nigeria, Chad, Congo-Brazzaville, Democratic Republic of Congo, Gabon, Madagascar, Niger, Kenya, Malawi, Seychelles, Tanzania, Uganda, Zambia and Rwanda.

The holding company’s board had authorised the management to initiate nonbinding exploratory discussions in mid-February with various banks or intermediaries to evaluate the feasibility of listing its shares.

AFRICAN SAFARI

Airtel’s Africa operations completed their first full year of profitability in March. Net profit amounted to Rs 1,827 crore on revenue of Rs 20,156 crore, marking a turnaround from previous years when losses mounted every quarter, dragging down consolidated numbers and casting doubt on Bharti’s strategy of expanding into the continent.

The situation has reversed, with the India operation reporting its first loss in 15 years — Rs 652 crore in the January-March quarter — weighed down by the continuing price war. It managed to stave off a loss at the consolidated level thanks to its Africa operations, which recorded a quarterly profit of Rs 698.7 crore, compared with Rs 26.3 crore a year ago. Bharti Airtel posted a consolidated profit of Rs 83 crore, down 78% year-on-year.

An overseas listing will help Bharti get better valuations for the Africa business thanks to more advantageous profit margins than the India business, said an investment banker with a foreign firm.

“The domestic market is in the midst of a price war, which is likely to continue for some time, while the African operation has now more or less stabilised,” he said. The proposed transactions—private placement to a private equity firm and subsequent initial public offer (IPO)—will not only give Bharti cash to deleverage its balance sheet, it will also enable the company to raise funds at short notice by diluting stakes in the listed company, Bharti Airtel International, in future.

“This will be similar to Bharti Infratel, where Airtel had raised billions of dollars through an IPO and subsequent sale of shares while still holding significant stake that is being diluted to raise fresh capital in the holding company, Bharti Airtel,” said one of the persons cited above.

Bharti Infratel is a Bharti Airtel unit that has raised over Rs 12,000 crore by selling minor stakes in the tower company in separate tranches over the past year.

Source: Economic Times