Last year Gloster Limited (Gloster) announced the group re-structuring where Gloster got merged with Kettlewell Bullen & Company Limited (KBC) subsequently the name was changed to Gloster Limited.

Gloster Limited is engaged in manufacturing and exporting of all types of Jute & Jute allied products, Woven & Non-Woven Jute Geotextiles, Treated Fabric-Rot Proof, Fire Retardant, jute products for Interior Decoration and Packaging of Industrial and Agricultural produce. Company’s two manufacturing units are situated at Bauria, West Bengal.

KBC, a promoter group company, was NBFC holding 17% stake in Gloster. Other than Gloster, it was holding shares of few listed & unlisted companies.

The Transaction

In 2016, the management has decided to merge its listed entity Gloster into unlisted KBC. The appointed date for the transaction was 1st January 2015. Post-Merger, the name of the KBC changed to Gloster Limited. Further, all cost related to the merger like stamp duty, consultancy fees etc. were borne by the Gloster.

Swap Ratio

Swap Ratio for the merger was derived as 4 equity shares of KBC for every 5 equity shares held in Gloster. Later, the swap ratio got adjusted to 2:5 for the bonus issue by Gloster in the ratio of 1:1.

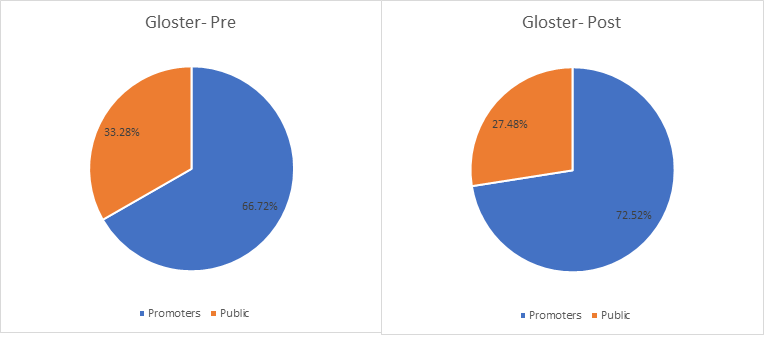

Shareholding Pattern

Before the merger, LIC was holding 22% stake in Gloster. ~95% stake of KBC was held by the promoter group and rest stake was hold by insurance companies. Post merger, shares held by KBC in Gloster got cancelled. The minority shareholders of Gloster’s shareholding came down to 25.46% from 33.28%.

Table 1: Shareholding of Promoters and Public

| Particulars | Gloster | KBC | Post-Merger |

| Promoters | 66.72% | 94.5% | 72.52% |

| Public-Gloster | 33.28% | 0.00% | 25.46% |

| Public-KBC | 0.00% | 5.5% | 2.01% |

| Total | 100.00% | 100.00% | 100.0% |

Key developments

Earlier, KBC was listed on the Calcutta Stock Exchange Limited. The shares of KBC was delisted from 10.08.2015. Post valuation date i.e. 31st December 2015, KBC had split the equity shares in the ratio of 1:10 and then declared the bonus in the ratio of 4:1 to its equity shareholders. Thus, the share capital got increased from INR 40 lakhs to INR 2 crore. In May 2016, Gloster issued bonus share in the ratio of 1:1.

Valuation

Table 2: Stake and value of Gloster & KBC

| Particulars | Amount |

| KBC’s Holding before merger | 17.1% |

| Shareholders of KBC ‘s holding after merger | 36.6% |

| Fair Value per share (As per Audit Report) | 2261 |

| MCAP based on Fair Value | 1,237 |

| Value assigned to Gloster | 787 |

| Value assigned to KBC (Including Stake in Gloster) | 450 |

| Value assigned to KBC (Excluding stake in Gloster) | 316 |

The value assigned to the other business of KBC was INR 318 crore. KBC derived its major income from interest, dividend and profit from the sale of shares & mutual funds (see table 3 for market value of KBC as March 18).

Table 3: Market Value (In INR Crores)

| Particular | Amount in Cr |

| Market Value of Quoted Investment* | 11 |

| Cost of Unquoted Investment | 4.8 |

| Fixed Assets* | 0.2 |

*: Market value of investment excluding Gloster & Fixed assets have land & building which could have revalued for valuation purpose.

Accounting Effect

Financials

Table 4: Financials of Gloster & KBC (All Figs in INR Crores)

| Particular | Gloster | KBC |

| Revenue | 503 | 1.51 |

| EBIT | 78 | 1.41 |

| PAT | 46 | 1.2 |

| Networth | 375 | 15 |

| Investment | 62 | 11 |

The market value of an investments of KBC as on 31st March 2017 were INR 105 crore (including the market value of equity shares of Gloster worth INR 94 crore).

Legal Compliances

The scheme got NCLT approval earlier this year and the record date for the transaction was 25th April 2018. KBC, being an unlisted company, has to obtain listing permission from the exchanges. Due to the procedural requirement, the shares generally not allowed to be traded for a few days. The equity shares of Gloster were last traded on BSE on 24th April 2018. The shares of KBC were allotted to the eligible shareholders on 10.05.2018. The last news uploaded on BSE was on 18.04.2018. Further, half of the tabs on the company’s website are not working properly and doesn’t have complete information available (Even the shareholding pattern uploaded is as on 31st March 2018).

Conclusion

Gloster means bright place but its action of merging the listed company into unlisted one does not seem to be as bright as its name suggests. Due to reasons best known to exchanges and the company, the company has not yet received the listing permission and its equity shares are not getting traded on any exchanges since last 6 months (as on Oct 2018). Further, minority shareholders didn’t get an opportunity for exit. Due to prolong period the shares being traded and slightly confusing special situation, one can see huge volatility in the prices of Gloster when it will start trading again (Recently, a similar thing has happened in Talwalkar).

The valuation report and the scheme got revised for the bonus issues announced by the Gloster post-valuation date. The company should explain the reason behind these corporate actions during such special situation as these creates unnecessary confusion amongst small shareholders. In our opinion, Exchanges should analyse these kinds of intra-group restructuring with some different yardsticks and criteria which captures real value creation and does not harm the interests of public shareholders. Even DII’s holding a substantial stake should have played a proactive role while approving the merger.