US-based Safesea Group and Bain Capital-backed ship operator JM Baxi & Co have submitted expressions of interest (EoIs) to participate in the privatisation process of Shipping Corporation of India, setting up a contest for the takeover of the Navratna public sector undertaking (PSU).

India’s largest private ship operator Great Eastern Shipping was also interested in participating in the process, said sources. However, its promoter Bharat Sheth declined to comment on whether his company had submitted an EoI.

Safesea Group and JM Baxi & Co confirmed that they had submitted EoIs. The last day for submission was Monday.

ET had first reported on February 5 about Safesea Group’s interest in the bidding process for the PSU.

Shipping Corporation of India (SCI) is among the four PSUs that the government has identified for privatisation in the last fiscal year.

Privatisation exercise running behind schedule

The others are Air India, Bharat Petroleum Corporation Limited and Container Corporation of India. Privatisation process for all four companies is running behind schedule due to the impact of the Covid-19 pandemic.

which was widely expected to join the bidding process has not submitted an EoI yet. Though it could still join a consortium at a later stage, according to sources in the know.

The department of investment and public asset management (DIPAM) had issued a preliminary information memorandum detailing the privatisation process of the PSU ship operator on December 22.

RBSA Capital Advisors and law firm L&L partners are advising the government on the disinvestment process. Safesea Group is a two-decade-old company promoted by Indian-origin businessman SV Anchan. The company is headquartered in New Jersey. JM Baxi & Co is one of India’s oldest shipping operators established in 1913. It is promoted by Krishna Kotak and his family. The company recently received a fund infusion from Bain Capital private equity.

Open offer

The government is selling its 63.75% stake in SCI. The successful acquirer will also have to make an open offer for a further 26% in the company held by the public shareholders as per change of control or takeover norms prescribed by the Securities and Exchange Board of India.

SCI’s shares were trading at Rs 103 apiece at the close of trading on Monday, up 3.75% from the previous day’s close. Based on this, a potential acquisition could cost the winning bidder about Rs 4,348 crore or $590 million.

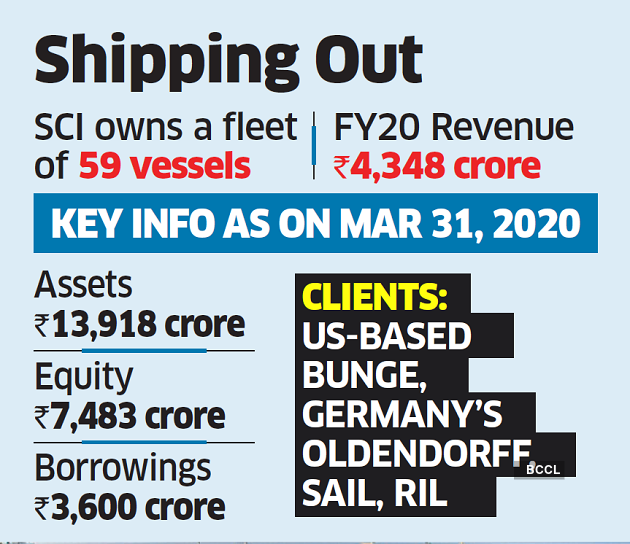

SCI is involved in the business of transporting goods and passengers. Its own fleet includes bulk carriers, crude oil tankers, product tankers, container vessels, passenger-cum-cargo vessels, LPG/ammonia carriers and offshore supply vessels.

As of November 30, 2020, the company owned a fleet of 59 vessels. The company clocked revenue of Rs 4,668 crore for the financial year ending March 31, 2020 and profit of Rs 336 crore. Its cumulative short-term and long-term borrowings totalled Rs 3,600 crore.