Offers from SSG and Cerberus have been selected for a final vote after lenders of Altico met on Monday and shortlisted the two as the key contenders to take over the troubled real estate financier, said people directly involved in the process.

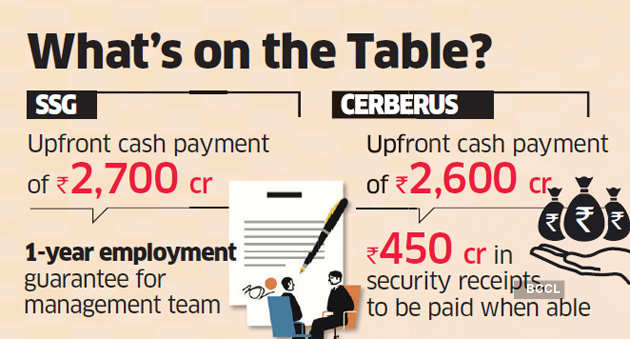

SSG’s final offer after multiple revisions is an upfront cash payment of Rs 2,700 crore and a one year employment guarantee for the management team.

Cerberus has offered Rs 2,600 crore in immediate cash payments and Rs 450 crore in security receipts, a kind of debt instrument backed by financial assets, to be paid when able.

Lenders vote on the proposals on March 12. SBI Capital, which is managing sale process along with EY, did not immediately reply to ET’s queries. Cerberus and SSG declined to comment.

“The plan by the incumbent management team has not found favour, though it will also be voted on,” said a person with direct knowledge of the matter.

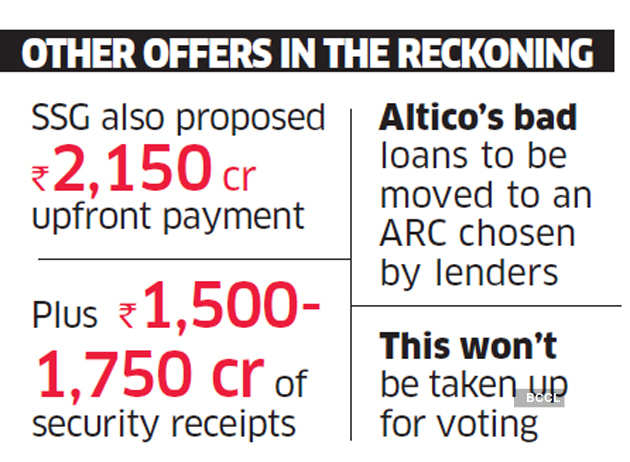

SSG made a second proposal — Rs 2,150 crore upfront payment plus Rs 1,500-1,750 crore of security receipts. It also suggested Altico’s bad loans be moved to an asset reconstruction company chosen by the lenders. But this won’t be taken up for voting.

Lenders analysed the revised offers on Monday in the presence of advisors such as SBI Capital, which also made a presentation on the competing bids followed by detailed pitches by each of the three bidders. ET reported on February 24 that the credit meeting will finalise the shortlist. The lenders were keen on bids that offered to run the company instead of shutting it down over a period of time.

“Even people working in the company have conveyed their intention to continue working for the real estate financier as they exuded confidence to rebuild it,” said an executive involved in the process.

The Clearwater-backed Altico management had suggested 100% repayment of the principal amount with outstanding interest being paid back at 10% over 5.75 years. But this hinged on Clearwater taking control of Altico as part of the resolution process. In this formula, existing shareholders would agree to pay Rs 630 crore by March 2021, which will be counted as year one. In years two and five, the management will make fresh equity infusions to keep the business viable, ET had reported.

Alternatively, the shareholders suggested that some lenders could get repaid before 5.75 years but only if they agreed to a 30% haircut. They will get 70 cents to the dollar at the same coupon.

With lenders working closely on the restructuring plan, a successful resolution could establish a benchmark in India’s shadow banking space.

Altico owes about Rs 4,000 crore to State Bank of India, Deutsche Bank, Bank of Baroda, Yes Bank, Union Bank, Mashreq Bank and IFC, besides NBFCs and mutual funds including Aditya Birla Finance, Bajaj Finance and L&T Finance.

“Potential buyers are quoting lower valuations as all such companies have stopped business. That is why it is important keep any such indebted company as a going concern, which help fetches a higher valuation,” said an advisor working on one of the debt resolution plans for cash-strapped nonbanking finance companies (NBFCs).

The real estate lender faced a liquidity crunch in September and defaulted on Rs 138 crore of debt repayments.

Source: Economic Times