ABB, Swiss-Swedish multinational corporation headquartered in Zurich, Switzerland, is a pioneering technology leader in power grids, electrification products, industrial automation and robotics and motion, serving customers in utilities, industry and transport & infrastructure globally. ABB is traded on the SIX Swiss Exchange in Zürich, Nasdaq Stockholm and the New York Stock Exchange in the United States.

Hitachi Limited, headquarter in Tokyo, Japan is a highly diversified company that operates eleven business segments: Information & Telecommunication Systems, Social Infrastructure, High Functional Materials & Components, Financial Services, Power Systems, Electronic Systems & Equipment, Automotive Systems, Railway & Urban Systems, Digital Media & Consumer Products, Construction Machinery and Other Components & Systems. Hitachi is listed on the Tokyo Stock Exchange and is a constituent of the Nikkei 225 and TOPIX indices.

The Transaction

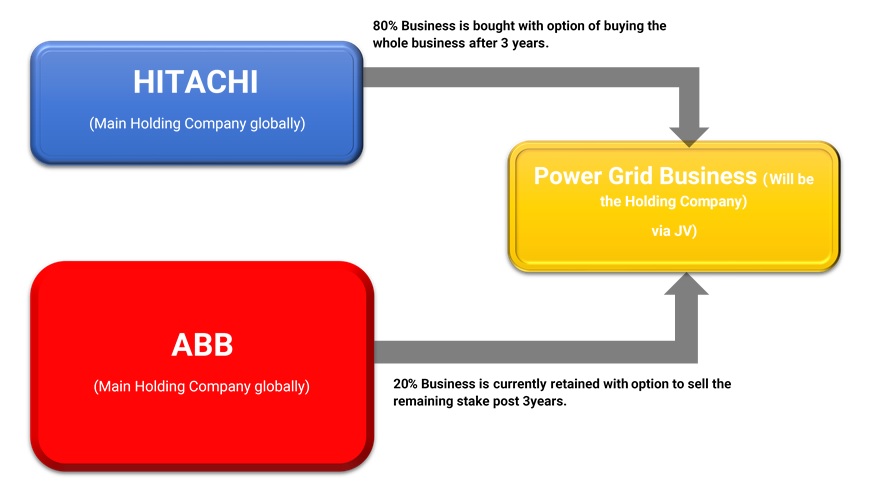

The relation of ABB & Hitachi formed in 2014, Hitachi & ABB formed a Joint Venture for High Voltage Direct Current operation in the Japanese market. After testing its partner, now ABB announced to hive off its Power Grid Business. Hitachi will acquire ABB’s Power Grid business, for an Enterprise Value of $11 billion for 100% of Power Grids.

Hitachi & ABB will set up a Joint Venture in which ABB will spin off its power Grid Business. ABB will initially retain a 19.9% equity stake in the joint venture, allowing a seamless transition. The transaction agreement includes a pre-defined option for ABB to exit the retained 19.9% share, exercisable three years after closing, at fair market value with floor price at 90%of agreed Enterprise Value. Hitachi holds a call option over the remaining 19.9% share at fair market value with floor price at 100% of agreed Enterprise Value.

Hitachi will fund the acquisition through internal accruals plus borrowings. The joint venture will be headquartered in Switzerland, with Hitachi retaining the management team to ensure business continuity. The transaction is expected to close by first half of 2020.

With the acquisition of the ABB power grid business, Hitachi will offer innovative energy solution business globally by combining ABB’s world-leading grid solutions & products with Hitachi’s digital technology. Furthermore, by building an energy platform to realize more efficient use of electricity throughout society, Hitachi aim at expanding its Social innovative Business not only in Power & Energy area, but also in the areas such as mobility, life & Industry. Hitachi will get global customer base through which it can expand its energy solution business.

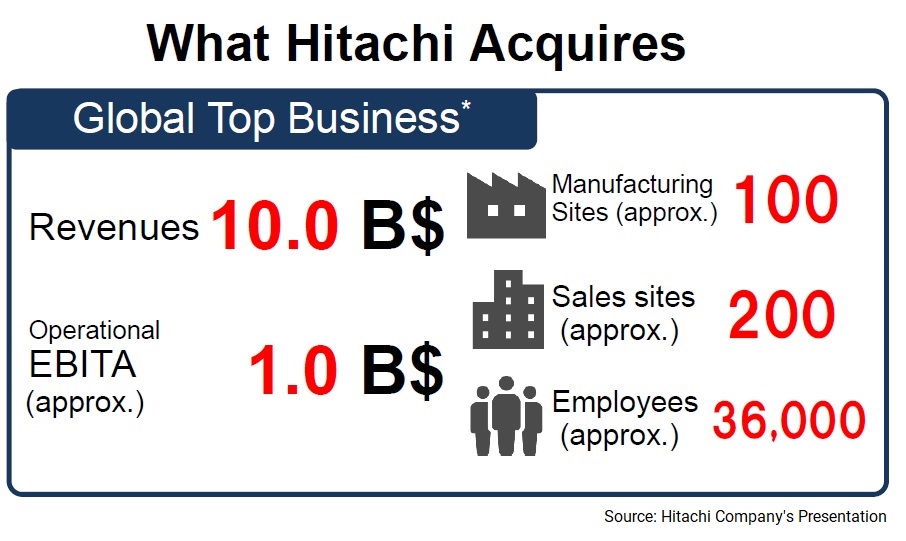

Power Grid Business

ABB’s Power Grids unit makes power transformers, long-distance transmission systems for power and also designs energy storage units. It accounts for about a quarter of ABB’s current business. Since 2014, Power Grids has been significantly improved under the ownership of ABB. The latest results (Q3 2018) are at the target margin corridor, having more than doubled margins.

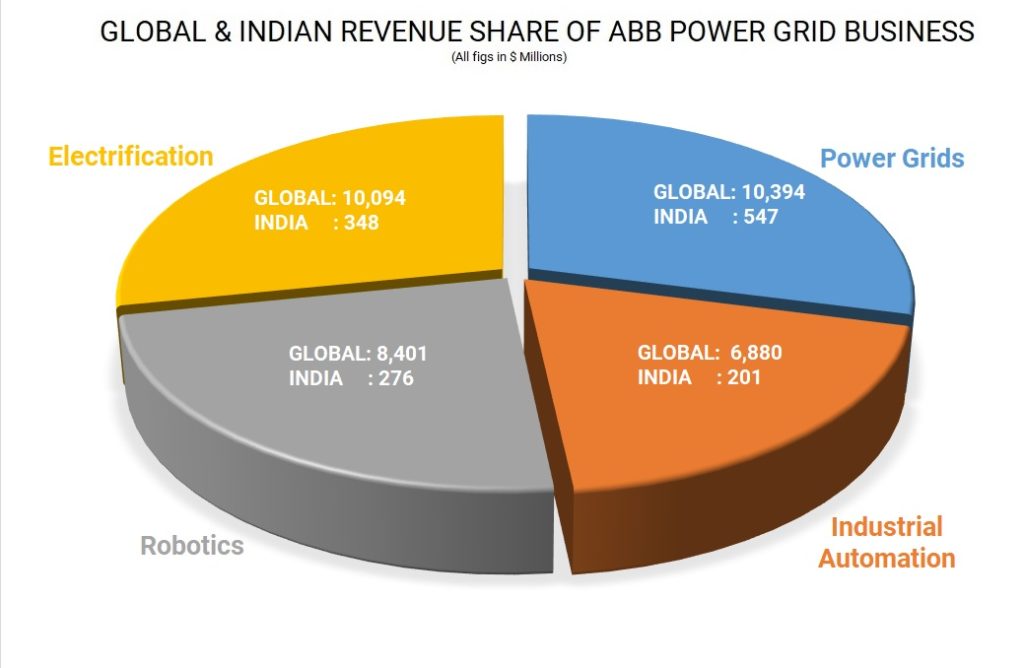

Global Revenue Share of Power Grid Business

Table 1:Revenue & EBIDTA Share (All figs in $Million)

| Year | Power Grid | Industrial Automation | Robotics & Motion | Electrification Products |

| Revenue | ||||

| 2017 | 10,394 | 6,880 | 8,401 | 10,094 |

| 2016 | 10,660 | 6,654 | 7,906 | 9,920 |

| Operational EBITA | ||||

| 2017 | 972 | 953 | 1,178 | 1,510 |

| 2016 | 998 | 897 | 1,223 | 1,459 |

India

Indian operation is very much dominated by the Power Grid Business. The segment has a health order book and almost 40% of the entity’s revenue is through Power Grid Business.

Table 2: Order Book of India Business (%)

| Particulars | Power Grid | Industrial Automation | Robotics & Motion | Electrification Products |

| Order book | 38% | 15% | 21% | 26% |

Financials

Growth across the Indian segments for the 9-months ended on 30th September 2018 compared with the 9 months ended on 30.9.2017

Table 3: Growth Y-o-Y for 9months Sep18 vs Sep 17

| Particulars | Robotic | Electrification | Industrial Automation | Power Grids |

| Revenue | 28.5% | 3.5% | 8.9% | 50.2% |

| EBIT | 33.9% | -7.9% | 43.9% | 73.5% |

Valuation

Table 4: Global Power Grid Valuation

| Particulars | Amount |

| Sale Consideration | $ 11 bn |

| 2017 EBITA | $ 972 mn |

| EBITA Multiple | 11.32 |

| Revenue Multiple | 1.06 |

| Global Entity MCAP | $ 41.05 bn |

| EBIT Share of Power Grid Business | 21% |

Table 5: Indian Business

| Particulars | Amount |

| EBITA Share of Indian Grid business in Global Grid Business | 5% |

| EBIT of India Grid Business (FY 17) | ₹344 Crores |

| Expected Valuation of Indian Grid Business | ₹3,905 Crores |

Assuming Indian Power Grid Business will get the same multiple which Global Power Grid Business got, the expected valuation of India Power Grid Business will be around circa ₹3900 crores. If they decide to transfer the Indian business through Slump Exchange and all the net proceeds they distribute to the shareholders in the form of dividend, after considering the tax, per equity share is likely to be around INR 125 -150.

| Particulars | Amount |

| MCAP of Indian Entity | 27,000 |

| EBIT Share of Power Grid Business | 36% |

Considering the growth opportunities available in India, ABB India trades at significant premium to the multiple its global arm is getting. Though Indian Power Grid business is 5% of ABB’s global power grid business, Indian business is likely to get significantly more valuation than INR 3900 crores.

Recent Global Acquisitions

To drive a stronger performance orientation in line with the next level strategy, the company is looking to transformed itself into future businesses.

In 2017, ABB acquire GE Industrial Solutions, GE’s electrification solutions business, which will strengthen its global #2 position in electrification and significantly expand its access to the North American market. The same year, company changed its business model for Engineering. Procurement & Construction business and divested high-voltage cable & cable accessories business.

ABB acquired B&R (Bernecker + Rainer Industrie-Elektronik GmbH), the world’s largest independent provider of machine and factory automation solutions. With this deal, ABB closed a historic gap in its portfolio and strengthened its leadership in industrial automation.

Way Ahead India

In India, ABB’s Power Grid business constitute more than 40% of the total revenue. As per the global press release and various interviews given by the management in recent past, Automation & Digitisation is going to drive the growth for the company. ABB does business in India in slightly different way. First, they bring global product, have the pilots and then start localising. Considering the cost advantage and availability of human resource, going ahead India can become major R& D Centre for the group.

Conclusion

The progressive move from shifting its focus from the core traditional business to technology driven futuristic business will be interesting to look. However, the transformation to asset heavy business to asset light technology driven businesses will come up with its own challenges. India, being the major R&D centre for the group, the hive-off decision is likely to bring significant growth opportunities for the Indian entity.

In India, Hitachi doesn’t operate through any listed company. It is likely that they will transfer the power grid business through slump sale and simultaneously will get unlisted. However, Hitachi can also consider the option of acquiring Power Grid Business through de-merger. The tax liability under this option will be lower and Hitachi will also have the option of listing Power Grid business. If they decide to list the Power Grid Business, the SEBI Open Offer requirements will likely to get triggered. The minority shareholders concern regarding the valuation of India Power Grid Business must be properly addressed by the management.

Add comment