Mahindra Group has entered into a global alliance with Spain’s CIE Automotive S.A. The agreement will come under Systech Sector, which happens to be the Mahindra Group’s automotive component, and CIE Automotive (also involving their subsidiary, Autometal). The alliance led to the formation of an automotive component group with a global presence. The combined sales of the global automotive component group will be around $3 billion. The expected areas of operation will include South America, North America, Asia, Europe and will conduct operations via India, Spain, and Brazil.

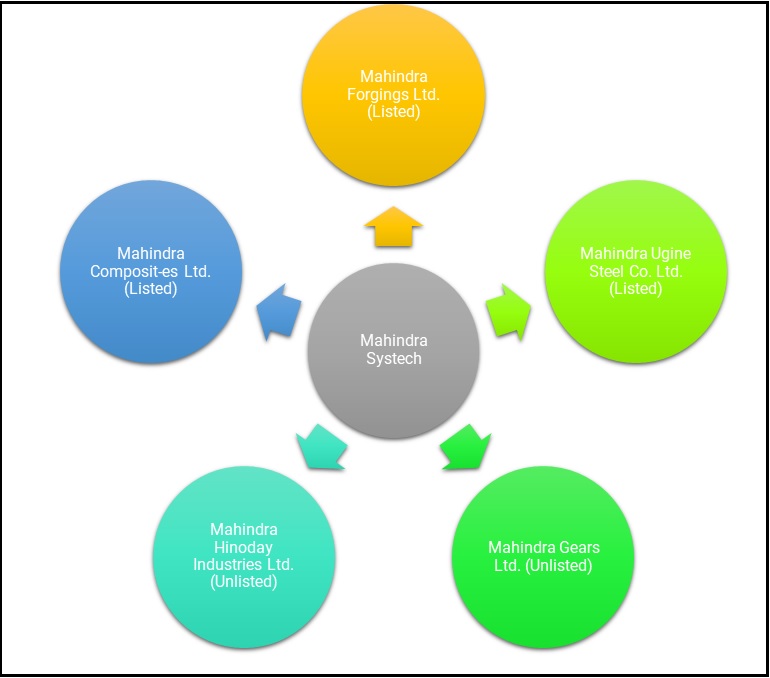

CIE Automotive is set to acquire a stake in the Mahindra Group. The transaction will see a subsidiary of the Spanish company acquiring stakes in the unlisted and listed companies, namely belonging to Systech Sector. Along with amalgamating its businesses in Lithuania and Spain, CIE Automotive is set to combine all the companies under MFL. The consolidated companies will be renamed as Mahindra CIE, and will carry on as a listed company on the National and Bombay Stock Exchange.

The complex business transactions will be executed over a series of steps, which will eventually lead to the following activities: Mahindra and Mahindra will own a stake of 13.5 percent in CIE Automotive, making it the second biggest shareholder in CIE. Two directors from M&M will be nominated to join the CIE board.

Mahindra Systech

The company was established in 2004 by the Mahindra Group with a vision. The Mahindra Group entered into the components industry as India’s global competitiveness took off.

Mahindra Systech portfolio includes Castings, Forgings, Stampings, Gears, Rings, Magnetic products, Steel, Composites, Engineering and Contract Sourcing services. It offers a variety of components and services to the automotive and other ground-based mobility industries around the world. The Company operates its manufacturing units across India, Germany, Italy, and the UK. The area of work includes forgings, castings, gears, stampings, steel & rings, magnetic, composites, contract sourcing, engineering services, and aerospace.

CIE Automotive

The company is one of the main suppliers of components and sub-components for the automobile sector operating in Europe, Brazil, Nafta, and China.

The Company manufacture components and sub-assemblies for all parts of vehicles, including: (i) the engine and power train; (ii) the chassis and/or steering assembly; and (iii) the exterior and interior of the vehicle, with these seven basic processes or technologies i.e. forging, machining, aluminum, stamping, plastic, iron casting and painting. The company’s operations in Brazil, Mexico, USA, and China are constituted under its subsidiary, Autometal, listed on the Sao Paulo stock exchange.

The business model concentrates on diversification and flexibility of technologies, clients, vehicle platforms, suppliers and geographical localization. This has enabled them to minimize risk and obtain significant economic results, with low dependence on vehicle platforms, or specific clients or industrial plants.

Structuring of Deal

As part of the cross-border swap deal reached after two-and-a-half years of negotiations, CIE Automotive would take a majority stake in a single listed entity in India. This entity would continue to operate the current automotive component businesses of Mahindra Systech globally. This would also include CIE’s European forgings operations.

As part of the complex deal announced, Mahindra Group, which has interests in businesses including automobile and information technology, will merge all its auto components businesses into its Mahindra Forgings unit.

CIE will buy a majority stake in the combined auto component unit of India’s diversified Mahindra Group for about $116 million to get access to new markets and supply networks. The listed Mahindra units in which CIE will buy stakes are Mahindra Forgings, Mahindra Composites, and Mahindra Ugine Steel.

Mahindra Forgings will be renamed Mahindra CIE Automotive, in which Spanish auto components maker CIE will hold 51 percent and Mahindra will own about 20 percent stake in the new entity. The rest will be held by institutional and public shareholders.

| Name of Holder | % Shareholdings |

| Spanish auto components | 51.1% |

| Mahindra | 20.2% |

| Institutional and Public Shareholders | 28.7% |

Looking at the shareholding, it does raise some questions in the mind of investors for choosing such a structure as Mahindra is known for acquiring majority stakes in any acquisitions or JV’s. But looking at the long-term objective of the company it would, in fact, be beneficial as CIE would provide a platform to Mahindra for entry into new markets to become a truly global player. Mahindra CIE will become one of the top 25 global auto component suppliers, with annual sales of $3 billion and operations from North America to Asia.

The amount invested by CIE i.e., €100 million for the stake would be used by the group’s flagship Mahindra & Mahindra Ltd., to acquire a 13.5 percent stake in the Spanish firm making it the second largest shareholder in CIE. As part of the deal, M&M also gets to appoint directors on CIE’s board. The deal said Mahindra officials is “cash neutral”.

Looking at the above transaction details it can be seen that multiple transactions were concluded simultaneously. The transactions were not only cashless and tax efficient but would also maintain rights for policy making and direction in which the company would run as the effective holding of promoters would be more than 27% (13.5%*51% + 20.2%).

Going ahead, the promoters of the company can also look into delisting the company from stock exchange without much tussle as the shareholding of Institutional and Public shareholding is close to bare minimum holding required for a listed company i.e. 25%.

Opportunities for:

Mahindra –

- After this transaction, M&M will be considered as the second largest shareholder of CIE Automotive. This tie-up will enable M&M to enter Latin American markets while offering the European partner footprint in the Indian market.

- CIE Automotive is one of the main suppliers of components and sub-components for the automobile sector this will help M&M to reduce its cost of production.

- Meanwhile, the deal unlocks value for stakeholders in the numerous auto-component firms. As per the Indian takeover rules, any company buying a 25 percent stake in a listed Indian entity will have to launch an offer for at least 26 percent more from the public.

- Mahindra, which has had a hard time building a presence outside India, has been scouting for overseas tie-up opportunities in recent years to realize a long-standing ambition to be a global player.

- Also since CIE would have controlling interest it will help Mahindra to be fully recognized as auto-component manufacturer globally. Mahindra, which initially used their auto-components mainly for captive consumption, can now tap other OEMs both in India and abroad for their component business.

CIE Automotive –

- In India Mahindra Group operates in the key industries that drive economic growth, enjoying a leadership position in tractors, utility vehicles, after-market, Information Technology and vacation ownership. This will help CIE to make their presence in India with the help of name and fame of Mahindra.

- Mahindra also enjoys a strong presence in the agribusiness, aerospace, components, consulting services, defense, energy, financial services, industrial equipment, logistics, real estate, retail, steel, commercial vehicles and two wheeler industries. Due to this CIE Automotive will be able to get a new line of business activity.

Conclusion

The structure used by Mahindra is a talking point for many and they would argue for the same. But looking at the long-term benefits that they would derive it seems to be justified. Through this deal, Mahindra is able to get global footprints for which they have been striving for many years. And they will be a player very much experienced in those areas and will be able to tap other global OEMs. Also, the deal will enable them to consolidate their various auto component businesses under one roof instead of through complex legal procedures.