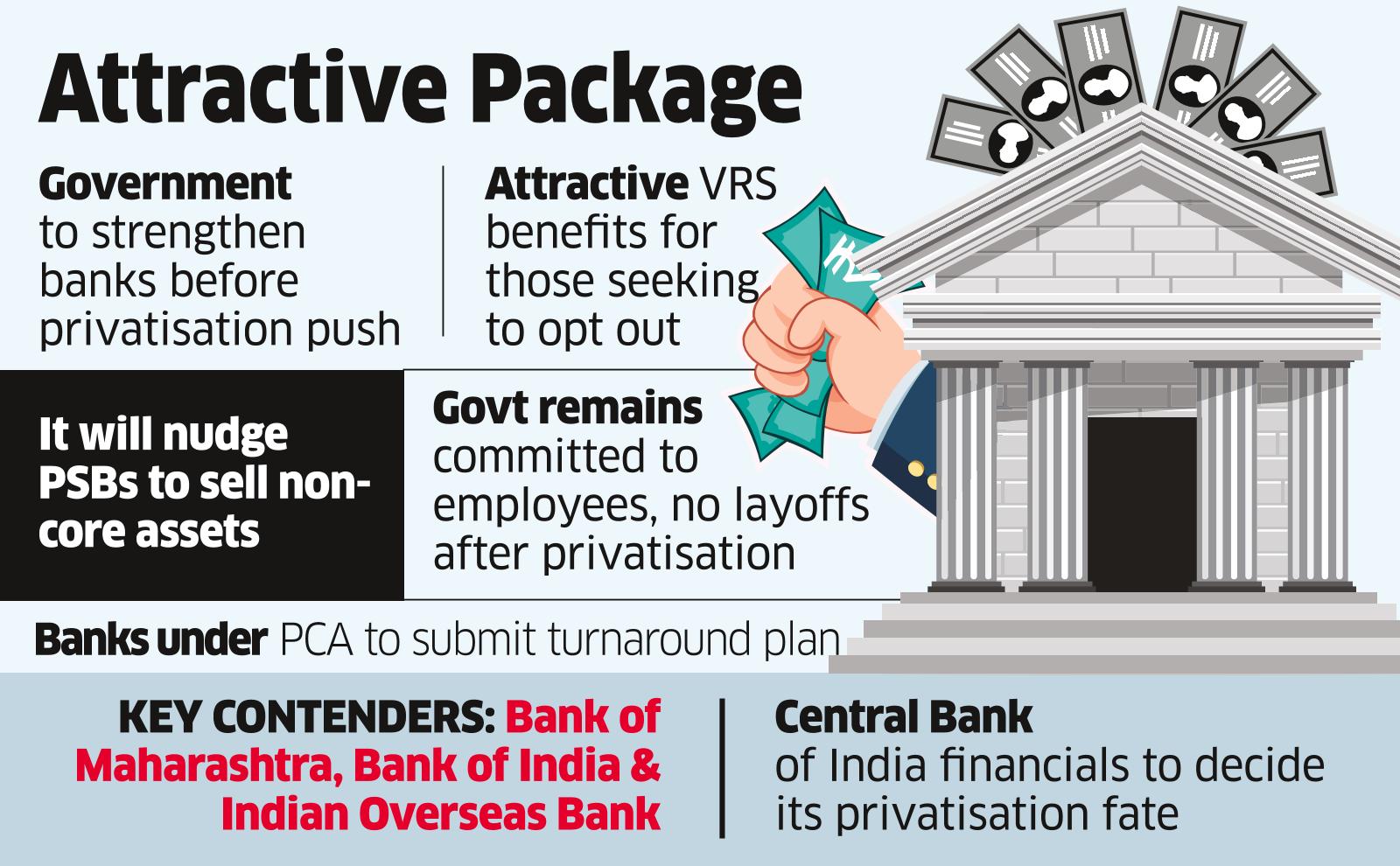

The government plans to dress up state-run lenders’ balance sheets through capital support and sale of non-core assets among other measures before putting them on the block. The transformation plan also includes the transfer of impaired loans to the proposed bad bank and reducing employee count by offering attractive voluntary retirement schemes, officials aware of the developments said.

Bank of Maharashtra, Bank of India, and Indian Overseas Bank are the frontrunners for being privatised, they said. Central Bank of India may be taken up based on its financial recovery. Punjab & Sind Bank and UCO Bank, the other two lenders that were not merged as a part of the public sector bank consolidation, are not being considered for privatisation yet, officials said.

“While the Niti Aayog has recommended two names, the empowered group of ministers may also consider other names based on suggestions from other stakeholders,” a government official said.

Independently, the government will seek a turnaround plan from banks that are under the Reserve Bank of India’s prompt corrective action (PCA) framework, the official said.

Central Bank of India, Indian Overseas Bank and UCO Bank are under RBI’s PCA framework, which imposes certain restriction on lending, management compensation and directors’ fees. “UCO Bank has turned profitable. We expect other lenders to also make similar comebacks,” another official said. Central Bank reported net loss of Rs 1,349.21 crore on a standalone basis in the last quarter of FY21.

Indian Overseas Bank is yet to report its year-end results.

Earlier this week, credit ratings agency Fitch Ratings, in a note, said that apart from political opposition, structural challenges including heightened balance sheet stress due to Covid-19, are likely to derail the privatisation bid.

Banks will be nudged to exit their non-core businesses to improve their financials before privatisation, the second official said. “It also depends on valuations, but they will need to actively lookout for opportunities.” The person did not rule out early capital infusion from the Rs 20,000 crore allocated in the FY22 Budget.

Attractive VRS benefits for employees can also be explored, he said. “On the lines of CPSEs offering voluntary retirement schemes to their employees, a similar mechanism can be looked at for those willing to opt-out.”

Finance minister Nirmala Sitharaman had said the government will ensure that after privatisation, every interest of the staff or the personnel who are there will be protected.