Sebi to empanel valuers; but questions remain on compensation, conflicts of interest

The Securities and Exchange Board of India (SEBI) wishes to empanel experts who can opine on the valuation of shares during takeovers or other company schemes which may require an open offer to minority shareholders. This is the first time the regulator is looking to put in place an independent panel of those knowledgeable, to assist in arriving at a fair price, say market participants.

“In terms of regulation 8(16) of the Takeover Regulations, SEBI may require valuation of the shares by an independent merchant banker other than the manager to the open offer or an independent chartered accountant in practice having a minimum experience of 10 years, for the purpose of ascertaining the offer price,” said a tender notice on the regulator’s website.

This would also apply to schemes of arrangement, which might involve a merger or spin-off of divisions within a company. In such cases too, Sebi might call for an independent opinion on how much the offer price should be.

“…it has been decided by Sebi to empanel CAs who may be entrusted with undertaking valuation work as described above, as and when a need is felt to obtain an independent feedback on the takeover or scheme related case at hand,” it said.

Interestingly, the company would pay the valuer and not the regulator, which experts feel, could create the conflict of interest issues.

“The CA firms shall be compensated by the subject company and Sebi shall not make any payment to the empanelled CA firm which is assigned a case,” clarified the note.

Shriram Subramanian, managing director, In Govern Research Services, said no way had yet emerged to address such conflicts of interest. “That is always there…but this way, there is at least a greater

the degree of independence if the regulator is appointing it, as opposed to a situation where the valuer is appointed by the company itself,” he said.

The firms can charge fees from Rs 1 lakh to Rs 25 lakh, says Sebi. Some also provide for a certain percentage if the consideration amount is in excess of a certain figure. This ranges from 0.002 per cent to 0.0004 per cent of amounts exceeding Rs 100 crore and Rs 5,000 crore, respectively.

Zulfiqar Shivji, international liaison partner and head-transaction advisory services, BDO India, said a transaction fee approach based on bands as opposed to value based is a better means to ensure independence. “If such valuers are paid through a flat-fee structure or through a use of a fixed formula, then it is likely to be fairer. Linking compensation to the outcome of valuation should be avoided,” he said.

Valuation itself remains an inexact science and a number of factors can impact whether or not a fair price is arrived at, according to Amit Tandon, founder and managing director of Institutional Investor Advisory Services India.

He said the quality of a valuer and complexity of the business would have an impact on the accuracy of the valuation. Besides, the company needs to cooperate and provide information for valuation to be done correctly, all of which cannot be taken for granted.

The regulator’s criteria for empanelment includes a minimum experience of 10 years and valuation experience of five years. Sebi has given two weeks for eligible entities to apply

(Source: http:// www.business-standard.com)

Transfer pricing disputes: Agreement with USto brings relief to MNCs

Deal likely during Barack Obama’s visit; more than 250 cases against American companies, dating back to 2004

India is set to sign an agreement with the US to resolve transfer pricing disputes, which will then serve as a template for settling such rows with multinational companies based in the UK, France and other European countries.

India and the US have finalised a framework to tackle cases that fall within the ambit of the mutual agreement procedure. The agreement may be signed during US President Barack Obama’s visit to India beginning on Sunday

India is targeting signing the advance price agreement with the US in three months, but only after the framework for pending cases starts yielding results. The major concern for multinational companies and other nations is the markup and tax dues on costs for services provided.

BREATHER ON CARDS

- India, the US to tackle cases falling under the mutual agreement procedure

- The countries finalise framework to resolve cases in litigation and dispute To resolve 60 cases in the first tranche

- Framework to establish markup for cases based on business activity for tax liability

- India looks to sign agreements with European nations, including UK and France

New framework

“Instead of a fixed markup, the framework sets out the process for determining it. The markup Will be based on activities of the company. That will make it easier for companies and tax authorities to work through cases,” said a tax official.

Now that the two sides are talking, the agreement would help resolve cases related to software development and information technology services. In the first tranche, the governments are hoping to resolve 60 cases pending with the income tax department in various stages of litigation and assessment.

There are more than 250 cases against US companies, some dating back to 2004. Many of these include royalty and permanent establishment and involve software development and infotech enabled services.

According to sources close to the development, the Central Board of Direct Taxes is planning to outline such frameworks for European nations such as the UK and France.

‘Right step’

“It is a step in the right direction and will help reduce the tax and compliance concerns of companies. But it is imperative the two governments form a policy that is forward-looking and prevents tax controversies from arising,” said S P Singh, senior director, Deloitte Haskins & Sells.

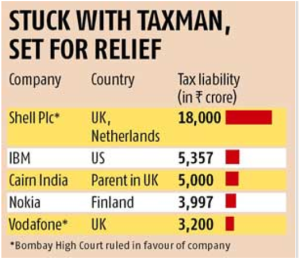

The framework will include the tax department’s learning from the Vodafone transfer pricing issue where the Bombay High Court had ruled a share sale could not be construed as income and, thus, could not be taxed. This will offer relief to IBM, Nokia and Cairn India that are embroiled in similar cases.

Many multinational corporations adopt advance price agreements to avoid litigation while doing business in India. In 2012, 146 applications were filed, followed by 232 the next year.

India recently signed a bilateral advance price agreement with Japan’s Mitsui for five years. Such bilateral agreements involve the governments on the two sides as well as the company concerned.

“Bilateral agreements score above unilateral ones between the government and the company because in many cases the company could face issues if the other government does not agree with the terms,” said Rajesh Simhan, head of the international tax practice at Nishith Desai Associates.

(Source: http://www.businessstandard.com)

Government won’t appeal Bombay High Court ruling in Vodafone case

India will not appeal a Bombay High Court decision that favoured British telecom major Vodafone in a transfer pricing case, as the Narendra Modi government looks to send out a strong signal to the investor community that it is committed to creating a non-adversarial tax environment.

The decision is expected to also offer relief to companies such as Shell India, IBM, Nokia, Cairn India and Leighton India which face similar cases, as the government has decided to accept decisions of courts, tribunals and dispute resolution panels that have been in the favour of taxpayers. The move would provide more confidence to foreign companies looking to invest in their Indian operations at a time when the government is pushing its ‘Make in India’ campaign.

“Investors’ confidence has been shaken in the past because of the very fluctuating tax policy,” Telecommunications Minister Ravi Shankar Prasad told a news conference announcing the government decision after a Cabinet meeting chaired by Modi on Wednesday.

“The government, led by Prime Minister Narendra Modi, wants to convey a clear message to investors world over that this is a government where the decisions will be fair, transparent and within the four corners of the law.” The decision follows an advice to this effect by Attorney General Mukul Rohtagi, the chairman of the Central Board of Direct Taxes chairman and the chief commissioner of international taxation.

I looked at the Bombay High Court ruling and agreed that under the IT Act, as it stands, the transaction was not taxable in India. I took a conscious decision not to file an appeal,” said Mukul Rohatgi, attorney general. “This will go a long way in boosting investor confidence and remove uncertainty in the tax regime.” Transfer pricing refers to the pricing of assets, tangible and intangible, services and funds moved within an organisation in a cross-border deal.

Tax administrations apply stringent rules to prevent the transfer of income from high tax jurisdictions to low tax jurisdictions to escape levies. Authorities had sought more taxes from Vodafone India alleging that it had undervalued the shares in a subsidiary transferred to a group company in Mauritius.

“We welcome the Indian government’s decision not to appeal the Bombay High Court ruling. Stability and predictability in tax matters are important for long-term investors such as Vodafone,”Vodafone said in a statement. “The Cabinet came to this view as this is a transaction on the capital account and there is no income to be chargeable to tax. So applying any pricing formula is irrelevant,” a government statement said.Vijay Iyer, national leader transfer pricing at EY, called it a “bold step” by the government.

“It is a huge change in approach and clearly and shows their commitment to avoid frivolous litigation,” Iyer said. “Investors would feel more assured that absurd adjustments would be not be encouraged by the government.”

Senior lawyer Harish Salve said: “This is a very positive decision. It sends out a strong message to foreign investors.” The Cabinet decision will bring greater clarity and predictability for taxpayers as well as tax authorities, thereby facilitating tax compliance and reducing litigation on similar issues, the government statement said, adding that it would also set at rest the uncertainty prevailing in the minds of foreign investors and taxpayers in respect of possible transfer pricing adjustments in India on transactions related to issuance of shares. This would help improve the investment climate in the country, it added.

The high court in October last year ruled in favour of Vodafone setting aside income tax department’s order as null and void. “Unsustainable demands in the books can show you in good glory, but eventually, those taxes will be blocked in some judicial court proceedings,” Arun Jaitley said soon after the court verdict.

(Source: http://articles.economictimes.indiatimes.com)