The $5.7 bn Facebook-Reliance Jio deal needs to be scrutinised by the country’s competition watchdog, mainly from the point of view of data that the combined entity will control, top government officials and industry experts told ET.

The two companies are “data elephants” in terms of controlling private data of Indians, and together the combined reach of Reliance Jio, Facebook and its messaging app WhatsApp would provide undue advantage against rivals, be it other technology giants like Google and Amazon or even local startups, according to the people cited above.

Anshuman Thakur, strategy head at Reliance Jio, told ET that RILNSE 0.43 % would shortly approach the Competition Commission of India (CCI) for approval. As per company officials, CCI approval is the only regulatory clearance needed.

A top government official said that the two companies would control a lot of data of consumers.

“…we need the law to scrutinise the deal from the data advantage point of view and not just money or market share,” said the official who did not want to be named. “Data is becoming a factor to reckon competitiveness and therefore the data aspects of the competition law need to be sharpened and revisited,” the person said.

Analysts Seek More Transparency

Analysts have sought more transparency in how Facebook and Jio will function.

“The government needs to look into the data-sharing agreement between these two parties and it should be made transparent to both consumers and the government,” said Neil Shah, vice president at Counterpoint Research. “One needs to look into intrusive advertising. Since they are using WhatsApp channels for digital commerce, it opens up transaction details of these SMEs to a foreign company. It needs to be clarified that once FB gets access to the millions of Jio users, how will it use (the information)?”

Another official said that India’s telecom regulator is looking at the implication of the deal for consumers as well as other telecom companies.

“Our legal and regulatory systems needs to grow in independence, strength and maturity to tackle the risks of concentration of market/network power,” said Apar Gupta of the Internet Freedom Foundation (IFF), which ran the Save The Internet Campaign against Facebook’s Free Basics programme.

“Today, competition law does not consider any privacy rights related harms which emanate from market concentration in information societies that are exaggerated by power and information asymmetries. These power asymmetries and lack of real consumer choice are spurred by network effects which characterise digital markets,” Gupta said.

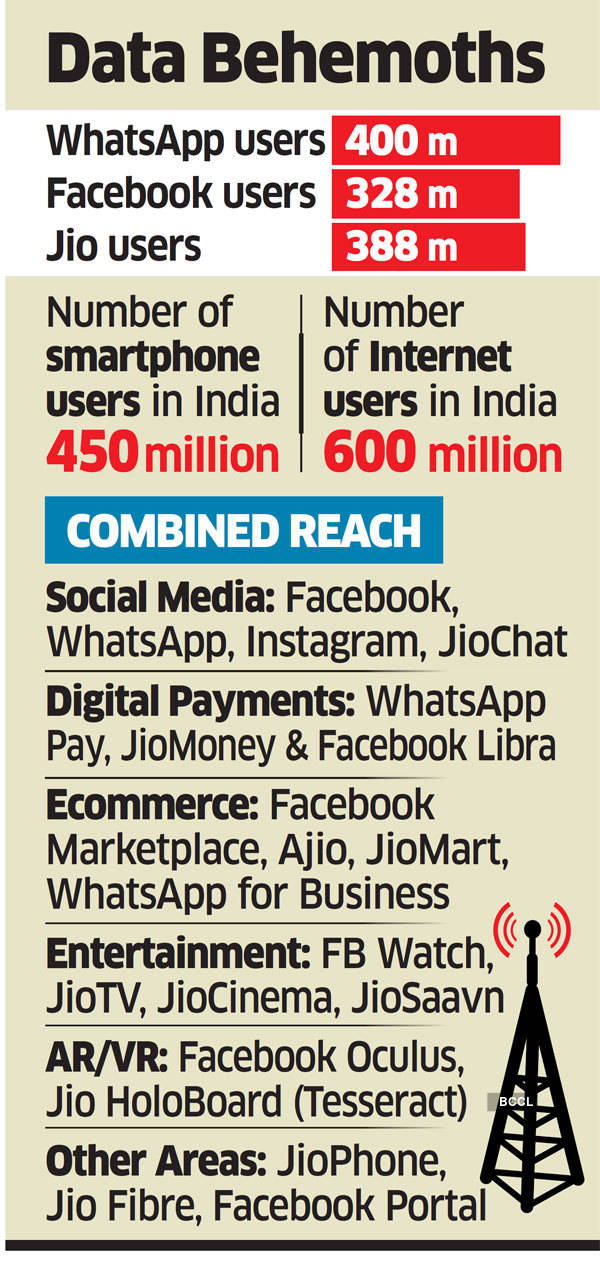

Jio has emerged as India’s largest telecom player with over 388 million subscribers within three years of its launch. Facebook has over 328 million users in India accessing its social network every month, while WhatsApp is present on over 400 million smartphones and is the most used messaging platform in the country.

‘NO DATA SHARING’

“Access to data is an interesting aspect of this deal, these two companies are like two elephants and the combined entity may have an unfair data advantage,” said the government official cited above. “Once WhatsApp and Jio join (hands), they may end up killing all competition and distort fair market practices.”

Ajit Mohan, MD of Facebook India, however told ET that there would be no data sharing in this deal.

CCI approves investments and mergers and acquisitions (M&A) by examining the market share of the entities involved in a transaction. It can however take suo motu action if it sees cartelisation or if there is a complaint that a company or grouping has higher concentration of market power.

“There is a policy gap and CCI should address this gap—how can one (set of companies) have all the data… After that, who will be able to compete in the market with them,” pointed out one official who spoke to ET on the condition of anonymity. “Whether it is payments or retail, the combined entities will concentrate too much power in their hands, then how are we going to regulate that?”

Researcher IDC estimates India has around 450 million smartphone users, and over 600 million internet users which makes it the second largest online market in the world, ranked only behind China.

Facebook has been keen on a stronger foothold in India for nearly a decade despite setbacks. In 2016, India’s net neutrality laws forced it to abandon Freebasics – internet firms giving preference to select sites. Separately the Indian government has been pushing WhatsApp to allow traceability of messages on its platform to curb rumours. WhatsApp has also not been able to fully operationalise its payment app that runs on the open source UPI platform due to regulatory concerns over storing user data locally.

Interestingly, both firms have businesses that could compete each other. While WhatsApp Pay is awaiting government nod, Reliance already has JioMoney. On the ecommerce side too there are multiple overlaps, while Reliance operates in the online space through Ajio and is close to launching JioMart in partnership with kiranas, Facebook also has Marketplace – a platform for buyers and sellers. For its part, WhatsApp has also launched WhatsApp for Business which allows small sellers to host their catalogue on the app as well as integrate payments seamlessly.

Government officials will also watch out for any violation of net neutrality rules once the integration with Jio and Facebook products is completed.

“At present we don’t have any laws on OTT (over-the-top) regulation in the country and this deal will have to be analysed from a larger angle. Obviously there are concerns if Facebook products including WhatsApp tend to work better on a Jio network ? However, this possible violation of net neutrality can only be observed once the deal comes through,” said a senior Telecom Regulatory Authority of India official.

Source: Economic Times