The US-based alternative investment manager InvestcorpNSE 0.00 % has acquired IDFC NSE -0.13 % Group’s private equity and real estate investment management business and plans to incrementally raise $50 million towards IDFC’s existing fourth fund.

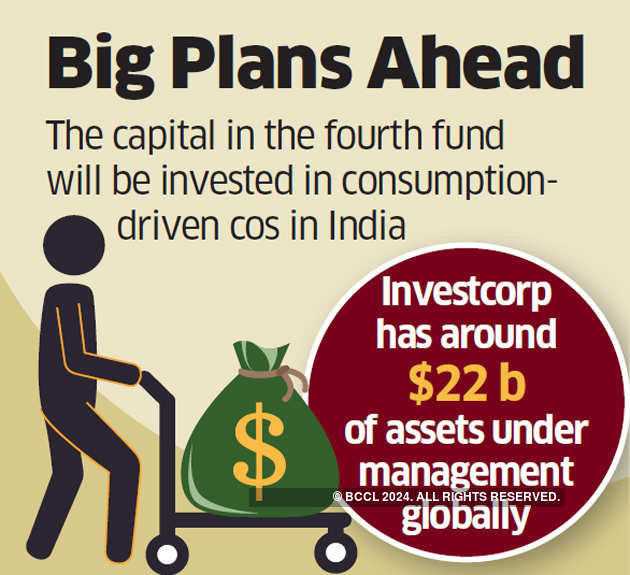

The incremental capital, along with the uninvested pool in the fourth fund, will be invested in consumption-driven companies in India, a senior company executive said.

HDFC chairman Deepak Parekh has joined the global advisory board of Investcorp.

“Once the acquisition is complete on January 31, we will use the greenshoe option and raise another $50 million in the fourth fund. This incremental capital, along with the dry powder (uninvested sum) of the fund, will give us a sizeable pool to invest in the next 24 months,” said Rishi Kapoor, co-chief executive of Investcorp.

Last year, Investcorp replaced IDFC as the general partner (GP) to manage their private equity business in India. This acquisition gives Investcorp, which has around $22 billion of assets under management globally, a toehold in one of the biggest emerging markets for PE investors.

The GP is a manager of a fund, whereas limited partners or LPs are the investors in such funds.

IDFC, as part of its business restructuring after receipt of the banking licence and acquisition by Capital First, decided to hive off non-core businesses and focus only on growing its retail banking business. IDFC PE’s infrastructure business was acquired by Global Investment Partners or GIP last year.

IDFC PE, started in 2002, was one of the early PE investors in the country. Investcorp is mandated to manage only the third and fourth fund. “As of now, our mandate is to monetise and realise the investments from the third fund and invest from the fourth. For the next 24 months, we will focus on this and only then think of launching a new fund, which will be bigger in size,” Kapoor told ET. “By 2020, we will start work on the new fund.”

Source: Economic Times