State Bank of India, representing creditors of Reliance Communications (RCom), has told the Supreme Court that spectrum is an “essential and integral” part of the telco’s assets and the insolvency process would fall apart if the right to use airwaves isn’t allowed to be transferred.

Without any spectrum to use, the telco would cease to continue as a going concern and cannot be transferred as a going concern, as required by the Insolvency and Bankruptcy Code, SBI said in an affidavit filed Thursday in the top court, seeking to be made a party to the case.

The lead banker’s plea comes after the SC questioned the sale of spectrum by bankrupt telcos RCom and Aircel and how the government plans to recover Rs 43,000 crore of their adjusted gross revenue (AGR) dues if all their assets were sold in the interim. The government says spectrum cannot be sold under the insolvency process because it owns the airwaves.

The entire basis of keeping the corporate debtor as a going concern would be frustrated if it is held that spectrum does not form a part of its assets for the purpose of a resolution plan, SBI said in the affidavit.

“The resolution applicant whose plan is approved has necessarily taken into consideration the spectrum licence for the resolution of the corporate debtor without which the corporate debtor would be unable to function after being taken over by the resolution applicant,” the bank said.

RCom owed the government Rs 25,194.58 crore in AGR dues, including those of Sistema Shyam Teleservices (Rs 222.1 crore), which was merged with it.

SBI said banks disburse loans to telcos based on their right to use airwaves.

“Lenders have lent huge sums of loans to the telecom companies based on security created over the right to use the spectrum,” SBI said.

The lender added that corporate debtors don’t want ownership of the airwaves but the right to use them.

“An approved resolution plan under the IBC is not to cause transfer of the ownership of the licence/spectrum but simply to require the transfer of right to use the spectrum as is currently vested in the corporate debtor, subject to the terms of the approved resolution plan,” SBI said.

SBI also said RCom’s resolution plan is for the benefit of DoT as well. DoT had told the SC that spectrum cannot be sold without clearing government dues.

“It is submitted that in terms of Regulation 38 of the CIRP Regulations, 2016, the amount payable under a resolution plan shall be paid in priority to operational creditors over financial creditors. Therefore, the interests of the DoT, an operational creditor, are adequately protected in terms of the IBC and the regulations made there under,” SBI stated.

Operational creditors such as tower companies, equipment vendors and DoT have claimed almost Rs 30,000 crore in dues from RCom and its units, of which the resolution professional has verified over Rs 21,000 crore.

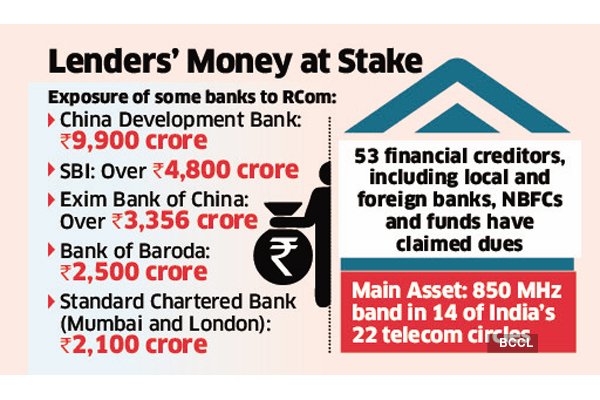

At the time of its bankruptcy filing, RCom had debt of Rs 46,000 crore. As many as 53 financial creditors, including local and foreign banks, non-banking finance companies and funds have claimed Rs 57,382 crore as dues from the company, out of which Rs 49,224 crore has been accepted.

The top Indian lenders include SBI (over Rs 4,800 crore), Bank of Baroda (Rs 2,500 crore), Syndicate Bank (Rs 1,225 crore) and Punjab National Bank (Rs 1,127 crore).

RCom and its unit Reliance Telecom, which house spectrum, fibre and data centres, are expected to go to asset reconstruction firm UVARCL and the insolvency court is expected to hear the resolution plan on August 19. RCom’s tower unit Reliance Infratel is set to be bought by Reliance Jio.

Source: Economic Times