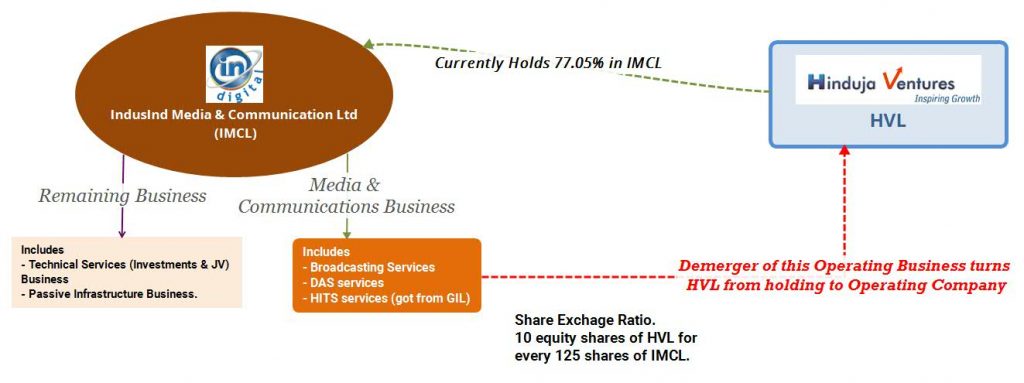

The Hinduja Group via its main holding company Hinduja Ventures had originally started with the communication business and now has multiple businesses via its subsidiaries and investments. The media and communication arms have been tallying up losses for the last few years the group started to consolidate its HITS and Broadcaster and DAS services via demerger and mergers.

The restructuring of its media and communication business will enable the group to expand its digital offerings in the rural market and reach of the group’s entire product portfolio to smaller towns and cities. The board of directors of Hinduja Ventures approved integration of IndusInd’s Media and Communications (IMCL – demerged company) with Hinduja Ventures.

Hinduja Ventures Ltd (HVL) –is a listed public company incorporated in the year 1985 is in the business of Media & communication, Real Estate, Treasury & Investment, through its various subsidiaries and also have dark Fibre Leasing business and close to 4,000 km of underground and overhead Dark fibre network across the country and also engaged in the business of high sea sale of set top boxes.

IndusInd Media and communication Ltd (IMCL) is a public limited company and is a multi system operator (MSO) engaged primarily in the operation and distribution of television channels through medium of analog, digital and terrestrial satellite cable transmission and distribution network in India.

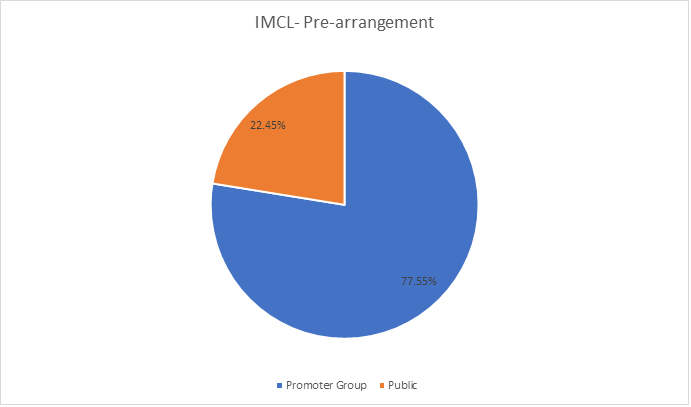

IMCL is the only largest integrated digital platform operator (DPO) with delivery via digital cable, satellite (‘HITS’). It is the only Company in the country having both the distribution platforms viz as Multi service operator (MSO) with Fiber and as HITS, with Hybrid satellite plus fibre-based network. The NXT Digital and IN Digital are distribution platforms of IMCL. As on 31st March, 2019, HVL holds 77.55% stake in IMCL.

Some Past Transactions

- 2007 – Scheme of Arrangement provides for the transfer by way of demerger of the IT/ITES Business (mainly BPO Business) of the HVL, then known as Hinduja TMT Limited to the HTMT Technologies Limited.

- 2011 – Scheme of Amalgamation of HTMT Telecom Private Limited, a WoS of HVL into HVL.

- 2015 – Scheme of Amalgamation of IDL Speciality Chemicals Limited, a WoS of HVL into HVL.

- 2017 – Scheme of Arrangement between Grant Investrade Ltd., a WoS of HVL and IndusInd Media & Communications Ltd, a subsidiary of HVL for Demerger of HITS Business Undertaking.

- 2018 – Scheme of Amalgamation of Grant Investrade Ltd., a WoS of HVL into HVL.

About the transaction

- Demerger of Media and communication undertaking of IMCL and vesting of same in HVL on a going concern basis. And the appointed date for the same is 1st October 2019.

- The share exchange ratio is decided to be 10 equity shares of HVL of Rs. 10 each for every 125 shares of IMCL of Rs. 10 each fully paid up.

- Post demerger IMCL will be left with Technical service business (including investment in JV) and passive infrastructure business.

- HVL will transit from a holding Company of IMCL to an operating Media Company.

Financials

Table 1: Standalone Financials as on 31.0.2019 (All Figs in INR Crores)

| Particulars | IMCL | HVL |

| Equity Paid-up capital | 182.47 | 20.56 |

| Reserves and surplus | 38.06* | 1,948.02 |

| Net worth | 220.53 | 1,968.58 |

| Secured loans | 572.09 | 546.68 |

| Unsecured loans | 80.70 | 4.05 |

| Fixed Assets | 719.62 | 223.50 |

| Total Income | 588.86 | 46.99 |

| Total Expenditure | 942.18 | 118.63 |

| Profit after tax | -353.32 | -47.20 |

*This includes carried forward losses of 1243.71 Crores

Comment on financials of IMCL (Mar-19)

- Company has incurred significant amount of losses in the FY 17-18 & 18-19 amounting to Rs. 219 Crs & 353 Crs respectively, total carried forward loss as on Mar-19 is stood at Rs. 1,237 crores (approx.).

- Question on recoverability of trade receivables, as on Mar-19 IMCL has Rs. 77 crores and for the year company has also write off / provision of debt of around Rs. 47 crores, which is almost around 38% of total debt (before considering bad debts) which raises the serious question on recoverability of debtor.

- As on Mar-19, company has investment in redeemable preference shares of Plant E-shop holding India Ltd which are acquired through a scheme of arrangement for demerger of its broad band division business, recorded at aggregate value of Rs. 267 crores whereas fair value of the same is Rs. 143 crores only.

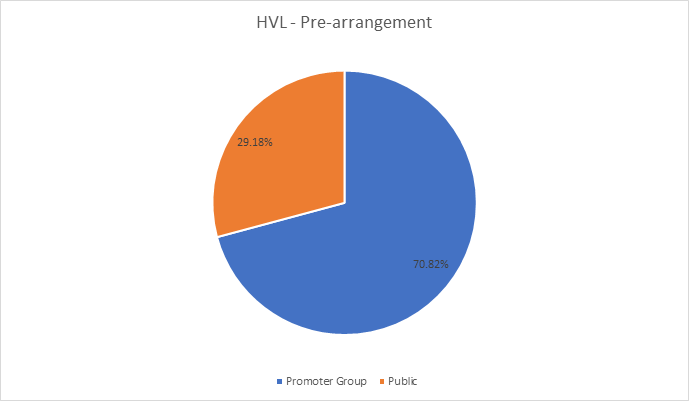

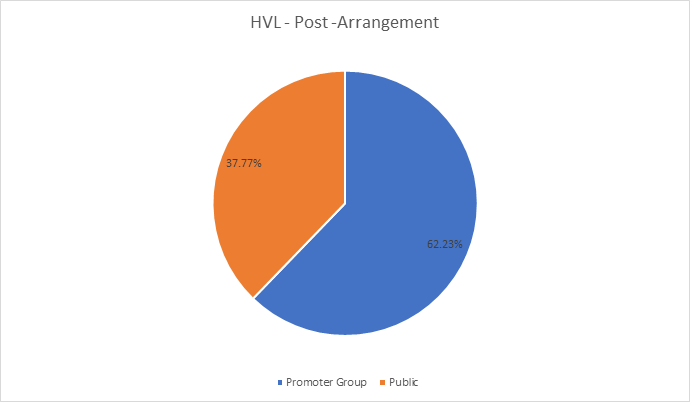

Shareholding Pattern

Note: There will be no change in shareholding of IMCL post demerger.

Valuation

As per the valuation report, fair value of HVL is Rs 2477.81 crores almost 4 times present market price and value of IMCL is Rs 1876.79 crores (as per income approach).

While calculating valuation of IMCL by income approach, value of investment in OneOTT by IMCL is considered as Rs.272 crores whereas the fair value of the same is Rs.148 crores (as reflecting in the consolidated balance sheet of the HVL), which led to increase in valuation of IMCL by Rs. 100 crores.

Since investment in OneOTT is considered in valuation, it is assumed that same is transferred as part of demerger to HVL.

Remaining business of IMCL

Post demerger IMCL will be left with investment (other than investment in preference shares of OneOTT ) & passive infrastructure business which is at present contributing just 1.02% of total revenue of IMCL.

Carried forward of losses

IMCL is having at present having losses of Rs 1,243 Crores, same will be allowed to carried forward by HVL subject to compliance of compliance with Sec 2(19AA) of the Income tax Act, 1961.

Accounting Treatment

In the books of demerged company:

- Upon the scheme being effective, demerged company shall reduce the book value of assets and liabilities pertaining to the media and communication undertaking transferred to resulting company.

- The excess of book value of assets transferred over the book value of liabilities transferred shall be transferred to retained earnings.

In the books of resulting company:

- The resulting company shall account for the scheme in accordance with pooling of interest method as per IND AS 103 (business Combination). And resulting company shall record assets and liabilities of the media and communication business at respective carrying values.

- Inter-company transactions shall stand cancelled.

- Reorganization of investment cost in demerged company proportionate to value of media and communication undertaking vis-à-vis total value of demerged company in absolute figures based on valuation carried out by an independent valuer for the purpose for demerger.

- Difference in carrying value and the amount credited to equity share capital and post adjusting the investment cost in demerged company shall be transferred to capital reserve account.

Possible rationale of the scheme

- IMCL has a total loan of Rs. 542 crores out of which repayable within a year is around Rs. 200 crores, considering the current position, company is incurring operating losses and further have only around Rs. 46.32 crores in cash (excluding escrow balance of Rs. 46.20 crores payment to foreign vendors), creating a high chance of default in repayment of loan.

- Due to introduction of New Tariff order (NTO) a minimum assured distribution fee to the distribution platforms are to be made hence it will help to cover the operational cost and the HVL looking for improving performance in the media business segment.

Conclusion

Though rationales mentioned in the scheme is consolidation and rationalisation, how holding company becoming operating company without hiving off other investments in the group listed company. One reason can be that cash flow and profits generated from large land parcel, in a tax efficient way may be used by the loss making and cash guzzling media business over and above to fund repayment of Rs. 200 crores loan along with interest. Though at the same time investments in listed group companies particularly investments in IndusInd bank get exposed to uncertainties and loss making media business. If for whatever reason, enough cash is not generated to sustain till the New Tariff Order comes into effect than in our opinion restructuring will prove only to be a theoretical exercise as one more attempt to grow media business. Let us look forward and believe in God.

Add comment