On May 26th, 2021, Anjani Portland Cement Limited (“APCL”) announced that it has entered into a Share Purchase Agreement with Bhavya Cements Private Limited (“BCPL”) and its Promoters, for acquisition of controlling stake in the equity shares capital of BCPL.

Established in the year 1983, Anjani Portland Cement Limited (APCL) manufactures three types of cement: Ordinary Portland Cement, Portland Pozzolana Cement and Composite Cement. On March 2014, Chettinad Cement Corporation Private Limited (CCCL) acquired 75% of the total shares of APCL. APCL sells its cement under the brand name of “Anjani” and has a dealer network of around 1,500 with presence across the southern states. Its holding company Chettinad Cement Corporation Pvt Ltd is also engaged in cement production with a capacity of ~15.5 MTPA with presence across the southern region.

Bhavya Cements Private Limited is established in 2007 and manufacture Ordinary Portland Cement, Portland Cement for the manufacture of Railway Sleepers, Portland Pozzolana Cement, Sulphate resisting Portland cement, and Portland Blast Furnace Slag Cement for use in coastal areas.

The Transaction

Pursuant to the Share Purchase Agreement entered with the Shareholders of the Investee Company on the 26th of May 2021, APCL acquired 11,54,55,015 fully paid-up Equity Shares of face value Rs.10/ each in the share capital of BCPL, representing 82.51% of the paid-up share capital, at a price of Rs. 52.59 Per share involving a total Sale Consideration of Rs. 607.18 Crores valuing company circa Rs 736 crores (five times book value) and Enterprise Value of circa Rs 800 crores based on assumed Rs. 74 crores loan at the end of FY2020. With this acquisition, Bhavya Cements Private Limited has become a subsidiary of Anjani Portland Cement Limited.

Table 1: Company Overview

| Particulars | APCL | BCPL |

| Products | Ordinary Portland Cement, Portland Pozzolana Cement and Composite Cement | Portland Pozzolana Cement and Ordinary Portland Cement |

| Capacity | 1.2 MTPA | 1.4 MTPA |

| Plant Location | Suryapet, Telangana | Guntur, Andhra Pradesh |

| Dealers | ~1500 | ~700 (based on website) |

| Captive Power Plant | Yes | Yes |

| Region | Telangana, Andhra Pradesh, Tamilnadu, Karnataka, Kerala | Telangana, Andhra Pradesh, Tamilnadu, Karnataka |

Rationale for the acquisition

APCL is part of giant CCCL. Over a period, despite having small manufacturing capacity, APCL has managed to maintain profitability. From Q2FY19, APCL has also started trading of cement manufactured by its holding company.

The main reason for acquisition of controlling stake in BCPL is to improve the market presence of APCL with addition of a new brand. The acquisition would more than double the cement manufacturing capacity under the control of APCL. Further, the plant location of BCPL is more towards coastal area which may result in some substantial saving in logistic cost for APCL.

Financials

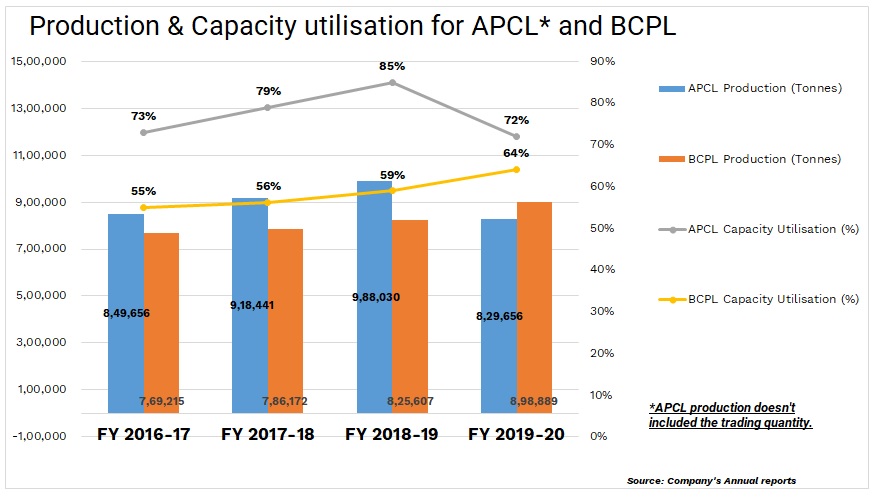

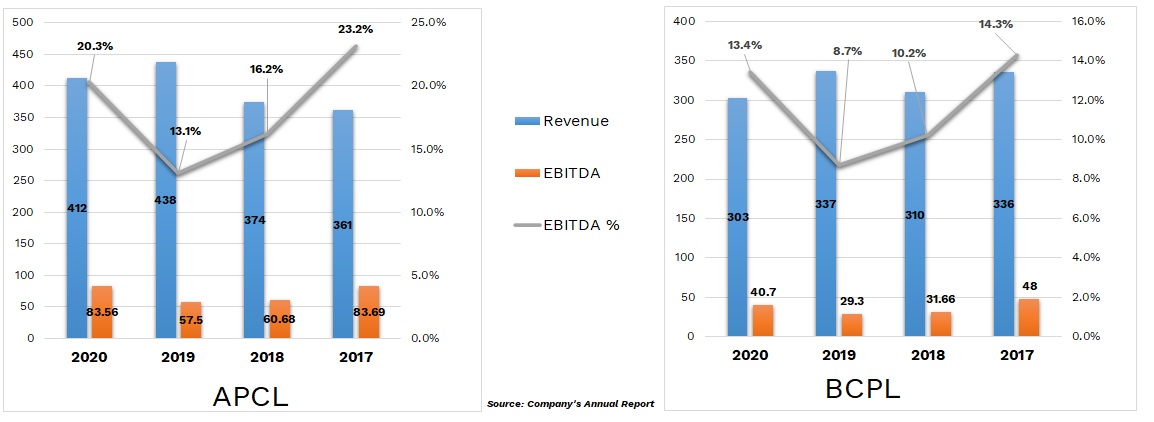

Though, APCL will only acquire a controlling stake in BCPL, merged entity financials are presented for better understanding purpose. Compared to BCPL, APCL has much better returns. This can be attributable to better capacity utilisation and support of parent entity. Post-acquisition, APCL using support of CCCL, can bring more efficiency to BCPL which most likely improve all performance ratios for the APCL on consolidated basis.

Table 2: Valuation Matrix

| Particulars | BCPL | APCL |

| Equity Valuation (Cr) | 736 | 550 |

| Enterprise Valuation (Assumed)- (Cr) | 800 | 364 |

| Capacity | 1.4 MTPA | 1.2 MTPA |

| EV per ton | 5712 | 3033 |

Please note:

- Enterprise Value of BCPL is assumed value.

- APCL Equity valuation is considering the rate of ACPL prevailing before the announcement.

- Enterprise Value has been arrived after adjusting the cash & cash equivalent amounting to INR 186 crores available with ACPL.

EV per ton of APCL is significantly lower than the one which the deal is getting. APCL must have paid some control premium over and above the normal valuation as they are acquiring 82.5%. Total cash & cash equivalent available with APCL as on 31st March 2021 was circa INR 186 crores.

Table 3: Funding the Deal

| Particulars | Amount (₹ Crores) |

| Amount required to purchase 82.5% stake in BCPL. | 607 |

| Internal Accruals | 186 |

| Remaining Amount | 421 |

APCL will be requiring INR 421 crores additionally which can come only as a loan. As CCCL already holds 75% stake in APCL, there is no scope available for infusion of fund through equity dilution.

Strategy

Earlier equity shares of Chettinad Cement Corporation Pvt Ltd (it was a limited company) were listed on stock exchanges. In 2012, the company successfully delisted and became private company. They acquired APCL after delisting however, they have kept it listed despite being minuscule compared to CCCL. Despite its small size, the company manages to earn a profit and continuously rewarding shareholders through dividend.

Interestingly, CCCL has its own manufacturing plant in Guntur where BCPL’s plant is located. However, being similar products, CCCL must have decided to peruse this acquisition through listed arm, APCL.

APCL is slowly trying to scale up its operations. First, they revamped operations by installing power plant; later started trading business and finally going for equal size (rather bigger than its) acquisition. Certainly, it is not going to be an easy walk for the company. However, with parent support, APCL is likely to reap the maximum benefits of these acquisitions. Initially, APCL likely to focus on implementing the practices followed by it /CCCL in BCPL and thereby, improving the operations of BCPL. Later, APCL may decide to merge BCPL with itself and giving a minority stake to the earlier promoters of BCPL.

Add comment