Tata Sons is said to have set up a taskforce to prepare a contingency funding plan to buy the Shapoorji Pallonji Group’s 18.4 per cent stake in the company at a valuation that will be at the centre of a hard-fought battle in the Supreme Court.

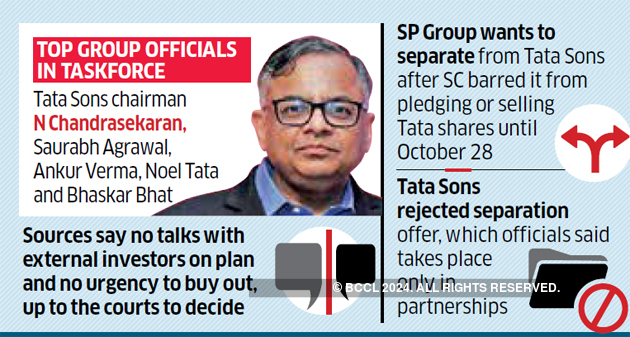

Top group officials in the taskforce include Tata Sons chairman N Chandrasekaran, Saurabh Agrawal, Ankur Verma, Noel Tata and Bhaskar Bhat, sources said. “While the finance team is actively involved, other top officials are also being consulted,” a person close to the group said.

The SP Group, which values its stake at Rs 1.78 lakh crore, said last week it wants to separate from Tata Sons after the top court barred it from pledging or selling any Tata shares until October 28. However, Tata Sons rejected the separation offer, which officials said takes place only in partnerships.

‘SP Group Chalking out Strategy’

It has already sought the apex court’s permission to invoke a provision in its Articles of Association (AoA) allowing it to squeeze out shareholders if it was not possible to set aside the pledges. Article 75 gives Tatas the power, via a special resolution, to squeeze out the Mistry family by buying out their shareholding at fair market value.

“There are no discussions with external investors and no immediacy to the whole thing. It is up to the courts to decide. We are in no hurry to buy the shares,” an official close to the Tatas said.

The SP Group is currently chalking out a strategy under the separation plan to ensure a fair and equitable valuation for its 18.4 per cent stake and may file an additional submission in the Supreme Court on the matter, officials said.

“This is not part of any discussion with Tata Sons. It is a relief sought from courts by a minority shareholder being pushed to a corner and therefore seeking fair value,” said a lawyer close to the SP Group. “Even in the case of invoking article 75, the minority shareholder would be entitled to the fair market value as set out in article 60.”

Cherag Balsara, a Bombay High Court advocate, said separation is optional, whereas a buyout would be under the right of first refusal, or article 75.

“Under a separation clause, Mistry gets a fair market value of shares which Tata Sons have to offer on even unlisted companies, real estate owned and the brand, which is priced at a huge value. A buyout is forced and could be subject to a different valuation and Tata Sons is trying here to squeeze out the liquidity to force a settlement,” said Balsara. “Tata Sons has sought permission to invoke a provision from AoA allowing it to squeeze out shareholders if it was not possible to set aside the pledges. That essentially means that it is seeking to buy out the minority shareholder at a price seen fit by them.”

Source: Economic Times