The Carlyle Group is set to acquire Sequent Scientific, India’s largest animal healthcare and nutrition company, ending months of negotiations with founders Arun Kumar and KR Ravishankar, people aware of the matter said.

Carlyle is expected to first buy around 50% stake from the promoters and their families at Rs 85-90 a share, or a 7-10% premium to the current market price, and then launch an open offer to the minority investors. The private equity group’s aim is to take its stake up to 75%, and if the open offer is not fully subscribed, the founders will sell more.

On Thursday, the shares ended at Rs 79.8 on the BSE, valuing the company at Rs 1,983.2 crore.

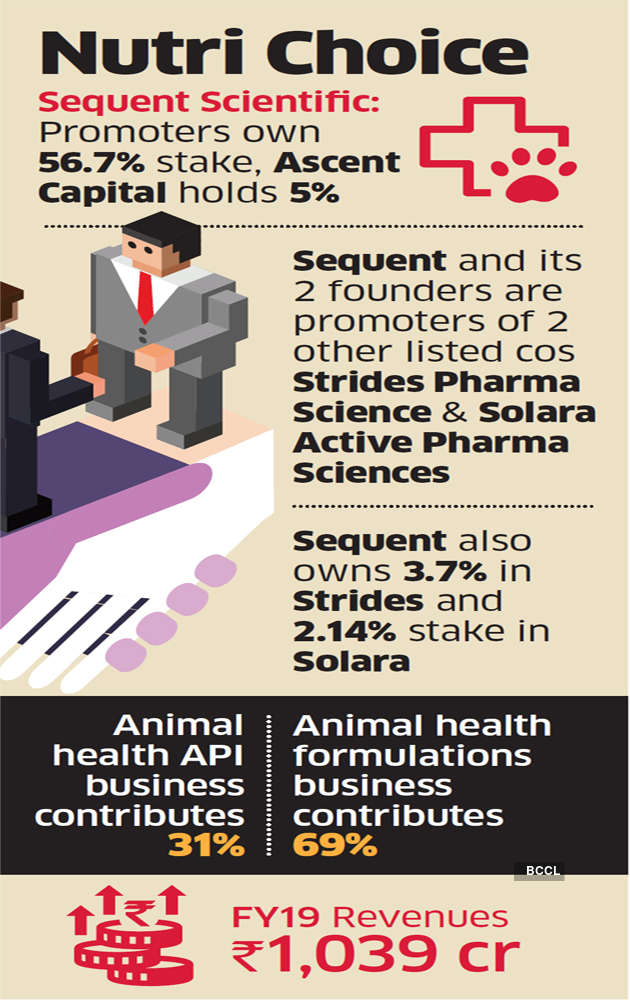

Ascent Capital, one of the private equity investors on board with a 5% stake, will also sell its shares, the people said. Depending on the success of the open offer, Carlyle is likely to spend Rs 1,600-1,800 crore for the purchase. The transaction is likely to be announced in the next few days, the people said.

Carlyle and Arun Kumar declined to respond to ET’s queries. ET was the first to report the potential deal in its December 4 edition.

Cofounded by serial entrepreneur Arun Kumar, who sold his injectables business to Mylan for more than Rs 10,000 crore six years ago, and KR Ravishankar, the company had hired JP Morgan around six months ago to find a buyer. After initial interest also from funds like Kedaara and Advent, Carlyle was the sole suitor that made a binding offer two to three weeks back.

The final negotiations took longer because of the price correction in the stock, said one of the people. Carlyle revised their price downwards after the stock came off, he said. This could not be independently verified.

The Sequent stock has been volatile for the last few months in anticipation of a sale, reaching a 52-week high of Rs 99.35 on February 24 and then a low of Rs 55.25 the very next month, on March 19.

Carlyle has a wide exposure in the animal health space through multiple investments in the last two decades. It had acquired animal nutrition and care products firm Manna Pro Products and sold it in 2017 to Morgan Stanley Capital Partners. The group had sold Saprogal, a producer of animal feed, to the Spanish private equity group Mercapital in 2005.

Sequent manufactures 26 commercial APIs and 1,000 finished dosage formulations (FDFs) of 12 dosage forms and markets those in more than 100 countries. It owns eight manufacturing facilities in India, Spain, Germany, Brazil and Turkey. Its API manufacturing facility in Vizag is India’s only US FDA approved animal health manufacturing set-up.

Animal health formulations business contributed 69% to its Rs 1,039 crore revenue in fiscal 2018-19, with the rest coming from API business. It posted an operating profit of Rs 133 crore and a net profit of Rs 57 crore for the year. Europe contributed 51% of the firm’s FY19 formulation business revenue, while emerging markets accounted for 22% and Latin America 13%.

Source: Economic Times