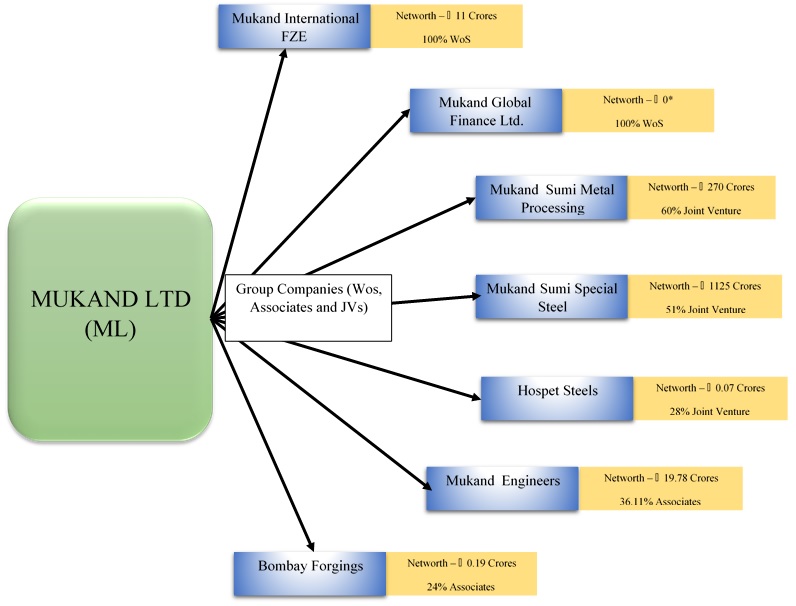

MUKAND LTD (ML), incorporated in the year 1937, was acquired by the present promoter families, Shri Jamanlal Bajaj and Shri Jeevan Lal Shah, on the behest of Mahatma Gandhi in the year 1939. The Company then operated re-rolling mills and a foundry in Lahore and at Reay Road, Bombay respectively. The Company was rechristened Mukand Ltd. in the year 1989 and had grown to become a multi division, multi product conglomerate

*Please Note: The company also have various WOS and Associates which has been recorded as zero value due diminution of value.

It also has a captive power generation plant with a capacity of 15MW. Apart from the core assets, Mukand has a large land bank in the industrial area of Thane.

MUKAND ENGINEERS LIMITED (MEL), incorporated in 1987, offer services in areas of engineering construction including feasibility studies, planning, procurement, construction, erection and commissioning of projects across industries such as petrochemicals, oil exploration and refineries, fertilizers, steel plants, aluminium plants, thermal and nuclear plants. MEL holds 0.48% equity shares of ML and 0.93% preference shares of ML.

ADORE TRADERS & REALTORS PRIVATE LIMITED (Adore) is engaged in the business of trading of metals and metal ores, loan & Investment and reals estate business.

MUKAND GLOBAL FINANCE LIMITED (MGFL) is engaged in Non-Banking financial activities viz. loans & advances and investment.

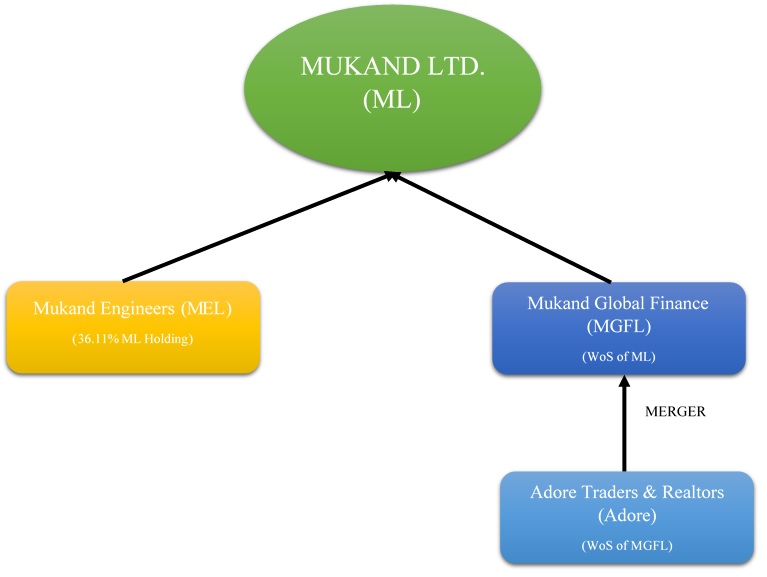

TRANSACTION

MEL is proposed to be amalgamated with ML, with effect from the Appointed Date of 1st April 2019, by way of a Scheme of Amalgamation pursuant to the provisions of Sections 230 to 232 of Companies Act, 2013. In the same scheme, the Adore Traders & Realtors Private Limited (WOS of MGFL) and Mukand global finance limited (WOS of ML) is merged with ML from the appointed date 1st April 2019.

RATIONALE

- Better realisation of potential of every business,

- Combined entity to develop and further grow and diversify with better funds and efficient utilisation of resources

- Greater economies of scale will provide a larger and stronger base

- Streamlining the management structure leading to better administration and reduction in costs for more focused operational efforts rationalisation standardization and simplification of business processes.

- Streamline decision making process help in better utilisation of human resources and will also provide better career

- Simplification of group structure of Mukand.

VALUATION

Since Adore and MGFL are WoS of there is no consideration to be issued for amalgamation. For amalgamation of MEL with ML both being listed companies Market Approach is also followed however the weightage for each method is follows:

Table 1: Valuation for Mukan and Mukand Engineers

| Valuation Approach | ML | MEL | ||

| Value per share | Weight | Value per share | Weight | |

| Cost Approach | 132.18 | 20% | 28.16 | 20% |

| Income Approach | 111.87 | 40% | 41.10 | 40% |

| Market Approach | 74.94 | 40% | 41.66 | 40% |

| Relative Value per share | 101.16 | 100% | 38.74 | 100% |

| Equity Valuation | INR 1430 crores | INR 48.71 crores | ||

| Swap Exchange ratio | 5:13 (for Every 13 equity shares in MEL 5 equity shares to be allotted in ML) |

|||

Under Cost Approach, all assets and liabilities are considered at replacement cost, however, investment and land at current market value adjustment for Contingent liabilities and preference shares. The surplus land will be sold in near future and net realisable value (post-tax and transaction cost) is considered. Under Income Approach the present value of cash flow after adjunct for Contingent liabilities, MAT credit, Debt, Surplus assets and other net assets and preference shares.

ACCOUNTING

For amalgamation of Adore in MGFL the accounting is under purchase method under AS-14, However, the assets and liabilities will be recorded at their respective carrying amount as appearing in the books of the transferor company. The difference is to be adjusted against Securities premium or capital reserve of the transferee company (i.e. MGFL)

Post above transaction, amalgamation of consolidated MGFL in ML the accounting is under Pooling of Interest method under IND_AS 103 Business combinations of entities under common control, the assets and liabilities will be recorded at their respective carrying amount as appearing in the books of the transferor company. The difference is to be credited to capital reserve of the transferee company i.e. ML.

For amalgamation of MEL in ML, cancellation of Equity shares holds by MEL in ML and accounting is under Bargain Purchase method under IND AS 103 Business Combinations, the assets and labilities will be recorded at fair value, equity shares issued will be recorded at fair value and the difference is to be adjusted to securities premium or capital reserve of ML .

TAXATION

Income Tax neutral as amalgamation in compliance of provision of Income Tax At 1961. There is stamp Duty implication on amalgamation of MEL into ML. However, no stamp duty on Merger of Adore into MGFL and MGFL into ML as it is WoS.

FINANCIAL

Merger is not earning positive as EBITDA of MEL is in Negative. The details are as follows:

Table 2: Standalone & Consolidated Financials

| Particulars | ML(Consolidated) | MEL | Total |

| Revenue | 3,573 | 79.35 | 3,652 |

| EBITDA | 257 | -0.98 | 256 |

| PAT | -374 | -11 | -385 |

| Net worth | 1,080 | 39 | 1,119 |

| Debt | 1,830 | 70 | 1,900 |

| Debt/Equity Ratio | 1.70 | 1.77 | 1.70 |

Please Note: Details of Other two companies being WOS is already clubbed in consolidated Figure

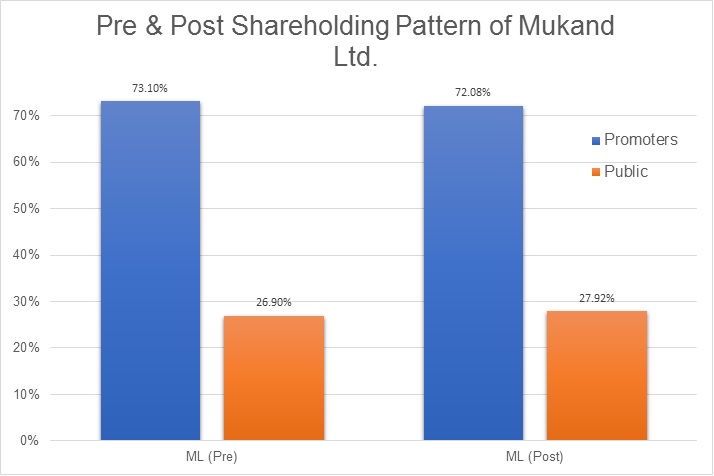

SHAREHOLDING

Please Note: ML hold 36.1% stake in MEL as part of merger ML will issue shares to the shareholders net of his stake in MEL. MEL holds 0.48% equity shares of ML and 0.93% preference shares of ML will be cancelled as part of merger. Merger of MGFL and Adore being WOS no consideration will be issued to them.

CONCLUSION

The group started restructuring by first having JVs with strategic partner SUMITOMO Corp., Japan, first in 2012 and second in 2018. The transaction followed by sale of surplus land seems to be the last step in the restructuring process.

Like many other groups, the transaction is to consolidate group entities created and incorporate as separate company not having any major commercial or business reasons. Changes in tax and corporate laws are compelling the promotors to create one consolidated entity. Considering loss at EBIT level and PAT level, pf MEL, consolidation will create value only and only if level of operations increases substantially with rationalisation of cost. The surplus assets of the company will have to be liquidated to have debt equity ratio of around 1.