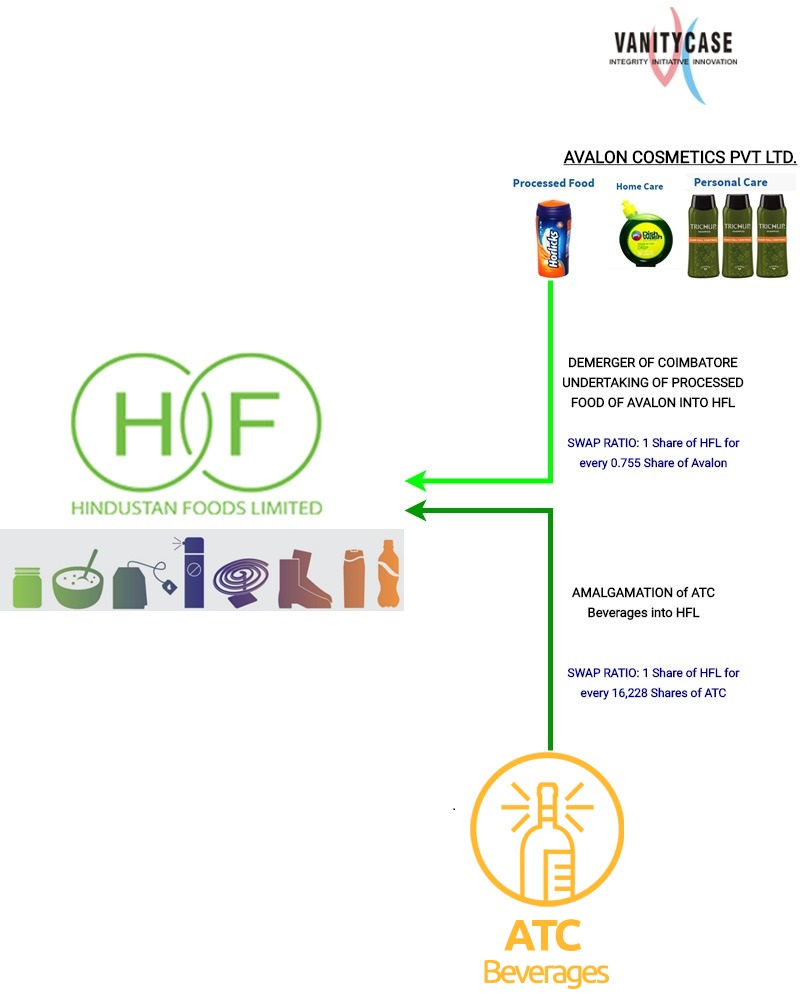

In a move to consolidate its business, FMCG company Hindustan Foods Ltd. has merged the Contract Manufacturing undertaking (Coimbatore) of its common control entity Avalon Cosmetic Pvt. Ltd and amalgamated its associate ATC Beverages Pvt. Ltd.

Hindustan Foods Limited (HFL) is a BSE listed FMCG company engaged in Contract Manufacturing of a diverse range of products including cereals, energy drinks, shampoos and detergents to even leather shoes and pesticides. Clientele includes Hindustan Unilever, Reckitt & Benckiser, PepsiCo, Steve Madden, Flipkart, Marico and more. It was incorporated in 1984 as a JV between Glaxo India Ltd. and the Dempo Group. In 2013 the Vanity Case Group and the Kothari family acquired the controlling stake and run the company.

Initially, HFL was only a one client-one brand company. Over the years its business had declined to the point where most of its net worth was wiped off. After the Vanity Case Group stepped in 2013, with funding and new management it was able to reverse its misfortunes.

The company is headquartered in Mumbai and as a growth strategy has inorganically increased its geographical footprint across 6 locations in India by acquiring manufacturing factories making a diverse range of products. It seems that this scheme is alignment with this strategy.

Avalon Cosmetics Pvt. Ltd. (Avalon), an unlisted FMCG company headquartered in Mumbai having manufacturing sites across 6 locations, is engaged in contract manufacturing of cosmetics like lotion, shampoo, etc. and food products. It was incorporated in 1981 and is owned by the Kothari Family (77%) and Vanity Case India Pvt. Ltd. (23%), who are also the promoters of HFL.

Clientele includes the likes of HUL, Amway Global, Godrej, Emami, Reckitt Benckiser and more.

ATC Beverages Pvt. Ltd. (ATC), an unlisted FMCG company headquartered and having its manufacturing unit in Mysore, is engaged in contract manufacturing of soft drinks and non-alcoholic beverages. It was incorporated in 2004 and is mainly owned by Maxwell Asgari and family (52%) and Hindustan Foods Ltd. (48%).

The company has clients like PepsiCo and O’cean beverages. ATC is mainly involved in bottling and packaging of cold beverages.

Transaction

Appointed date for the transactions is 1 April 2020.

Through the scheme HFL is acquiring the following:

- Coimbatore undertaking of Avalon Cosmetics which is into manufacturing Malt/wheat-based foods and energy drinks. Amalgamating ATC beverages. ATC Beverages manufactures energy drinks and non-alcoholic beverages like fruit juices.

The undertaking businesses getting acquired are from the Food sector and their businesses are similar to HFL’s.

Both the transactions are all equity deals.

Swap Ratios

- For demerger of Coimbatore undertaking of Avalon:

1 share of HFL to be issued for every 0.755 share held - For amalgamation of ATC beverages:

1 share of HFL for every 16,228 shares.

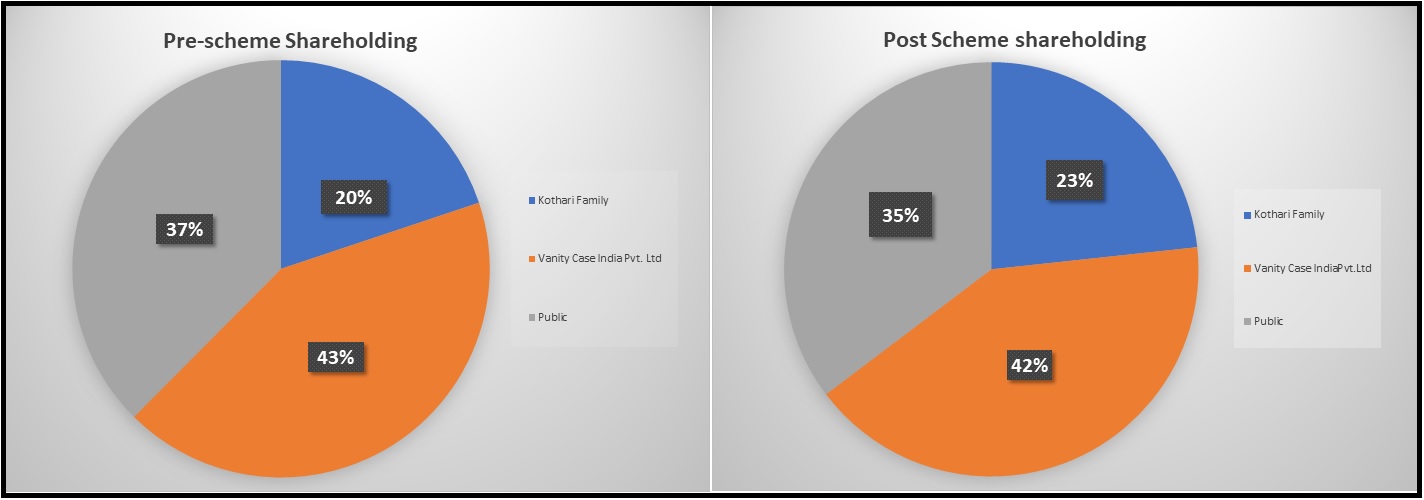

Pre and post scheme shareholding pattern of HFL:

Post scheme, promoter holding has gone up because in one of the companies involved in the scheme i.e. Avalon, the promoters (Kothari family and Vanity Case) are holding 99% shares

Rationale of the Scheme:

1. The amalgamation of ATC beverages (Mysore) is beneficial in the following ways:

- Amalgamation proves to be tax efficient. Both companies involved are industrial undertaking asper sec 72A, ITA 1961. Thus, the carried forward losses of ATC Beverages of up to Rs. 35 crore and will be available for set off subject to compliance of stringent conditions under Sec 72A of The Income tax act,1961.

- The acquisition is also in alignment with the overall growth strategy of the company of acquiring manufacturing entities in different products in the food sectors and different geographical locations.

- HFL already had a stake of 40% in ATC beverages which was bought in FY19 for Rs1.42 Crores. Then in early FY 20HFLalso converted, to equity, a loan of Rs.1.75 crore, increasing HFL’s holding to 48%. Now, only a year later, amalgamation of ATC indicates that HFL saw an acquisition opportunity at a reasonable valuation. ATC beverage had a poor financial position Now the valuation given to the company (as per the Valuation report) is about Rs. 11 Lakhs for equity value and enterprise value of Rs 13.11 crores considering unsecured loans of more than 13 crores.

- In fact, in FY 2019, HFL had converted an unsecured loan of Rs.1.75 cores which it had given to ATC beverages into equity shares. This was done despite the poor performance of the company over the previous years. ATC beverages were suffering losses since a few years and unsecured loans were piling on. HFL’s earlier acquisition of 40% stake, the subsequent conversion of the loan of Rs. 1.75 Crore (which brought holding to 48%) and now the amalgamation clearly is a bailout for ATC and its promoters. Besides, ATC has PepsiCo and O’cean beverages as its clients and beverages is a new segment for HFL so this amalgamation might as well be a synergetic business decision also.

2. This is the second acquisition of HFL from Avalon Cosmetics. In 2017-18, its Hyderabad undertaking (manufactures fabric cleaning products like detergents) was acquired by HFL. Avalon is 100% owned by promoters of HFL. So, selling of one Avalon’s businesses to HFL at good valuations benefits the promoters directly. From the point of view of public investors, this staggered acquisition of Avalon avoids a huge cash outflow in one go. Besides, entering one sector at a time helps HFL realize value from each such acquisition.

The related party transactions between both the companies are insignificant barring the purchase of land by HFL for Rs. 2.8 crore in FY 2019.

3. GST benefits:

- With the GST implementation, a trend has been seen with many companies like HUL, Lux Industries, Orient Refractoriesacquiringtheir unlisted manufacturing entities which have businesses same as the controlling entity. This reduces the compliance costs, GST cost because of related party transactions and simplifies the organizational structure. Having entities in different geographic locations also brings the entity closer to the markets and makes it easier to establish a GST efficient supply chain.

Valuation:

Avalon Cosmetics Pvt. Ltd.

| Particulars | Value |

| Total no. of shares that are going to be issued (A) | 13,49,283 |

| Value per share of HFL as per valuation report (B) | 603 |

| Thus, Value of undertaking of Avalon (A*B) | Rs. 81.36 Crore |

| Market cap of Hindustan Foods as on 30April 20 | Rs. 1200 Crore |

Note: Net worth of the whole of Avalon Cosmetics as on 30 Sept. 19 (as per its audited financials) is 58.9 Crores. Valuation given here, for the Coimbatore division, is much higher than book value of entire company. Considering that almost 100% shares are held between the Kothari’s (77%) and Vanity Case Group (22%), who are the promoters of HFL, post scheme the promoter holding % in HFL will).

ATC Beverages

| Particulars | Value |

| Total no. of shares that are going to be issued (A) | 1882 |

| Value per share of HFL as per valuation report (B) | 603 |

| Thus, Value of ATC Beverages (A*B) | Rs.0.11 Crore |

| Market cap of Hindustan Foods as on 30April 20 | Rs. 1200 Crore |

Note: Net worth of ATC Beverages as on 30 Sept. 19 as per its audited financials is 3.82 Crore but it has been consistently making huge losses and has undertaken significant unsecured loans. The valuer has only applied the DCF method and that has substantially discounted the enterprise value of ATC beverages.

Accounting treatment in books of Hindustan Foods:

The demerger will be accounted for using the “Pooling of Interest” Method as per Appendix C of IndAS 103: Business Combinations. Avalon Cosmetics is controlled by the promoters of HFL as the transaction being a common control combination.

Performance Analysis of HFL:

a. Trend of Revenue and EBITDA over the years of HFL:

Source: AR FY 19

Note: The company made 2 major acquisitions in 2017-18 apart from getting new clients and more funding, leading to a dramatic increase in turnover. The acquisitions were of G Shoe Export Ltd.(Mumbai) and a factory of Reckitt Benckiser (India) Pvt. Ltd, on slump sale basis, in Jammu and Kashmir, which makes pest control products for the brand “Mortein”. The J & K unit particularly has huge manufacturing capacity.

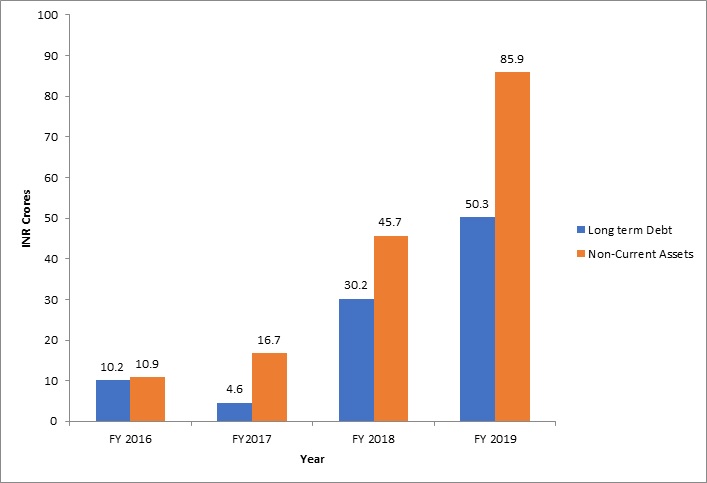

b. Long term debt and Non-current Assets:

The company has been growing and expanding its business through acquisitions, and hence needing more funds, and the same is reflected in the graph above.

c. Some financial ratios of HFL over the years:

| Particulars | FY10 | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 | FY17 | FY18 | FY19 |

| Receivable Days | 28 | 258 | 161 | 204 | 390 | 57 | 44 | 49 | 47 | 50 |

| Inventory days | 24 | 63 | 60 | 72 | 132 | 39 | 31 | 35 | 40 | 46 |

| Fixed Asset Turnover | 0.44 | 0.46 | 0.80 | 0.68 | 0.28 | 1.21 | 1.48 | 2.77 | 5.3 | 3.9 |

| ROCE (%) | -5.38 | 3.26 | -14.51 | -2.56 | -5.67 | 39.32 | 8.55 | 7.25 | 18.64 | 18 |

Source: Ratestar

As can be seen since 2013 there has been a massive improvement across all ratios. This was the year when the Vanity Case Group entered the scene.

Conclusion

Covid-19 has badly hit all companies across all sectors. The Indian economy was already struggling, and this pandemic has worsened the scenario. Hindustan Foods Ltd., being an FMCG manufacturer will see a decrease in business but since many of its products are consumer staples and other essentials it may be in a better position than companies in other industries. This scheme can prove to be helpful since it brings efficiency not only in HFL’s organizational structure but also reduces GST compliance costs and leads to direct tax benefits. With uncertain times ahead, we can expect more such re-structuring and also acquisitions where the big players like HFL absorb the small, struggling players like ATC Beverages. No doubt it will all depend on how quickly HFL is able to turn around the loss-making operations of ATC Beverages and also reduce tax cost by successfully en-cashing losses incurred by like ATC Beverages.

Add comment