With the massive success of new age start-ups, India is set to witness bold acquisitions by start-ups. In April 2021, Byju’s announced the acquisition of multi-decade old Aakash Educational Services Limited. In the health-tech sector we saw a couple of deals viz, Tata Digital’s 60% acquisition of 1MG at $270 Million (₹ 2025 Crores) and Reliance’s 60% acquisition of Netmeds at $85 Million (₹637 Crores).

In a complete reverse move, PharmEasy announced the acquisition of Thyrocare Technologies Limited. In a one-of-its-kind as of now deal, PharmEasy is going to become the first unicorn to acquire public-listed company in India.

Thyrocare Technologies Limited is India’s one of the most advanced Totally Automated Laboratories having its strong presence in more than 2000 cities/towns in India and internationally. The equity shares of Thyrocare are listed on nationwide bourses.

PharmEasy i.e., API Holdings Private Limited is founded by Dharmil Sheth, Dhaval Shah, Harsh Parekh, Hardik Dedhia and Siddharth Shah. PharmEasy operates a pan India e-pharma marketplace. It also caters to the chronic care segment and offers a range of services such as teleconsultation, medicine deliveries, and sample collections for diagnostic tests. PharmEasy claims to have a user base of 12 million consumers and a network of 6,000 digital consultation clinics and 90,000 partner retailers across the country.

The Transaction

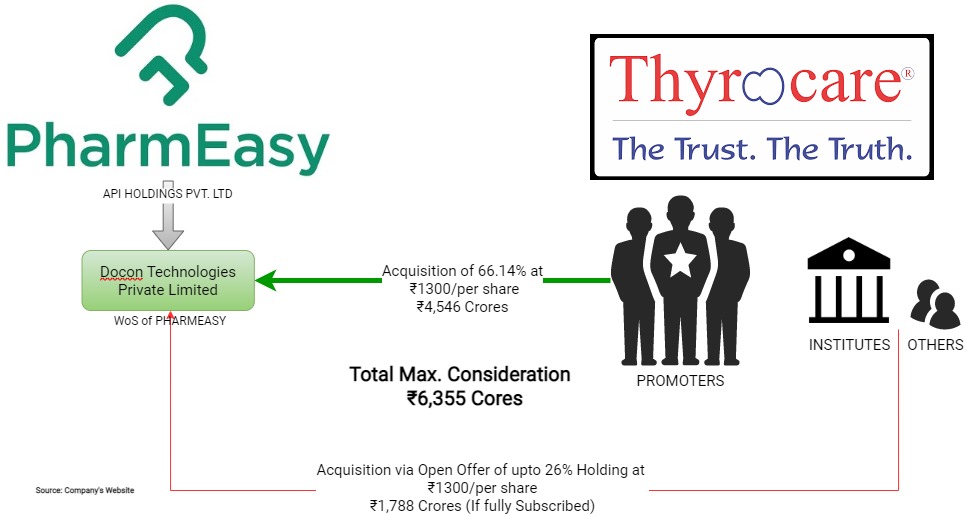

The promoters of Thyrocare, Velumani Family have entered into a Share Purchase Agreement with Docon Technologies Private Limited (wholly owned subsidiary company of PharmEasy) to acquire their entire shareholding in the company which is equivalent to 66.14% for a valuation of ₹ 4546 crore translating into ₹ 1300 per share.

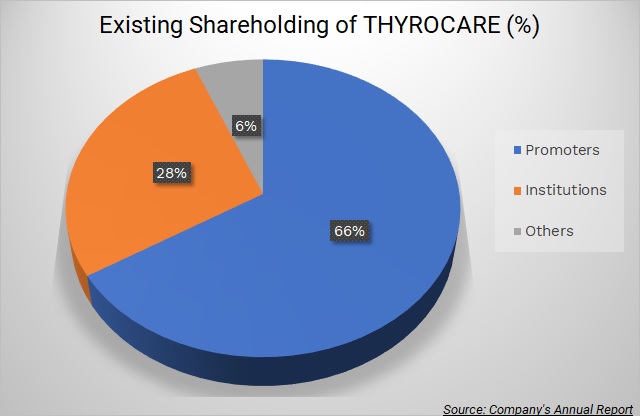

Immediately, Docon Technologies Private Limited along with API Holdings Private Limited, have announced an open offer for acquisition of up to 1,37,55,077 equity shares from the Public Shareholders of Thyrocare representing 26.00% of the Expanded Voting Share Capital, at a price of ₹ 1,300/- per Equity Share aggregating to total consideration of ₹ 1788 payable in cash. Present shareholding pattern of Thyrocare is as follow:-

It is also proposed that Dr. A Velumani, one of the promoters of Thyrocare will participate in a funding round by PharmEasy. Dr. Velumani will invest circa ₹ 1500 crore for an aggregate stake of 4.9% in PharmEasy. This will give PharmEasy comfort & smooth transition and for Dr. Velumani an opportunity to participate in the future growth of entire PharmEasy including Thyrocare.

If the open offer is fully subscribed, then the total outgo for PharmEasy will be as follow:

₹ in Crore

| Particulars | Amount |

| Acquisition of 66.14% stake held by Promoters | 4,546 |

| Open offer (upto 26%) | 1,788 |

| Total Cost for acquiring 92.14% stake | 6,335 |

Brief about Thyrocare & Industry

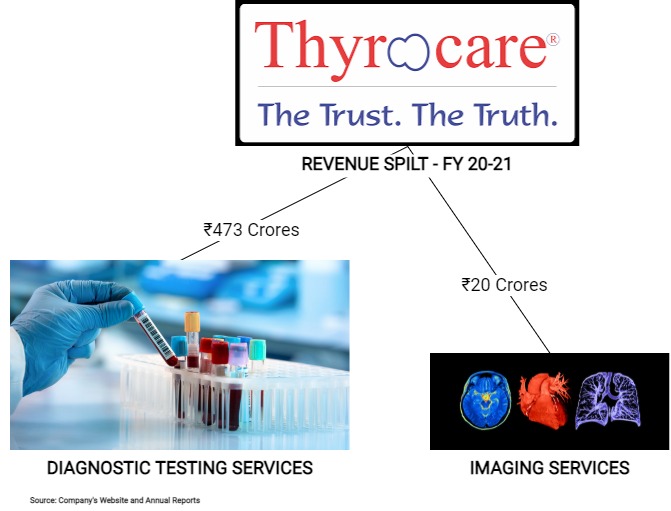

Thyrocare also has wholly-owned subsidiary, Nuclear Healthcare Limited which operates growing network of molecular imaging centres, primarily focused on early and effective cancer detection and monitoring. Thyrocare’s associate company (30% holding) Equinox Labs Private Limited is engaged in the business of water, food and other environment and hygiene testing.

As on March 31, 2021, Thyrocare offered 279 tests and 79 profiles of tests to detect number of disorders including Thyroid disorders, growth disorders, metabolism disorders, auto immunity diabetes, anaemia, cardiovascular disorder, infertility and various infectious diseases.

20 years after commencing the operations, in 2016, Thyrocare went public with an Initial Public offering by way of an Offer for Sale(“OFS”). In OFS, along with Strategic Investor, Promoter also sold some of their shares.

Details of OFS in 2016:

| Particulars | Number of Shares | Price per Share | Total (INR in cr) |

| Strategic Investor | 1,02,07,472 | 446 | 455 |

| Promoters | 5,37,236 | 446 | 24 |

| Total | 1,07,44,708 | 479 |

Thyrocare growth during last 6 years:

₹

| Particulars | 2014-15 | 2020-21 | CAGR |

| Revenue | 191 | 494 | 17.2% |

| EBITDA | 80.4 | 183.47 | 14.7% |

| EBITDA % | 42.1% | 37.1% | |

| PAT | 44 | 113 | 17.0% |

| PAT % | 23.0% | 22.9% | |

| Networth | 365 | 427 | |

| Property, Plant & Equipment | 151 | 129 | |

| Cash & Cash Equivalent | 101.6 | 115 | 2.1% |

| Capital Employed (excl. Cash & Cash Eq & Goodwill) | 263.4 | 212 | |

| RoCE | 25.7% | 71.7% |

Considering the acquisition price of ₹ 1300 per share, Thyrocare’s valuation has also grown almost in line with increased profitability, though current P/E multiple is lower than what was assigned at the time of OFS in 2016.

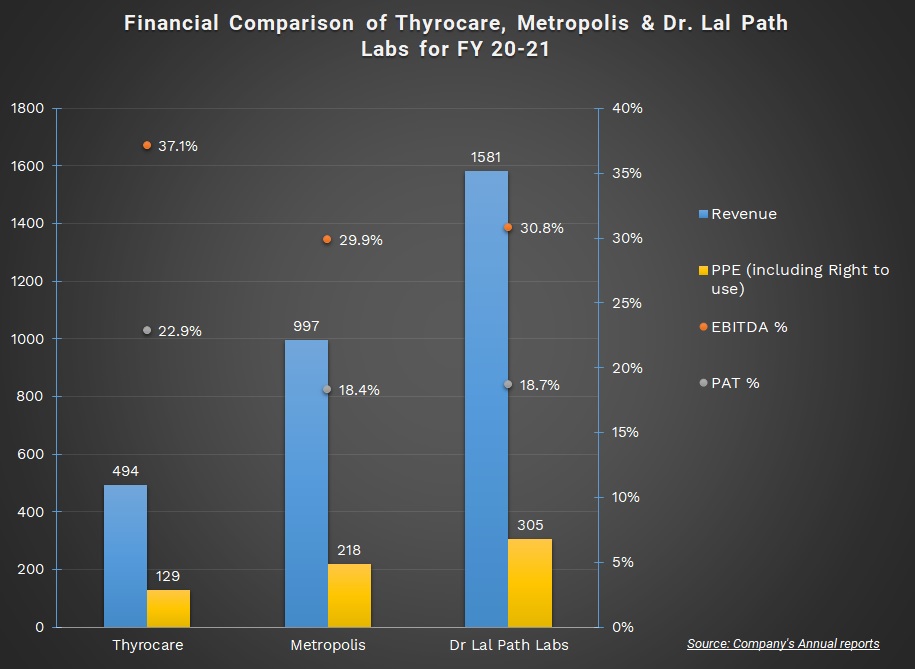

Financials for three major listed vanilla laboratory players in India

₹ in Crore

| Particulars | Thyrocare | Metropolis | Dr Lal Path Labs |

| Revenue | 494 | 997 | 1581 |

| EBITDA | 183.47 | 298 | 487 |

| EBITDA % | 37.1% | 29.9% | 30.8% |

| PAT | 113 | 183 | 296 |

| PAT % | 22.9% | 18.4% | 18.7% |

| FCF | 109 | 220 | 363 |

| FCF % of Revenue | 22.1% | 22.1% | 23.0% |

| PPE (including Right to use) | 129 | 218 | 305 |

The Indian diagnostic market is at a nascent stage as compared to the developed markets but growing rapidly. The laboratory industry is dominated by small and regional unorganised laboratories which controls more than 70% share. The recent pandemic has resulted in paradigm shift in healthcare sector including diagnostic business. Main organised players like Thyrocare, Metropolis, Dr Lal PathLabs are trying to expand their footprints by acquiring regional dominant players.

PharmEasy

Started as home delivery of medicines, E-pharmacy market in India has evolved significantly in last couple of years. With an increased penetration, the competition across e-pharmacy players is getting intensified with every passing day. To differentiate itself from competitors and provide complete range of healthcare services, all e-pharmacy players started offering multiple healthcare & wellness related products including diagnostic services mainly through tie-ups with regional/national players.

PharmEasy’s acquisitions come at a time when Reliance Retail, Tata Group and Amazon have dipped their feet into the fast-growing e-pharmacy sector. For E-Pharmacy, it gives access to large cash and for conglomerates like Reliance Retail, Tata Group and Amazon, it’s a step towards making “Super App”.

PharmEasy, has also been hitting one milestone after another this year. In a move to become numero-uno position, recently PharmEasy announced merger of another e-pharmacy start-up “Medlife” with itself. PharmEasy has already built its diagnostics business vertically through pilots and the acquisition of Medlife. This acquisition ushered in largest consolidation deal in India’s fast-growing online pharmacy sector. To place itself into different league, it has decided to acquire Thyrocare. The 25-year-old company, Thyrocare operates a network of over 3,330 collection centres in over 2,000 towns in India.

In 2020, in a move to consolidate the entire business & shareholding into a single entity, i.e., API Holdings Private Limited, earlier operational company of PharmEasy, 91Streets Media Technologies Private Limited along with other companies got amalgamated with API Holdings Private Limited.

To fund its ambitions, PharmEasy is continuously raising funds from various investors including global investors. To fund Thyrocare acquisition, PharmEasy has already raised $650 million in the last 3 months.

Competition and Valuations

We give below valuation metrics of three major players

| Particulars | Thyrocare | Metropolis | Dr Lal Path Labs |

| Networth (₹ Crores) | 427 | 706 | 1276 |

| Capital Employed (Excl. Investment & Goodwill)(₹ Crores) | 197 | 189 | 191 |

| RoCE | 93% | 158% | 255% |

| Circa Market Capitalisation(₹ Crores) | 6,875 | 15,000 | 26,000 |

| Enterprise Value(₹ Crores) | 6,745 | 14,573 | 25,000 |

| Price-Earning Ratio | 61 | 82 | 88 |

| EV/EBITDA | 37 | 49 | 51 |

As mentioned in the offer documents, the equity valuation of PharmEasy (Post Thyrocare Acquisition) comes to circa ₹ 30,600 crore. If one look at stand-alone valuation of PharmEasy based on the recent round before the acquisition was circa ₹ 13,500 crore which is multi-fold to the valuation assigned to Thyrocare.

| Particulars | Amount |

| Amount to be invested by A. Velumani | ₹ 1500 crore |

| Stake A. Velumani will get | 4.9% |

| Valuation of PharmEasy (combined after Thyrocare Acquisition) | ₹ 30,600 crore |

| Valuation of PharmEasy (Series E in 2021) | ₹ 11,250 crore |

| Valuation of PharmEasy (Early June 2021) | ₹ 13,500 crore |

Stand-alone valuation of PharmEasy based on the round before the acquisition of Thyrocare was ₹13,500 crore and valuation assigned to Thyrocare is ₹6800 crore. The proposed combined valuation of PharmEasy now stands at i.e. ₹ 30,500 crore which is more than 50% higher.

PharmEasy became the country’s first e-pharmacy to enter the unicorn club after raising a $323-million round from Prosus Ventures, TPG Growth etc. at a valuation of $1.5 billion. At the time of merger of Medlife with PharmEasy, PharmEasy discharged consideration aggregating to circa 19.59% stake in PharmEasy making its valuation circa ₹ 9500 crore. With every other acquisition, PharmEasy will become stronger and able to provide much more services to its customer which will, in turn, increase its valuation substantially.

Market Cap of some of the similar companies listed in USA though it is not an apple-to-apple comparison as these companies are much bigger and provide various other healthcare services including Insurance which PharmEasy may go for in future.

| Particulars | Walgreens Boots Alliance, INC (Year 2020) | CVS Health Corporation (Year 2020) |

| Sales ($ Mn) | 1,39,537 | 2,68,706 |

| EBIT ($ Mn) | 1,382 | 12677 |

| EBIT % | 1.0% | 4.7% |

| PAT ($ Mn) | 424 | 7,192 |

| Networth ($ Mn) | 21,136 | 69,389 |

| Market Cap ($ Mn) | 45,130 | 1,10,750 |

| Market Cap/Revenue | 0.32 | 0.41 |

Rationale

PharmEasy is planning for an IPO in the coming months. The acquisition of a profitable pathology business is not going to add just one new significant vertical, but it has increased the overall valuation significantly. Going ahead, PharmEasy can scale its business significantly using large infrastructure of 3300 collection centres available with Thyrocare. PharmEasy’s aggressive management will try to leverage cross-selling opportunities available with both businesses. Further, PharmEasy will also get access to the health insights available with Thyrocare which it can use for bringing operational efficiency to its own business and similarly, Thyrocare can decide its expansion plan based on data with PharmEasy. Most of the revenues for Thyrocare are derived through B2B as compared to its peers which derive higher B2C revenue. B2B is volume play rather than value. PharmEasy can bring the much needed B2C play to Thyrocare which will improve margins. Similarly, PharmEasy can use strong B2B network of Thyrocare for its own services/products. Pan India presence of PharmEasy will give significant boost to Thyrocare to establish its footprint into other markets.

What Next Reverse Merger?

Assuming the entire 26% public shareholders tender their shares to PharmEasy, its holding in Thyrocare will be circa 92.14% which will be significantly higher than SEBI’s maximum permissible limit of 75% though the possibility looks blink. Within one year, PharmEasy has to bring its shareholding below/at 75% by selling its stake through the Offer for Sale route or selling to Institution/Strategic Player. Other available option could be Reverse Merger (merging PharmEasy’s business with Thyrocare) and get PharmEasy’s business listed. This could be the most suitable option as PharmEasy is planning for an Initial Public Offer in the coming period. Instead of listing PharmEasy’s business separately, it will announce reverse merger pawing for listing PharmEasy as well as bringing its holding below 75%.

Conclusion

This acquisition will set a different example for all e-businesses. In a one-of-its-kind deal, PharmEasy is going to become the first unicorn to acquire public-listed company in India. This will pave the way for other start-ups/unicorns to opt similar kind of strategy. This is also a unique model in the Indian market because other E- Pharma players want to integrate with its other e-businesses and become a universal e-market while this acquisition will connect e-business to brick and mortar. Thyrocare acquisition is a result of its bolt-on acquisition strategy to place itself uniquely by offering single-window healthcare services. Looking at the valuation of e-pharma operators in USA, may lead to substantial value creation for all the stakeholders. For Thyrocare, this may help in re-branding itself with a help of super-aggressive management.

Reverse Merger may expediate the process of listing and it will be like listing through SPAC (Special Purpose Acquisition Company), though here SPAC is not a shell company.

Add comment