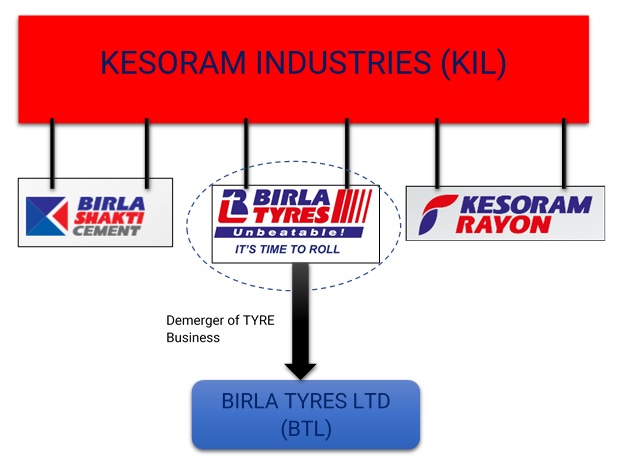

Kesoram Industries (KIL), a flagship company of the B. K. Birla group, is as old as its current chairman. It started its business from Cotton Mills then Rayon and eventually into Tyres and cement. Currently it is engaged in three distinct lines of business namely:

- Manufacturing & Distribution of cement through its “Birla Shakti” brand

- Manufacturing & Distribution of Automotive tyre through its brand name “Birla Tyres”.

- Rayon Business through its wholly owned subsidiary, Cygnet Industries Limited.

KIL’s cement business is located near the limestone deposits of Sedam and Basantnagar, having a total combined capacity of 7.25MTPA.

Birla Tyres Limited (BTL), was incorporated in 2018, to

Earlier Transaction

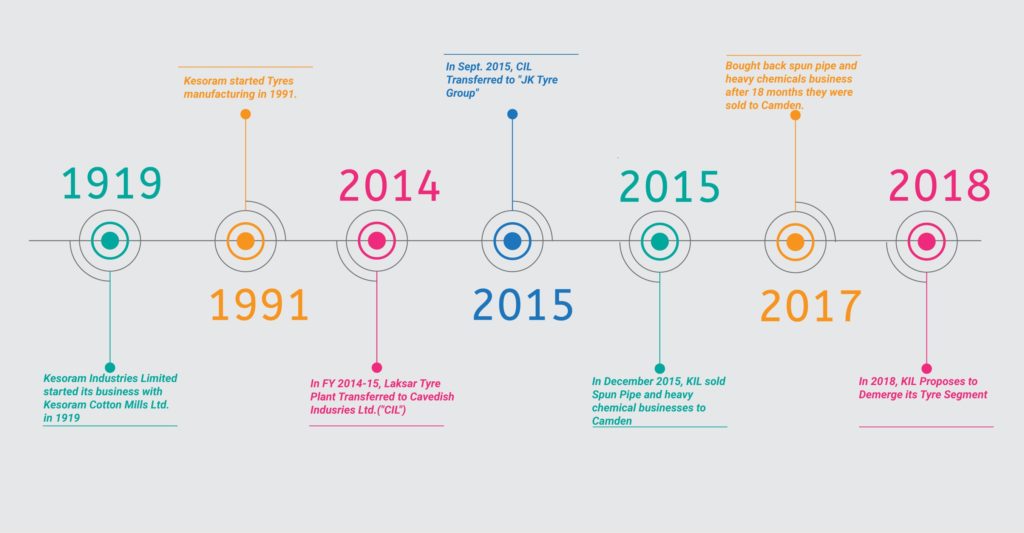

As a part of a debt restructuring exercise, the Company re-organised the Tyre Business during the Financial Year 2014 – 15. The company sold its one of the two tyre manufacturing facilities to JK Tyres. The manufacturing facility at Laksar, District Haridwar in the State of Uttarakhand was first transferred to a subsidiary, Cavendish Industries Limited (CIL) and then CIL was sold to JK Tyres for Rs. 2195 crores. Post stake sale, KIL continues its tyre business through the Balasore tyre manufacturing facility.

The Transaction

To separate its tyre business from its core cement business, KIL has announced to demerge its “Tyre Business” to BTL. The appointed date for the transaction will be 1st Jan 2019. Post-demerger, the equity shares of BTL will get listed on nationwide bourses.

Shareholding Pattern

As a result of the de-merger, BTL will issue one equity share for one equity share held in KIL. Currently, all the equity shares of BTL are held by the promoters of KIL. After demerger, the equity shares held by the promoters in BTL will get cancelled.

Past-Preferential Allotment

During 2016, the promoters of the company infused ₹180 crores in the company through subscribing partly equity shares and optionally convertible preference shares (OCPS).

During FY 2017-18, KIL issued and allotted 52,50,000 share warrants at a price of Rs. 175/- per warrant to a promoter group entity on preferential basis amounting to ₹91 crores.

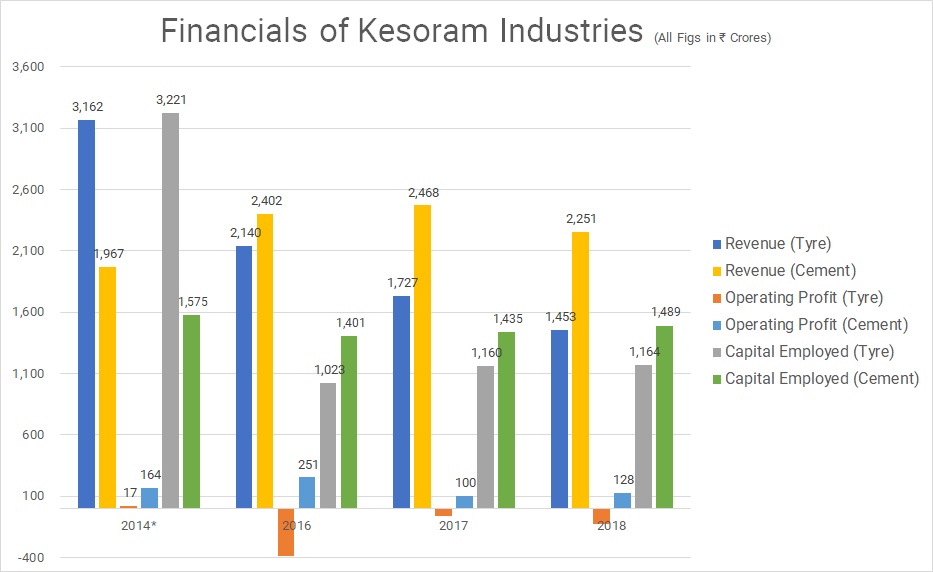

Financials of KIL

*Including Plant in Haridwar.

It looks after CIL sale, the tyre segment performance remains subdued. Despite stable performance of the Cement Business, Tyre Business is dragging down returns of KIL as a whole.

The company was continuously paying dividend from 2002 to 2013 but after 2013 it has not paid any dividend. The Company is having huge debts and having negative operational profits since last couple of years. For FY 2018, the debt of the company is more than the revenue it generated for the year. Post-demerger, the cement business is likely to have positive operating profits, but it will be interesting to see how the tyre business services its debt. It is not yet clear how much debt will get transferred to the tyre business but approximately ₹1000 crores of debt will get transferred to BTL.

Table 1: Other Financials KIL (All Figs in INR Crores)

| Particulars | 2,014 | 2,015 | 2,016 | 2,017 | 2,018 |

| Equity | 471 | 87 | 403 | 189 | 527 |

| Total Borrowings | 4044 | 4497 | 4456 | 3208 | 3979 |

| EBIT | 92 | -96 | -287 | -78 | -60 |

| Interest | 572 | 680 | 677 | 283 | 443 |

Conclusion

In 2015, KIL sold its modern tyre manufacturing facility maybe cause the buyer wasn’t interested in the older one. It seems the company is trying to sell the older tyre manufacturing facilities but not getting any buyer at a right valuation. The promotors supported the company and business by subscribing to preferential allotment. During the last two years, the company has spent more than INR 300 crores towards its tyre business, but with sees no visible increased in profitability.

As part of the family arrangement, it seems promotors of B.K. Birla Group wants to hand over the cement business to Ultratech Cement, and the demerger shall facilitate the same. Considering the negative operating profits, it will be interesting to see how does the

Add comment