The Board of Directors of Mastek Limited (“Mastek”), at its meeting held on February 8, 2020 announced the acquisition of the business of Evolutionary Systems Private Limited (“Evosys” or “ESPL”). The acquisition will be done through partly purchased of business through slump sale by one of the subsidiaries of Mastek and partly by way of demerger into a wholly-owned subsidiary of Mastek. The acquisition is likely to pave the way for Mastek to enter the next league.

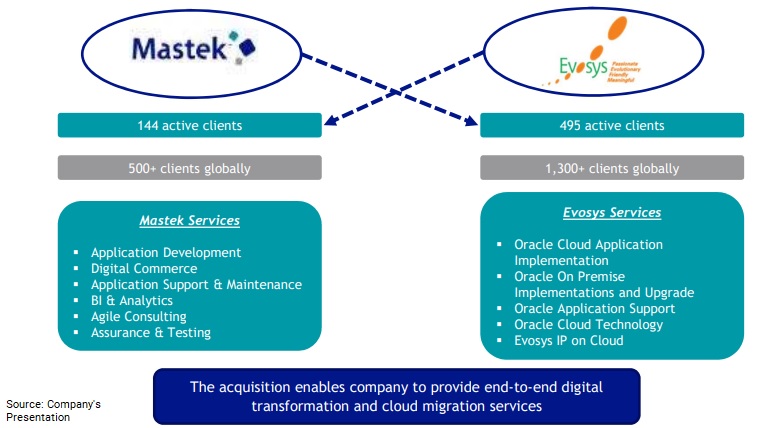

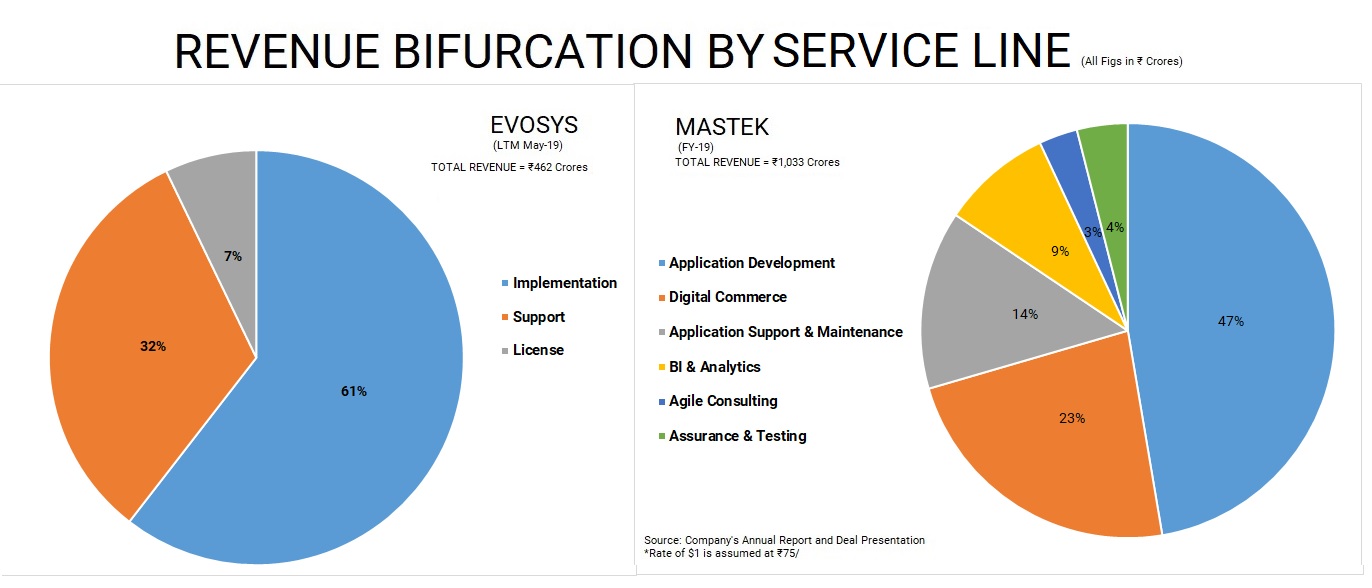

Mastek is an enterprise digital transformation specialist that engineer’s excellence for customers in the UK, US and India. It enables large-scale business change programmes through its service offerings, which include application development, support and testing, BI and analytics, agile consulting and digital commerce. Whether its creating new applications, modernising existing ones or recovering failing projects, Mastek helps enterprises to navigate the digital landscape and stay competitive.

Evosys is a leading, Oracle Cloud implementation and consultancy company serving 1,000+ Oracle Cloud customers across 30+ countries. An Oracle Platinum partner, Evosys provides solution offerings like Oracle HCM Cloud, Oracle ERP Cloud, Oracle SCM Cloud, Oracle CX, Oracle EPM Cloud, Platform as a Service (PaaS) solutions including custom-built solutions, Al, loT and machine learning. Evosys diverse customer portfolio consisting of Government, Healthcare, Finance, Logistics, Manufacturing & Distribution organisations, is a testimony to the expertise and leadership in Oracle Cloud implementation.

The Transaction

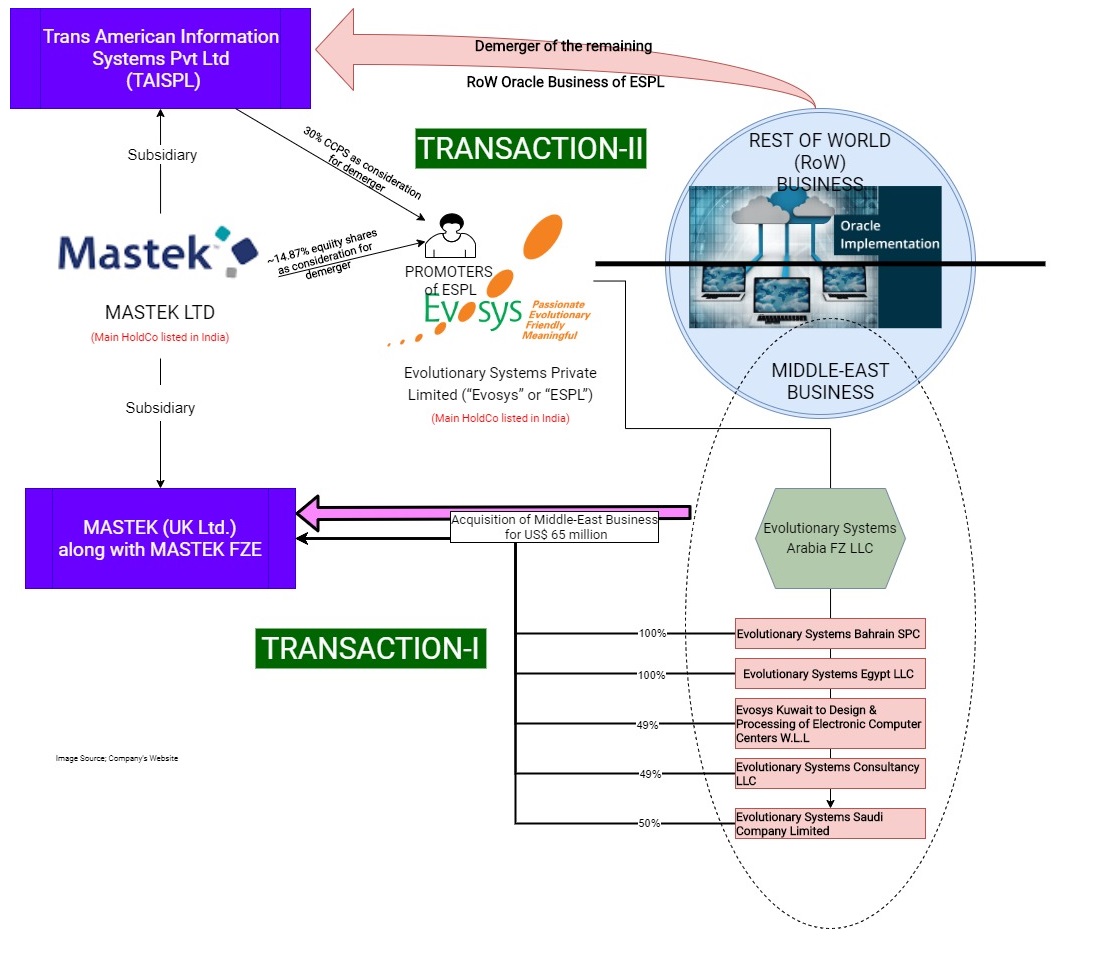

Mastek Ltd through its subsidiaries acquired Evosys. The deal has been structured in two stages with the business in India, USA, UK and RoW of Evosys merging with a wholly-owned subsidiary of Mastek, Trans American Information Systems Private Limited (“TAISPL”) while the Middle East business of Evosys has been acquired by Mastek UK Ltd, a wholly-owned subsidiary of Mastek for cash consideration through Slump Sale. Effectively, the consideration of the deal is through a mix of cash, equity shares of Mastek and Compulsorily Convertible Preference shares of a wholly-owned subsidiary of Mastek as described below.

Transaction I

Mastek (UK) Limited, a wholly-owned subsidiary of Mastek Limited, has announced that it has signed a definitive agreement to acquire the Middle East business of Evolutionary Systems Arabia FZ LLC through its group company for USD 65 million.

Identified Business of Undertaking to transferred through Slump Sale:

| Name of entities to be acquired | % Shareholding acquired |

| Evolutionary Systems Bahrain SPC | 100 |

| Evolutionary Systems Egypt LLC | 100 |

| Evosys Kuwait to Design & Processing of Electronic Computer Centers W.L.L | 49 |

| Evolutionary Systems Consultancy LLC | 49 |

| Evolutionary Systems Saudi Company Limited | 50 |

Transaction I is now completed and consideration has been paid by Mastek.

Transaction II

Demerger of the entire identified undertaking which includes all of the Oracle cloud implementation and consultancy services and ancillary and support services business of ESPL (“Demerged Company”) on a going concern basis to TAISPL (“Resulting Company”). Mastek is participating in the Scheme as the holding company of TAISPL and will issue fully paid-up equity shares to the shareholders of the Demerged Company in partial discharge consideration.

The Appointed Date i.e. February 1, 2020 or such other date as may be directed by the National Company Law Tribunal.

Consideration

4,235,294 fully paid-up equity share(s) of INR 5 each of Mastek and 15,000 compulsorily convertible preference shares(CCPS) of TAISPL of INR 10, credited as fully paid up, for every 10,000,000 equity share of INR 10 each of the Demerged Company held by such shareholders of the Demerged Company.

Each CCPS is eligible to get converted in 1 equity share.

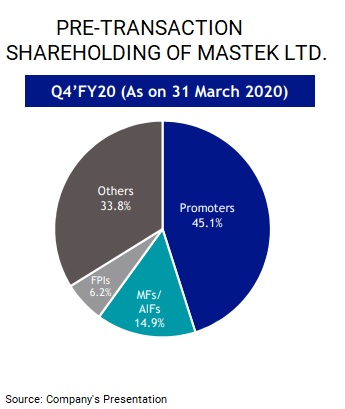

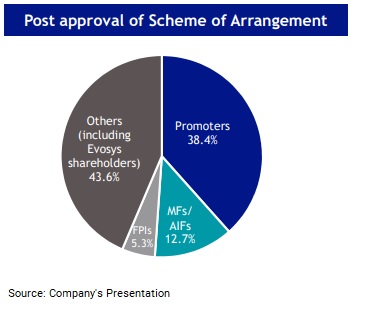

Pre & Post Transaction Shareholding Pattern of Mastek Limited

As consideration for the demerger, Mastek will issue its equity shares circa 14.87% (post-dilution) paid-up capital to the shareholders of Evosys. The Consideration for the demerger has been structured in such a way that the shareholders of Evosys will get equity shares in the holding company of demerged business and 30% directly in demerged business by way CCPS. The Mastek will have the rights to purchase the 30% stake of Evosys promoters in TAISPL(it is linked 10% each over next three years and at a pre-agreed formula). Effectively, the whole Middle East business will be placed directly under Mastek (through Mastek UK Limited) and remaining business will be placed in TAISPL where 30% will be held by Evosys promoters and 70% by Mastek.

The Effective stake of Evosys Promoters in the combined entity:

| Particulars | Beneficial Stake |

| Middle East Business | 14.9% |

| Remaining Business | 40.4% |

| Beneficial stake remaining in the whole business | 27.6% |

The stake foregone by the Evosys Promoters will be compensated partly by cash and equity shares in the existing business of Mastek.

Umang Nahata (Founder and CEO) and Rakesh Raman (CO-Founder and COO) to join the Mastek management team.

Rationale for the Acquisition

There are multiple synergies involved in the acquisition of Evoysys. The acquisition will likely to result in diversification of business for Mastek, adding growth territories, clients addition, etc. The Company, in the future, could also take a benefit of cross-selling.

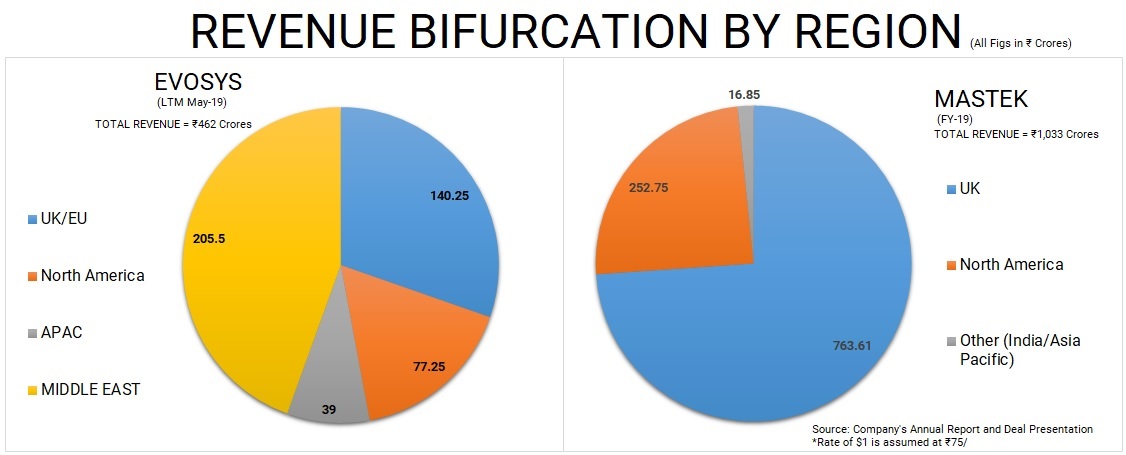

Revenue Bifurcation of EVOSYS and MASTEK

Good geographic diversity with 30-plus countries, Evosys has got a solid concentration in the UK, the US and the Middle East. And that will bring some geographic diversification for Mastek, which is good having half the last three years with a very heavy orientation towards the UK. This transaction allows Mastek to access new geography and mine the strong customer base of Evosys.

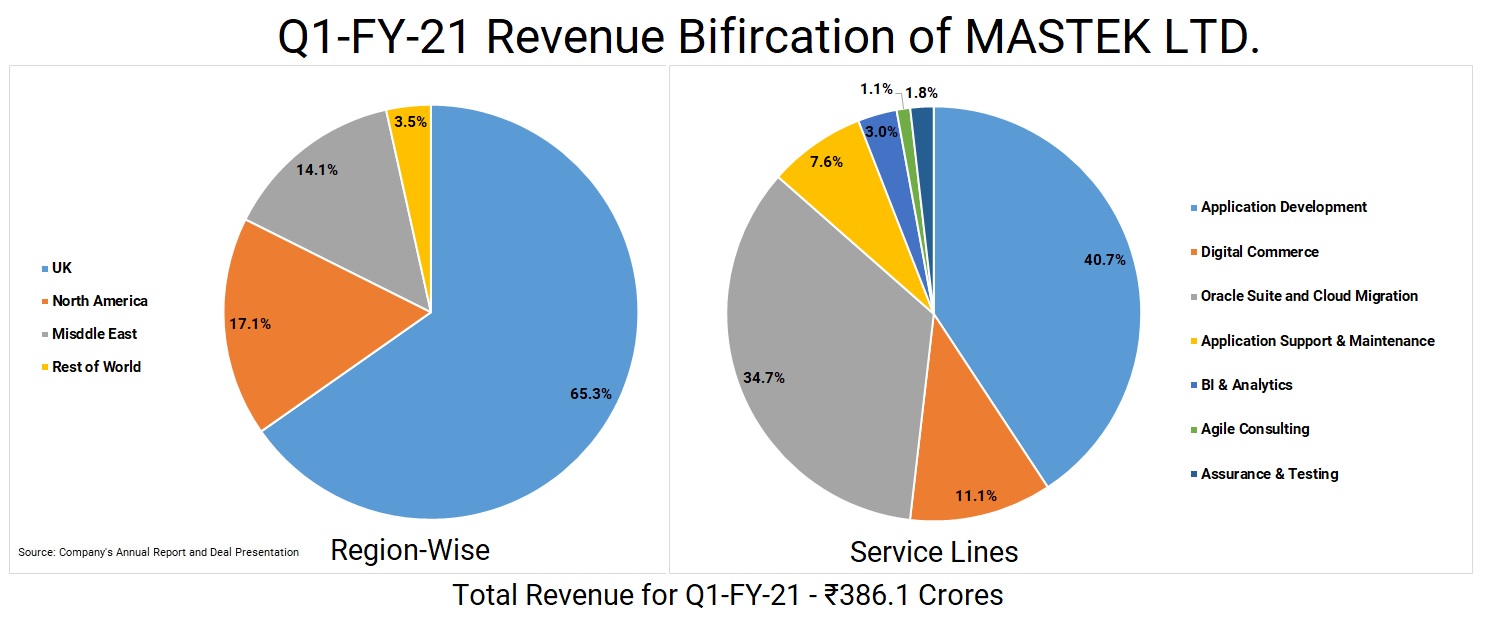

For Q4FY20, ESPL and its identified overseas subsidiaries have been consolidated effective from February 2020 and Evosys Middle East business and its subsidiaries have been consolidated effective from March 2020.

The coming together of these companies will benefit customers as they select a new type of long-term service partner to deliver their digital roadmaps. Evosys’ proven business model in the in-demand ERP market, which leverages unique IP, and Mastek’s broad service offering and delivery reputation creates an ideal combination for acceleration in the digital transformation space.

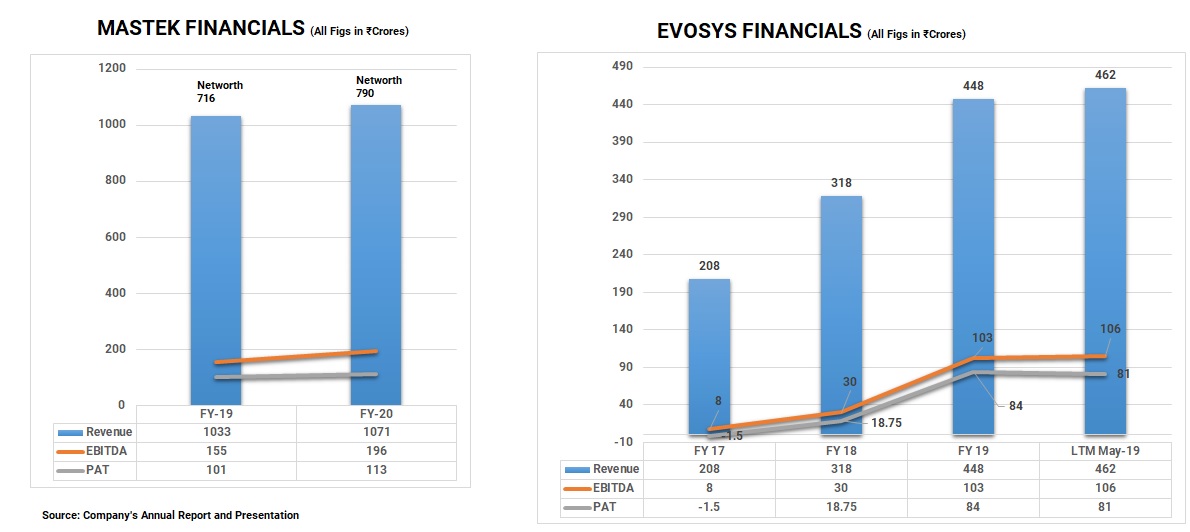

Financials

For Q4FY20, ESPL and its identified overseas subsidiaries have been consolidated effective from February 2020 and the EvosysMiddle East business and its subsidiaries have been consolidated effective from March 2020. The average conversion rate is assumed to be INR 75 per $.

For FY 20, the revenue was close to INR 525 crores and EBITDA margins were at circa 20%. If we exclude the impact of Evosys revenue of Mastek in FY 20, Mastek revenues were flat rather degrown. The business is very much concentrated around UK market. Evosys is likely to bring much-required diversification and product addition.

Valuation

| Particulars | Mastek | Evosys |

| Market Cap/Assigned Valuation | 1,099 | 1035 |

| Adjusted Revenue FY 2020 | 946 | 525 |

| Revenue Multiple | 1.16 | 1.97 |

| Adjusted EBITDA FY 2020 | 138 | 105 |

| EBITDA Multiple | 8 | 10 |

The Market Cap of Mastek is based on price immediately before the deal announcement. Further, revenue & EBITDA margins have adjusted for the consolidation of Evosys for FY 2020 in Mastek & assuming EBITDA margins of 20% of Evosys.

Evosys has been valued considering the growth opportunities available. For arriving at a swap ratio, Mastek has also given a premium. While calculating the swap ratio, Mastek has been valued at circa INR 1550 crores. One should also consider huge surplus assets available with Mastek on account of recent stake sell in Majesco US and other measures taken by the management.

Conclusion

To focus on its core business & for growth of the Insurance business, Mastek in 2014, had approved the demerger of the Insurance Products and Services business of Mastek, into Majesco Limited and listed it separately. Though in the process, Mastek retained some stake in the insurance business. During the last couple of years, Mastek initiated plans to monetise the surplus assets (including a stake in the insurance business) to grow its own business. Last year they sold part stake in Insurance business and finally getting complete exist as Thoma Bravo, L.P., a leading private equity firm signed a definitive agreement to buy entire stake of Majesco USA.

Like in any acquisition in technology space, the post-acquisition integration of the most valued asset i.e. Human Resource and cross selling of products to each other customers going to be the key for reaping the benefits of the acquisition. The merger/acquisition of equals is not going to be an easy thing for Mastek. if they make it, it will definitely create a win-win deal for stakeholders of both Mastek & Evosys

The structure for the transaction is designed in such a way to give Evosys promoters Cash and at the same time Mastek will get handholding from existing promoters for smooth integration. Mastek will have the rights to purchase the issued CCPS over next three years. Further, the decision to buy Middle east business through UK subsidiary could be as availability of significant cash with UK entity (as stake in Majesco USA held through Mastek UK). Thus, Mastek discharged the consideration by using surplus cash in UK subsidiary and minimising dilution in the listed entity by issuing part consideration in the form of CCPS of WoS. If and when Evosys promoters decides to exit, they will have easy liquidity by selling shares of Mastek.

Add comment