Finnish packaging materials major Huhtamäki Oyj and private equity firm Warburg Pincus are the final two contenders to acquire a controlling stake in India’s largest independent folding carton manufacturer Parksons Packaging, said multiple people aware of the development.

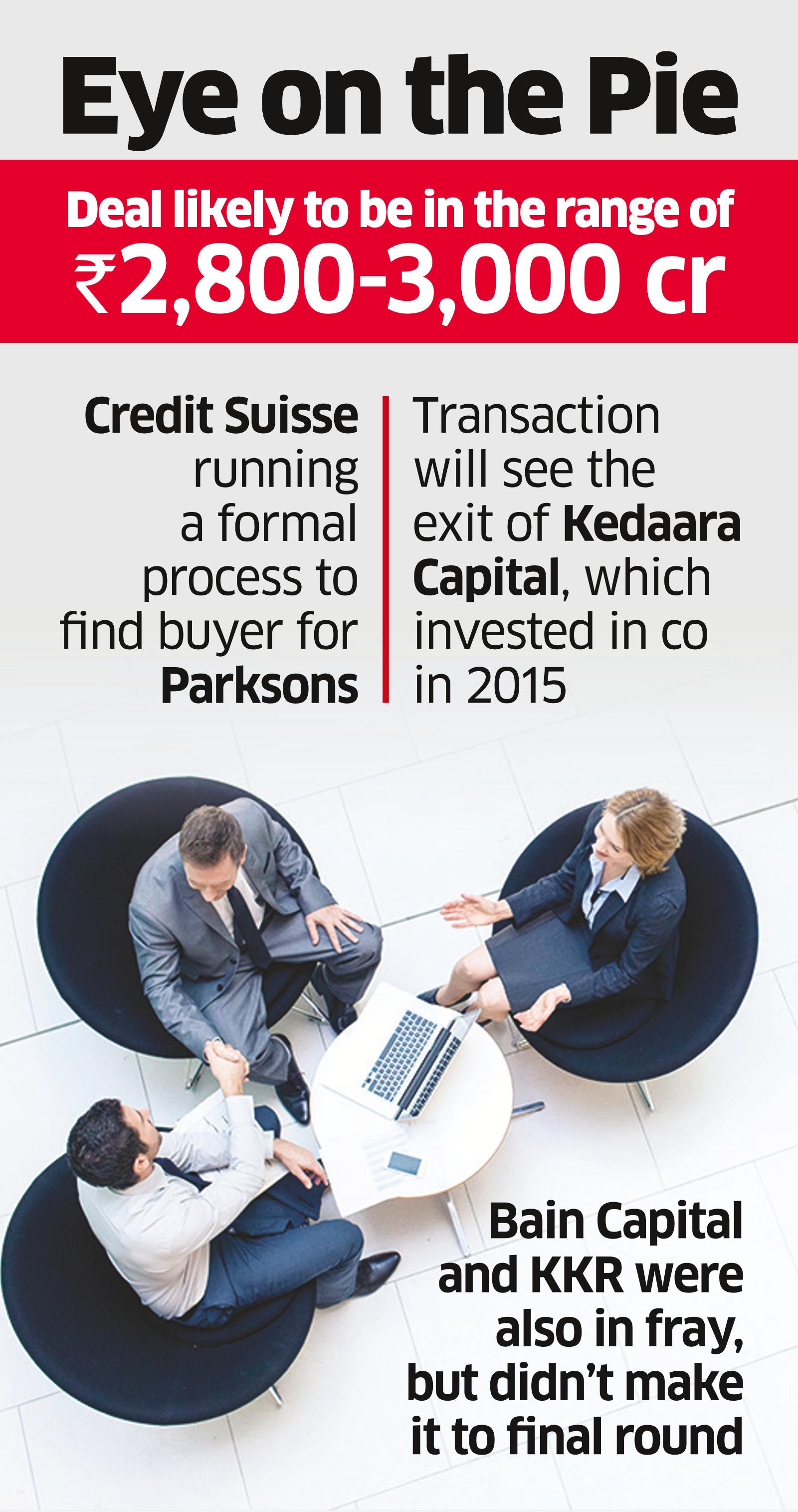

The transaction, valuing the company at about ₹2,800-3,000 crore, will see the exit of private equity firm Kedaara Capital, which invested in the company in 2015. Meanwhile, promoters of Parksons will continue to hold a minority stake post-transaction if the deal is signed with the PE fund, said one of the persons cited above.

Bain Capital and KKR were also in the fray to buy Parksons, but didn’t make it to the final round, sources said. Credit Suisse is running a formal process to find a buyer for Parksons.

When contacted, spokespersons of Huhtamäki, Kedaara Capital, Bain KKR and Warburg Pincus declined to comment while mails sent to Parksons Packaging did not elicit any response till press time.

Established in 1996 by Ramesh Kejriwal and managed by his two sons, Siddharth and Chaitanya, Parksons caters to companies in sectors such as pharmaceuticals, FMCG and household/personal care products. The company has six manufacturing plants across Daman, Maharashtra, Uttarakhand, Andhra Pradesh and Assam, and it counts, McDonald’s India, Godrej Consumer Products, Emami, Sun Pharmaceuticals and as its top clients, as per the company’s website. Parksons reported revenues of ₹946 crore during FY19 and an Ebitda of ₹130.8 crore. Net profit of the company stood at ₹39.5 crore.

“Parksons’ revenues have grown at a compounded annual growth rate of 15.5% over the last five fiscals through fiscal 2020 while maintaining a healthy double-digit operating margin. The financial risk profile is seen remaining comfortable with reduced capex intensity, adequate debt protection metrics and healthy liquidity. Relatively lower capex plans are seen leading to gradual reduction in debt and strengthening of capital structure,” rating agency CRISIL said recently.

Kedaara Capital had invested ₹200 crore in the company in 2015 to buy about 25% stake held by another private equity firm, Chrys Capital. Huhtamäki has a strong presence in India through its subsidiary Huhtamaki PPL. It expanded presence through multiple acquisitions — such as Mumbai-based Positive Packaging in 2014 and Valpack Solutions in 2016.

The packaging industry in India was valued at $75 billion in 2020, and it is expected to reach $205 billion by 2025, registering a CAGR of 26% during this period.

The per capita consumption of packaging in India is significantly lower than the global average and the Indian market constitutes about 5% of the global packaging industry. India’s per capita packaging consumption is 11 kg per year, as compared to 45 kg in China, 32 kg in Brazil, 110 kg in the US and 65 kg in Europe.

Due to the high growth potential, the Indian packaging industry remains on the radar of global packaging players and private equity funds. The largest buyout in the Indian packaging sector was Blackstone’s acquisition of for $470 million in 2019. However, the largest buyout by a foreign company was that of Huhtamäki’s purchase of Mumbai-based Positive Packaging in 2014 for $336 million. Huhtamäki also acquired a 51% stake in Valpack Solutions, a paper cup manufacturer in Mumbai, in July 2016.