Bhushan Steel was under Corporate Insolvency Resolution Process (CIRP) and on May 15, 2018, resolution plan was approved by the NCLT. On May 18, 2018, the company was acquired by Bamnipal Steel Limited (BMSL), a wholly owned subsidiary of Tata Steel Limited and later on renamed it to Tata Steel BMSL Ltd. Company recently issued its first Annual report post acquisition. We tried to dive into the impact of the resolution plan to the financial, other stakeholders and other aspects through this article.

Structuring of the deal

As a part of resolution plan, BMSL paid Rs. 35,100 crores to the financial creditors of Bhushan Steels to settle their claims. Amount was infused by way of issue of equity shares and inter-corporate deposits. Detail break-up is as follows:

Table 1: Resolution Plan Break-Up (All Figs in ₹ Lacs)

| Treatment | |

| Issue of Shares to BMSL (Rs. 2 each) | 15,888.58 |

| Treated as Inter-Corporate Deposit | 34,97,369 |

| 35,13,258 | |

| Utilisation | |

| CIRP and employee’s payment | 3,258 |

| Payment to Financial creditors | 35,10,000 |

| 35,13,258 | |

Note: ICDs are fully repaid by the end of Mar-19. Proceeds from the Issue of Preference shares (to Tata Steels) and borrowings is utilised.

Capital structure

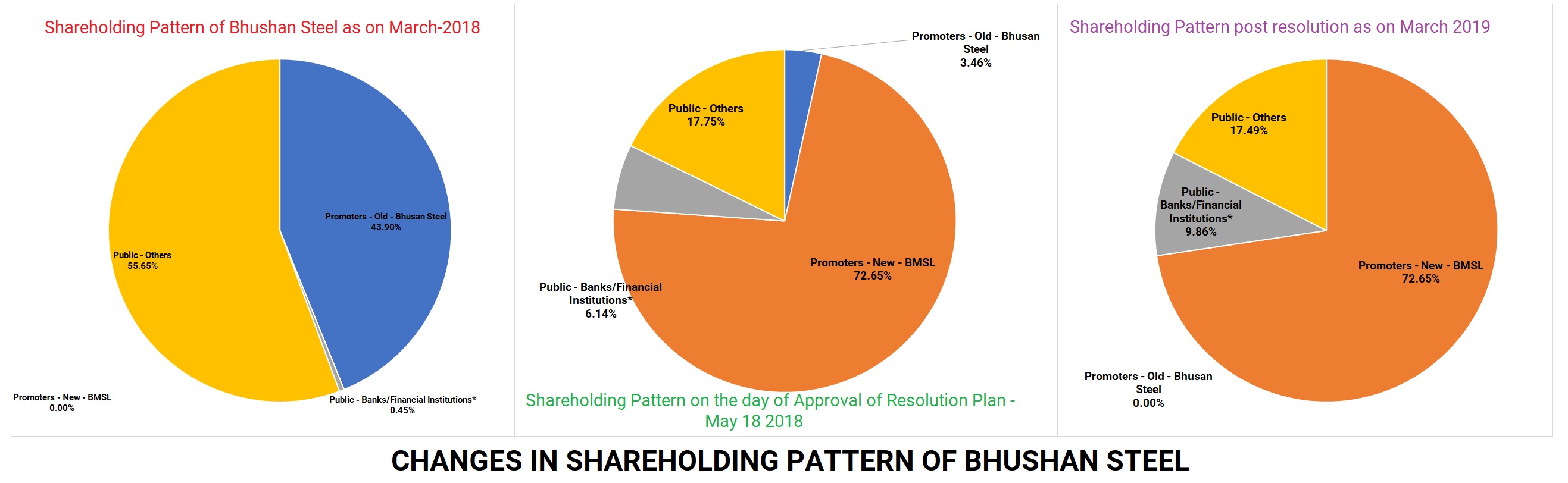

New shares were issued to the BMSL as a preferential allotment as per the resolution plan and their shareholding stands at 72.65% of total capital. Further erstwhile promoter and its group shareholding was 43.90% as on Mar-18, and during the year bankers invoked the pledge on their shares and their shareholding reduced to 3.46% as on date of implementation of plan and subsequently, they were reclassified from promoter group to public category, their shareholding remains unchanged as on Mar-19.

*72496036 shares are issued to lenders on conversion of certain debt into equity, and bankers also invoked pledge on shares of some promoters and sold in the market. Market value of shares invoked is Rs. 181.75 crores. We noticed a mismatch in no. of shares for which the pledge was invoked as per disclosure submitted to Stock exchanges (6,15,68,990) and as mentioned in the audited balance sheet (6,76,54,810). Reconciliation of shares at the beginning and at the end of bankers holding is not available since certain shares might be sold off by the bankers in the open market.

Implication on various stakeholders

On Financial Creditors:

Table 2: Repayment Financial Creditors – Insolvency Resolution Plan

| Financial creditors | Amount. (Rs. Crores) | % of loan |

| Payment Received | 35,100 | 57.94% |

| Allotment of Shares | 14.50 | 0.02% |

| Invocation of pledge shares | 181.58 | 0.30% |

| Balance due to FC novated to BMSL* | 25,285.51 | 41.74% |

| Total Financial creditor Liabilities ** | 60,581.58 | 100.00% |

*Cost of novation is Rs. 100 crores which is paid over and above 35,100 crores

**Updated list of creditors not available, we have re-calculated the total liabilities based on information available

On Operational creditor:

Table 3: Repayment Operational Creditors (including Statutory Liabilities) – Insolvency Resolution Plan

| Amount. (Rs. Crores) | % of loan | |

| Payment to operational creditors | 1,200 | 68.49% |

| OC extinguishment of liability | 552.12 | 31.51% |

| Total | 1,752.12 | 100% |

Tax implication

Due to implementation of resolution plan, there is an extinguishment / write-back of liabilities which lead to recording of exceptional gain in the books. Break-up is as follows:

| Particular | Rs. In lacs |

| Innovation of Pledge by FC | 18,158 |

| Liability extinguishment by OC | 55,212 |

| Pref Share redemption | 2,42,557 |

| Total Exception gain booked | 3,15,927 |

There was no tax implication on the transaction reported in the Mar-19 balance sheet for resolution plan impact. Company as on Mar-19, have Rs. 9,188 crores unabsorbed depreciation still left in its books. No deferred tax asset is created in the books.

Further with effect from AY 2018-19 (FY 2017-18), in case of a company, against whom an application for CIRP has been admitted by the adjudicating authority under the IBC, the amount of total loss brought forward (including unabsorbed depreciation) shall be allowed to be reduced from the book profit for the purposes of levy of MAT under section 115JB of the Act,”.

Impact on Shareholder

Table 4: Shareholding & MCap Changes

| Particular | Mar-19 | Mar-18 | ||

| % holding | Mkt Cap (in Cr) | % holding | Mkt cap (in Cr) | |

| Promoter | 72.65% | 2,228.37 | 43.90% | 398.02 |

| Public | 27.35% | 838.73 | 56.10% | 508.71 |

| Total | 100.00% | 3,067.10 | 100.00% | 906.74 |

Other Points:

- There was no extinguishment of share capital of existing promoters of the company, as usually happens in the other resolution plans, they are still holding shares in the company, now classified in the public category.

- In last month, Tata Steel files scheme for merger of Tata Steel BMSL Ltd and BMSL with Tata Steels Ltd, merger is still in approval stage.

Key Ratios

| Particular | FY19 | FY18 | Change % | Remark |

| Debtors Turnover (Days) | 16.74 | 28.78 | -42% | The fall is primarily on account of introduction of channel financing facilities across the distributor segment and discounting arrangements across the other segments. Further, the fall is on account of higher sales in FY19. |

| Inventory Turnover (Days) | 138.62 | 132.32 | 5% | |

| Interest Coverage Ratio (Times) | 0.66 | 0.08 | 713% | Improved primarily on account of higher operating profits and reduction of finance cost on account of reduction in external borrowings. |

| Current Ratio (Times) | 1.91 | 0.11 | 1694% | Improved primarily on account of reduction in the current liabilities due to reduction in current portion of long term borrowings and short term borrowings (due to repayments). |

| Debt Equity Ratio (Times) | 0.93 | Not compared since company was in CIRP | ||

| Net Debt Equity (Times) | 0.83 | Not compared since company was in CIRP | ||

| Return on Net Worth % | 9.35 | Not compared since company was in CIRP | ||

| EBITDA Margin % | 18.18 | 12.67 | 44% | primarily on account of higher operating profits. |

| Net Profit Margin % | 8.2 | -142.57 | -106% | Improved primary on account of exceptional gains (compared to exceptional losses in FY18), higher operational profits and reduced depreciation and finance cost. |

Conclusion

Due to CIRP process, valuable and productive assets could be saved and various stakeholders including employees continued to be gained fully employed. It also leads to profitable utilisation of assets and generating positive EBITDA. As a next step, it is getting merged with Tata Steel Ltd giving big opportunities to all the stakeholders to become part of one of the largest steel producer and get returns.

This can be considered as a classic case under IBC which fulfills aspirations of all the stakeholders and achieved the objectives as envisaged under the law. Let us hope that all assets heavy corporate debtor under stressed (eg. steel, cement, metal companies) get revived similarly and in the process productive assets and infrastructure are not required to be dismantled and sold in open for recovery.

Add comment