Majesco USA, a leading software solution for insurance business transformation, founded by Ketan Mehta and headquartered in Morriston, New Jersey has announced that it has signed a definitive agreement to be acquired by Thoma Bravo, L.P., a leading private equity firm focused on the software and technology-enabled services sectors.

Majesco USA (“Majesco USA”) provides technology, expertise, and leadership that helps insurers modernize, innovate and connect to build the future of their business – and the future of insurance – at speed and scale. Our platforms connect people and businesses to insurance in ways that are innovative, hyper-relevant, compelling, and personal. Over 200 insurance companies worldwide in property and casualty (P&C), life and annuity (L&A) and group benefits are transforming their businesses by modernizing, optimizing, or creating new business models with Majesco. The shares of Majesco USA are listed on the New York Stock Exchange.

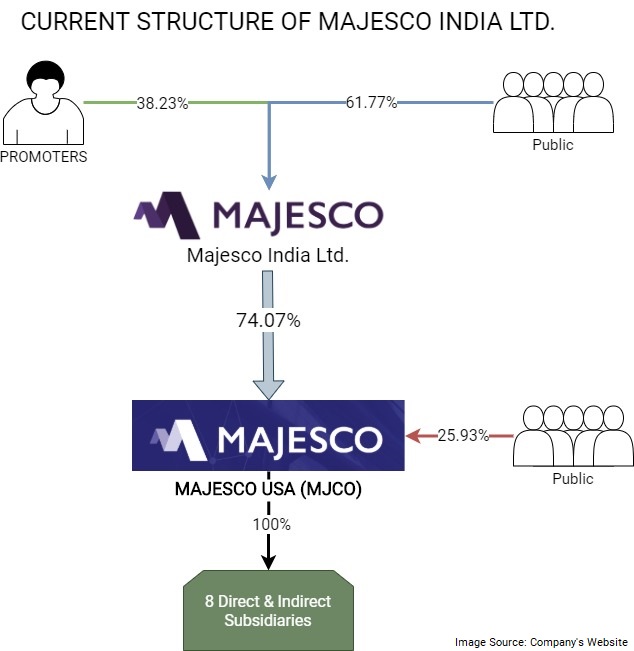

Majesco USA is the subsidiary of Majesco Limited. Majesco Limited’s equity shares are listed on nationwide bourses in India. Apart from investment in Majesco US, it does not have any significant assets. The company is not engaged in any business as on date.

| Particulars | Amount |

| Total Consolidated Revenue | ₹1062 crores |

| Attributable to US Subsidiary | 99.04% |

| Total Net-worth | ₹698 crores |

| Attributable to US Subsidiary | 93% |

Thoma Bravo is a leading private equity firm focused on the software and technology-enabled services sectors. With a series of funds representing more than $45 billion in capital commitments, Thoma Bravo partners with a Company’s management team to implement operating best practices, invest in growth initiatives and make accretive acquisitions intended to accelerate revenue and earnings, with the goal of increasing the value of the business. The firm has offices in San Francisco and Chicago.

Current Structure

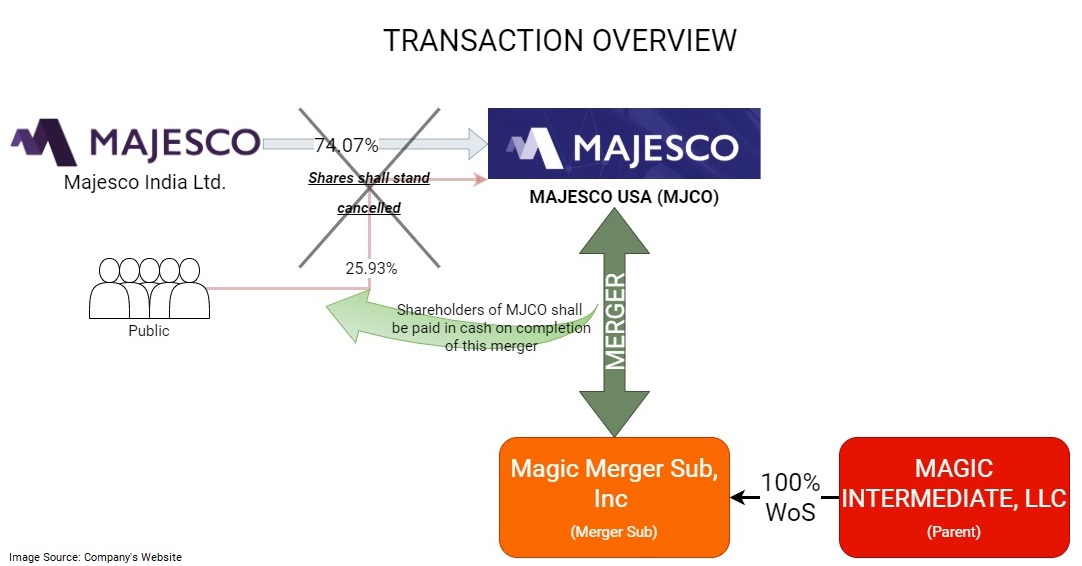

The Transaction

The board of directors of Majesco USA, in its meeting held on July 20, 2020, approved and declared as advisable and in the interest of its shareholders the merger between the Majesco USA and Magic Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and a wholly-owned subsidiary of Magic Intermediate, LLC, a Delaware limited liability company (“Parent”). In the Merger, inter alia, all the outstanding common stock of the Majesco USA will be extinguished and eligible shareholders (including Majesco Limited) will become entitled to receive cash.

Under the terms of the agreement, all Majesco USA shareholders will receive $16 (revised offer, earlier it was $13.10) in cash for each share of Majesco USA upon closing of the transaction.

Majesco Limited intends to distribute entire proceeds from the sale of its stake in Majesco USA (net of taxes, transaction costs, and other expenses to be incurred during the intermediary period), to the Company’s shareholders in a tax-efficient manner.

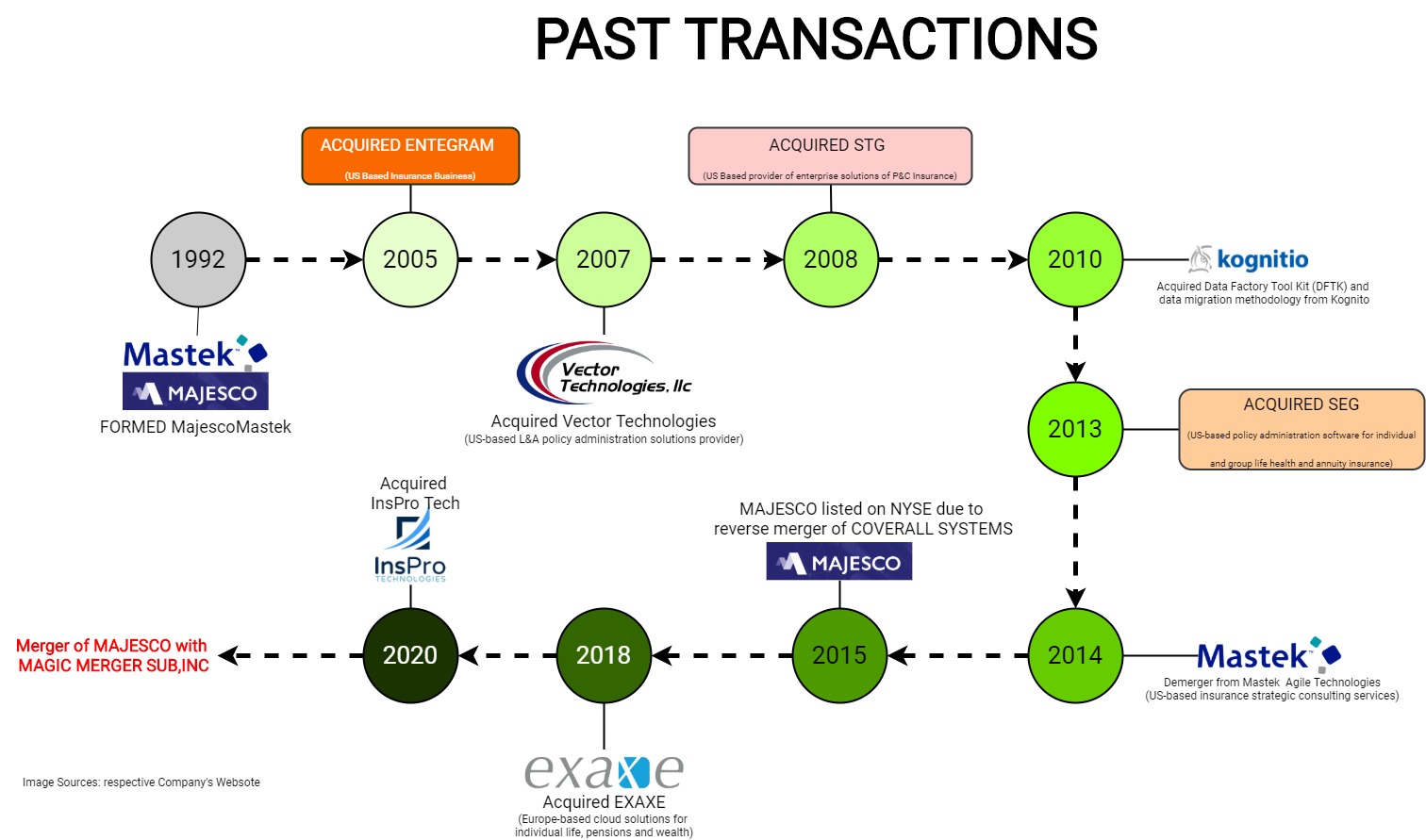

Earlier Transactions

2014

Towards the way for the growth of Insurance business, Mastek Limited (“Mastek”) in 2014, had approved the demerger of the Insurance Products and Services business of Mastek, into Majesco Limited, followed by transfer by the Majesco Limited of the offshore insurance operations business in India to Majesco Software and Solution India Private Ltd (“MSSIPL”) a wholly-owned subsidiary of Majesco Software and Solution Inc., USA (i.e. Majesco USA) a subsidiary of the Majesco Limited, retaining the domestic operations with Majesco Limited. The appointed date of the scheme was April 1, 2014 and the appointed date for the transfer of the offshore insurance operation business transfer was November 1, 2014.

Later in 2015, Majesco USA completed integration by merging entities in the United States and as a result of a reverse merger with USA based listed entity, it got listed on the New York Stock Exchanges.

Circa value creation through Demerger

2018

In FY 2017-18, the Majesco Limited had issued 44,43,849 Equity shares of INR 5/- each for cash pursuant to qualified institutional placement (QIP) for inorganic growth, including through overseas subsidiaries and step-down subsidiaries at INR 520/- per share aggregating to INR 22,527 lakhs. The funds so raised were utilized by the Majesco Limited by exercising the rights issue of shares of its subsidiary, Majesco, USA, invested INR 23,202 lakhs and was allotted 45,81,109 number of shares.

2019

Majesco Limited had entered into a share purchase agreement with Mastek (UK) Limited (the “Seller”) on December 12, 2019, for the acquisition of 2,000,000 shares of Majesco USA. In consideration for the purchase of the shares, Majesco Limited had paid the Seller INR 11,306 lakhs (USD 15.94 Million). Accordingly, from December 12, 2019, the stake of Majesco Limited in Majesco USA increased to 74.6% from the existing 69.9%.

In March 2019, the Majesco Limited had entered into an agreement with a subsidiary of Majesco USA (which is also step down subsidiary of Majesco Limited) Majesco Software and Solutions India Private Ltd. to sell its India Insurance Product and Services business together with all the licenses, permits, consents and approvals whatsoever and all related movable assets and liabilities together with employees as a going concern on a slump sale basis for a lump sum consideration of INR 2,437 lakhs, w.e.f April 01, 2019. The conditions precedent to transfers were completed on May 15, 2019 and the purchase consideration was received and the net profit of INR 1,869 Lakhs has been recognized by Majesco Limited.

| Particular | Amount (In lakhs) |

| Revenue | 1999 (March 2018) |

| Consideration | 2437 |

Some of the Prior Acquisitions by Majesco/Mastek in Insurance Business

| Year | Name |

| 1992 | Formed Majesco Mastek (insurance focused products and services) |

| 2005 | Entegram (US-Based Insurance Business) |

| 2007 | Vector Technologies (US-based L&A policy administration solutions provider) |

| 2008 | STG (US-based provider of enterprise solutions of P&C insurance) |

| 2010 | Data Factory Tool Kit (DFTK) and data migration methodology from Kognitio |

| 2013 | SEG (US-based policy administration software for individual and group life health and annuity insurance) |

| 2014 | Demerger from Mastek

|

| 2015 | Cover-All Systems (a core P&C product and service provider), which was listed on NYSE and as a result of a stock swap transaction, reverse-merged and listed Majesco, USA, on NYSE Market |

| 2018 | Exaxe (Europe-based cloud solutions for individual life, pensions and wealth) |

| 2020 | InsPro Technologies |

Deal Financials

The consideration price i.e. $16 per share represents a premium of approximately 113% over Majesco’s average closing price during the 30-trading day period ended July 17, 2020.

Valuation given to Majesco USA

| Particulars | Amount (in million except per share) |

| Transaction price per share | $ 16.0 |

| Equity Value | $ 728.7 |

| Implied Enterprise Value | $ 700.2 |

| P/E Multiple | 72.3 |

| EV/Revenue | 4.8 |

Cash inflow to Majesco Limited

| Particulars | Amount |

| No. of Shares held in Majesco USA | 3,21,11,234 |

| Price Offered ($ Per Share) | $16 |

| Gross Value to Majesco Limited (In $) | $513.78 million |

| Average INR / $ rate | ₹75 |

| Gross Value to Majesco Limited (in INR) | ₹3,853.35 crores |

| Majesco Limited Market Cap (17th July 2020) | ₹1,045.64 crores |

| Majesco Limited Market Cap (5 August 2020) | ₹1,815 crores |

Cash to be distributed by the Majesco Limited

| Particulars | Amount (in ₹ Million) |

| No. of Shares Majesco Limited | 28.75 |

| No of Shares: Majesco Limited (Diluted) | 30.32 |

| Value of Proposed Stake | 38,533 |

| Value after capital gain tax (assumed) | 31,212 |

| Existing Cash balance available (after transaction expenses) | 235 |

| Total Cash Balance | 31,447 |

| Cash available per share (In INR) | 1037 |

| CMP of Majesco Limited per share (5 August 2020) | ₹631 |

| CMP of Majesco Limited per share (17 July 2020) | ₹364 |

The gross value to be received by the Majesco Limited for its stake in US Subsidiary in the Merger is circa INR 3853 crores, compared to the total investments made by the Majesco Limited in US Subsidiary of circa INR 515 crores, to date. Clearly, due to the significant premium of the transaction, the stock prices of Majesco Limited shot up quickly.

Conclusion

Mastek Journey of creating an Insurance business and then separating out and finally selling it was well panned 5 years project. In 2014, Mastek Limited paved the way for the growth of the Insurance business by demerging it from Vertical Solution Business. It also consolidated offshore Insurance business under the USA entity. Later in the reverse merger, it listed USA operations on the New York Stock Exchange. Further, over a period they realigned the business, acquire multiple entities to strengthen the operations, and did some changes in management.

Finally, in 2019, the Majesco Limited sold its India Insurance Product and Services business to Majesco USA’s subsidiary company through Slump Sale. Further, In December 2019, it also purchased some shares of Majesco USA held by Mastek Limited (through its subsidiary). And finally, it has decided to take an exit from the business by selling it.

Options available to refund money to the shareholders are dividend, share buyback, and reduction of capital. The regulatory requirements/limits under various options are different. A dividend is likely to be the most efficient way for small shareholders. Buyback is efficient for all shareholders who are liable to pay tax above 20%. Reduction of Capital is an ideal option for large shareholders who are liable to pay tax at 30% or more. But except in reduction along with delisting and liquidation, in none of the other options full amount can be distributed.

The management could also evaluate the option of looking at potential acquirer who would buy out all shareholders of Majesco Limited which will also trigger open offer or delisting offer which could prove to be a win-win for all stakeholders and could also be one of the most efficient ways for returning funds to all the shareholders.

Add comment