The Competition Commission of India (CCI) has approved the Axis Bank-Max Life Insurance transaction, which had faced several regulatory roadblocks from Insurance Regulatory Development Authority of India and the Reserve Bank of India over the issue of share purchase agreement.

According to the approved transaction by CCI, Axis entities which comprise Axis Bank, Axis Capital and Axis Securities will be acquiring 19% stake in Max Life Insurance as against the first deal in April where the bank had proposed to acquire 29% stake in Max Life Insurance.

Max Life is currently the largest non-bank owned private life insurer in India. Max Financial Services presently holds a 72.5% stake in Max Life while Mitsui Sumitomo Insurance and Axis Bank hold 25.5% and 2% stake, respectively.

Background

On February 20, 2020, Axis Bank, Max Financial Services Limited and its subsidiary Max Life Insurance Company Limited signed a confidentiality and exclusivity arrangement to explore the possibility of Axis Bank entering into a long-term strategic partnership with Max Life. The Board of Directors at its meeting on April 27, 2020 had approved entering into an agreement with Max Financial Services Limited (MFSL) to acquire 29% stake (55,64,94,102 shares) in Max Life Insurance Company Limited. Axis Bank had noted that the acquisition of stake in Max Life Insurance will not fall within the related party transaction. The bank also noted that the shares will be acquired from the listed parent entity of the target company i.e., from Max Financial Services Limited.

The nature of consideration was cash consideration and the definitive agreements also provided for certain rights regarding governance of Max Life including the right of appointment of nominee directors, and affirmative vote rights for the bank and MFSL. Accordingly, MFSL will have the right to nominate four directors on the Board of Directors of Max Life and Axis Bank will have the right to nominate three directors on the Max Life Board. The bank underlined that post-completion of the series of transactions, Max Life will become a 70:30 joint-venture between MFSL and Axis Bank.

Axis Bank and MFSL had also agreed to certain Value Creation Options and related rights. It said that if the Value Creation Options are not consummated within 63 months from the closing, the transactions provide for a put option for Axis Bank on MFSL to sell all shares held by Axis Bank in Max Life at a price of Rs 294 per share (subject to adjustments mutually agreed between parties) within nine months of exercise of such put option.

Regulatory challenges with IRDAI and RBI

Objections from IRDAI

The transaction was caught in regulatory challenges and the two companies had to do a series of tinkering in the deal structure related to share purchase agreement. On July 23, 2020, Axis Bank in a regulatory filing said that based on correspondence from IRDAI received, Axis Bank and MFSL have agreed to make some changes to the Value Creation Options and factor in some alternate mechanisms subject to regulatory approvals and as may be permitted under applicable law.

The insurance regulator, IRDAI, raised concerns over certain clauses in the merger agreement, namely a put option involved in the deal structure for Axis Bank to sell its stake. As a result, in July, Max Financial Services and Axis Bank made some significant changes to the value creation option in the deal and removed the ‘Put option’ after resistance from the insurance regulator.

Then in August, instead of the 29% stake announced at the first time. On August 24, the bank said in a regulatory filing that Axis Bank proposes to acquire 17% of the equity share capital of Max Life, resulting in total ownership of 18% post the transaction.

Objections from RBI

The Reserve Bank of India raised objections to Axis Bank’s application for directly acquiring 17% of the equity share capital of Max Life. The Reserve Bank of India had advised Axis Bank that the application for direct acquisition of 17% has not been considered because of Para 5(b) of Master Direction- Reserve Bank of India (Financial Services provided by Banks) Directions, 2016 dated May 26, 2016 as updated from time to time (“Para 5(b).)”).

Para 5(b) of Master Direction- Reserve Bank of India (Financial Services provided by Banks) Directions, 2016 states that no bank shall make an investment of more than 10% of the unit capital of a Real Estate Investment Trust/Infrastructure Investment Trust or insurance business subject to overall ceiling of 20% of its net worth permitted for direct investments in shares, convertible bonds/ debentures, units of equity-oriented mutual funds and exposures to Alternative Investment Funds.

As a result of the RBI’s objection, in October, Axis Bank and MFSL tweaked the deal for acquisition of up to 19% of the equity share capital of Max Life. Axis Bank’s total stake in Max Life Insurance will remain within the limits stipulated under the applicable laws and regulations. Under the Revised Agreements, Axis Bank proposed to acquire up to 9% of the equity share capital of Max Life, and, Axis Capital Limited and Axis Securities Limited will together acquire up to 3% of the share capital of Max Life. In addition, Axis Entities will have a right to acquire an additional stake of up to 7% of the equity share capital of Max Life, in one or more tranches, in accordance with existing laws and regulations.

The tweaked deal structure comes under the automatic approval route of the central bank. Under the current RBI guidelines Master Direction- Reserve Bank of India (Financial Services provided by Banks) Directions, 2016—banks are not required to take any prior approval from RBI if the proposed investment is less than 10% of the investee company’s paid-up capital and the aggregate shareholding of the bank along with its subsidiaries is less than 20% of the investee company’s paid-up capital.

The tweak in the merger contours gave relief to investors that both parties were willing to make changes to the deal structure. Also, with Axis Bank acquiring a lower than the originally envisaged, stake in Max Life, minority holders of Max Financial will remain at an advantage. Axis Bank will have a strategic advantage as it has the banking branches and several other elements of governance, joint product development and IT integration.

Gains for Axis Bank from the deal

Axis Bank and Max Life have had a successful bancassurance arrangement for a decade. The new premium generated through this bancassurance arrangement has aggregated to over Rs 12,000 crore over this period while maintaining high persistency. Both companies have invested extensively in product and need-based sales training, thereby leading to a consistent increase in productivity.

For Axis Bank, the deal will help in getting a foothold in the growing life insurance business. Axis Bank, the third-largest private sector lender, is the biggest banking channel partner for the distribution of Max Life Insurance’s products. Max Life is the country’s largest private-sector life insurance company that is not owned by a bank, and the fourth largest in the private sector overall. The transaction will help Axis Bank to garner higher fee income as it can cross-sell the loans and other retail products to Max Life customers. Also, as banks are becoming the main points for the distribution of insurance products, the deal will help Max Life Insurance to tap all branches of Axis Bank to sell its life insurance policies.

Max Life Insurance has been looking to get a bank partner for around five years. In 2016, Max Financial had signed a merger agreement of Max Life Insurance and with HDFC Standard Life Insurance to create India’s biggest private sector life insurance company. However, the Insurance and Regulatory Development Authority of India raised several objections to the transaction structure and the deal had to be finally called off.

About Axis Bank

Axis Bank is the third-largest private sector bank in India and offers an entire spectrum of financial services to customer segments covering large and mid-corporates, MSME, agriculture and retail businesses. The bank has a large footprint of 4,528 domestic branches (including extension counters) with 12,044 ATMs and 5,433 cash recyclers spread across the country as on March 31, 2020. The overseas operations of the bank are spread over 11 international offices with branches.

Axis Bank is one of the first new-generation private sector banks to have begun operations in 1994. The bank was promoted in 1993, jointly by Specified Undertaking of Unit Trust of India (SUUTI) (then known as Unit Trust of India), Life Insurance Corporation of India, General Insurance Corporation of India, National Insurance Company Ltd., The New India Assurance Company Ltd., The Oriental Insurance Company Ltd., and United India Insurance Company Ltd. The shareholding of Unit Trust of India was subsequently transferred to SUUTI, an entity established in 2003. With a balance sheet size of Rs 9,15,165 crore as on March 31, 2020, Axis Bank has achieved consistent growth and with a 5-year CAGR (2014-15 to 2019-20) of 15% each in total assets, deposits, and advances.

About Max Life

Launched in 2000, Max Life is a Joint Venture (JV) with Mitsui Sumitomo Insurance, a Japan-based global insurance leader. This business saw change in JV partner in June 2012 where the extant JV partner, Mitsui Sumitomo, acquired 26% stake in the then Max New York Life Insurance — 16.63% from New York Life International Holdings which wanted to exit the JV to focus on their core markets in the US and Mexico and 9.37% from Max India, which in turn acquired it from New York Life Insurance. Max Financial currently holds a 72.5% stake in Max Life while Mitsui Sumitomo Insurance owns 26%. The Japanese company is swapping its stake in the insurer with a stake in Max Financial.

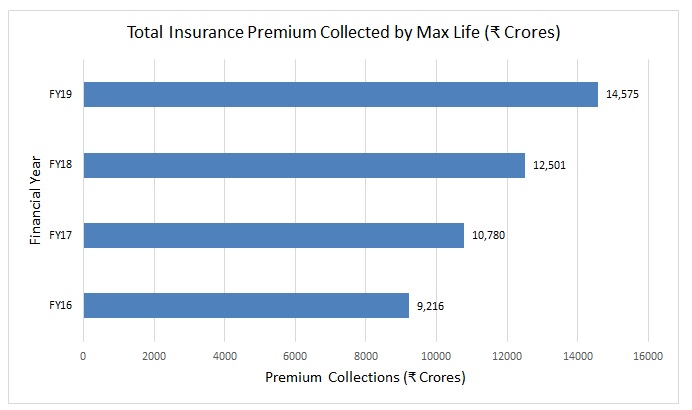

Max Life is India’s largest non-bank private life insurer and the fourth largest private life insurance company, with a gross premium income of Rs 14,575 crore and claims paid ratio of 98.74% in FY19. It has over 4 million policies in force and has a pan-India presence through 345 branch units.

About Max Financial Services

Max Financial Services Limited, a part of the leading Indian multi-business conglomerate Max Group, is the parent company of Max Life, India’s largest non-bank, private life insurance company. Max Financial Services Limited actively manages a 72.5% stake in Max Life Insurance Company Limited, making it India’s first listed company focused exclusively on life insurance. Max Financial Services Limited is listed on the NSE and BSE. Besides a 28.3% holding by Analjit Singh sponsor family, some of Max Financial Services’ marquee shareholders include KKR, New York Life, Baron, Vanguard, Blackrock, Aberdeen, First Voyager, Jupiter, Dimension, East Spring and the Asset Management Companies of Nippon, HDFC, ICICI Prudential, Aditya Birla Sun Life, Mirae, BNP, DSP and Sundaram.

Increase in FDI limit in insurance

To attract foreign funds, finance minister Nirmala Sitharaman hiked the foreign direct investment (FDI) limit in the insurance sector from the existing 49% to up to 74%. In 2015, the government hiked the FDI cap in the insurance sector from 26% to 49%. The government has earlier allowed 100% foreign direct investment in insurance intermediaries such as insurance brokers, reinsurance brokers, insurance consultants, corporate agents, third party administrators, surveyors, and loss assessors.

The hike in the FDI limit is indeed a big booster for the insurance sector and will increase insurance penetration in the country. At present, insurance penetration as a per cent of GDP is 3.71% as compared to the world average of 7.23%. Insurance is a capital capital-intensive business and as per IRDAI’s norms, every insurance company must keep a solvency margin of 150%. The solvency margin is a minimum excess on an insurer’s assets over its liabilities set by regulators. It can be regarded as like capital adequacy requirements for banks. The hike in FDI limit will enable the additional flow of capital and insurance companies can expand their business, especially at a time when the need for insurance has risen because of the Covid-19 pandemic.

Conclusion

Once the insurance regulator gives the final approval to the acquisition, Axis Bank and Max Life Insurance must get to the drawing board to integrate the transaction process and get to business as the insurance sector is seeing rapid growth after the Covid-19 pandemic. Companies that are offering complete digital onboarding and servicing platforms will grow faster as the two companies have all the required capabilities in digitization and can see growth.

Add comment