Four years after it was first suggested, the proposal of a reverse merger between IDFC First Bank and IDFC Ltd has been revived, two top industry sources told ET. This will involve the holding company being absorbed by the bank, which will seek regulatory approval for such a move on the grounds that it will simplify the structure, they said. It’s also likely to tell the regulator that it doesn’t require a holding company in the absence of a significant non-lending subsidiary, they added.

“The plan of reverse merger is back on the table and efforts are being made to reorganise the holding company in such a way that they become eligible not to have a holding company structure. The request could be made to the regulator as early as next month,” an official aware of the matter said on condition of anonymity.

IDFC First Bank and IDFC did not respond to queries.

Under banking guidelines, a Non-operative Financial Holding Company (NoFHC) is required to house a bank and other financial services units of a promoter. IDFC will argue that it doesn’t have any other significant businesses apart from the bank.

The move is also expected to benefit IDFC Ltd shareholders and unlock value, according to the people cited above.

Such a plan was first envisaged in 2016 after the Reserve Bank of India (RBI) had said that the formation of a holding company was not mandatory for new universal banks. While this was not applicable to the erstwhile IDFC Bank, it had planned to seek special exemption from the regulator. The plan was shelved after it went through an unsuccessful merger exercise with the Shriram Group.

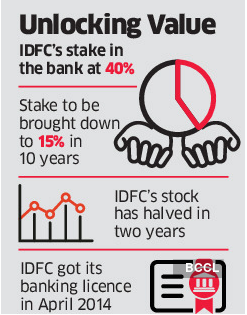

It later merged with erstwhile Capital First to create IDFC First Bank at the end of 2018. The lender completes five years of operations at the end of September after having secured its banking licence in 2014. IDFC Ltd, the holding company and promoter of IDFC First Bank, holds 40 per cent of the lender. The 40 per cent stake has a five-year lock-in period, which ends on September 30, 2020, after which it should be lowered to 15 per cent within 10 years as per the current licensing norms. In anticipation, IDFC’s shares have gained almost 30 per cent in the last three trading sessions to Rs 26.25.

“The reverse merger could lead to value unlocking and remove the holding company discount. IDFC shareholders have lost out after the demerger as they do not have a direct line of sight to the operating earnings of the bank,” said one of the people cited above said. “Shareholders are expected to benefit if the plan goes through.”

After IDFC got its banking licence in April 2014, it went through a complex demerger process of the then existing business that involved transfer of assets and liabilities from the parent to a new banking company. IDFC Ltd shareholders who got one share of IDFC Bank for each share of the infrastructure finance company lost out as the stock was trading at a considerable discount.

Source: Economic Times