General Atlantic is set to cut its stake in KFin Technologies, formerly Karvy, to almost half, with the New York-based PE fund planning to sell about 40 per cent stake to a new investor.

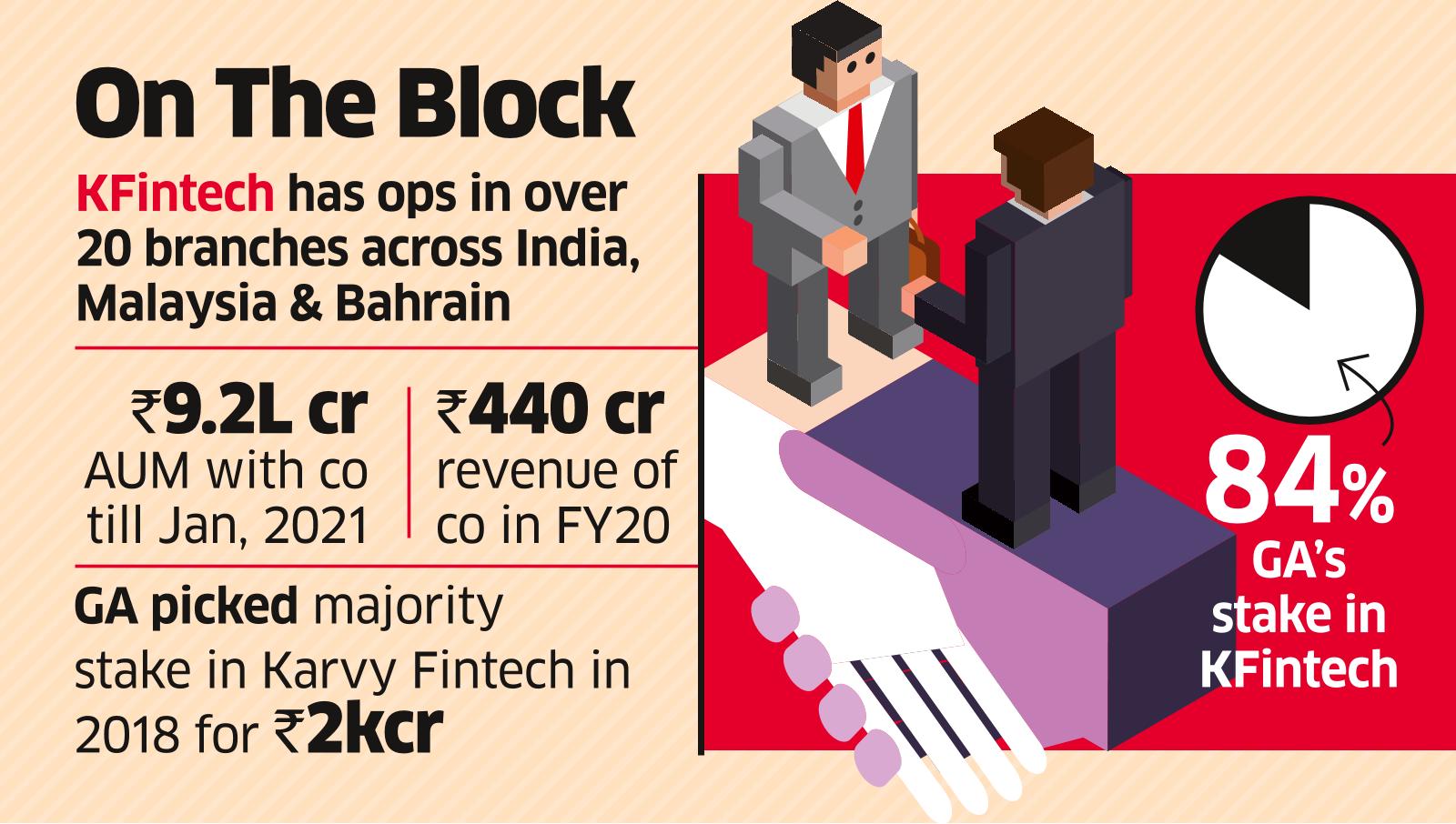

Investment bank Barclays has been hired to run the sale. General Atlantic holds about 84 per cent stake in KFintech.

The deal is expected to value KFintech, a leading registrar and transfer agent for initial public offerings and mutual funds, at Rs 3,000 crore ($400 million), said people aware of the development. A few large PE funds have been approached, the people added.

GA acquired a majority stake in Karvy Fintech, which was jointly owned by Hyderabad-based Karvy Group and Australian share registry firm Computershare, at a valuation of Rs 2,000 crore in 2018.

Spokespersons of GA and KFintech declined to comment.

KFintech operates through 200-plus branches in India, Malaysia and Bahrain. With over 105 million investor accounts, it had Rs 9.2 lakh crore of assets under management in as on January compared with Rs 5.1 lakh crore in FY18. Its revenue was Rs 440 crore in FY20.

KFintech competes in India with Computer Age Management Services, Link Intime India and the National Securities Depository in areas such as mutual funds, issues and the National Pension System.

The US PE fund Warburg Pincus owns about 31 per cent in Computer Age Management, a listed entity.

In 2019, GA changed the name of Karvy Fintech to KFintech in an attempt to disassociate from the controversy surrounding its former parent company Karvy, which was involved in Rs 2,300 crore scandal.

KFintech’s line of business operations is not exposed to any kind of risk associated with the capital market. However, as a large amount of data processing is involved in this business, it is exposed to operational risks and human error, rating company Icra said in a note in March last year.

“The company has emerged as a market leader in investor servicing in the country. KFin’s profitability is expected to remain in the range of 35-40 per cent in the next couple of years. ICRA also notes the strong cashflow generation of the business with average cashflow from operations of Rs 110 crore in the last two years,” it added.

Last year, GA purchased a 0.84 per cent stake worth Rs 3,675 crore in

NSE 1.48 %’ retail business – Reliance Retail Ventures. This was the fund’s second investment in a Reliance subsidiary following a Rs 6,598.38 crore investment in Jio Platforms in early 2020.

Source: Economic Times