The Holcim Group, the world’s largest cement maker, has begun negotiating a detailed share purchase agreement (SPA) with two Indian contenders – the Adani Group and the JSW Group – as the near $10 billion sale of listed Ambuja Cement and ACC approach the final leg of negotiations, said people aware of developments.

The third likely contender, Kumar Mangalam Birla’s UltraTech, has not yet held any such deliberations, though it’s pushing to join the fray despite anti-trust worries, added the people cited above.

The SPA talks are expected to be completed by end May, within which all suitors are expected to furnish full details of financing.

“Once the terms of the SPA are finalised, then there will be a short window to show up with the committed financing,” said one of the persons. “At that point, whoever can move in first scalps the assets.”

Cyril Amarchand Mangaldas is said to be advising while Shardul Amarchand Mangaldas is working with the Birla Group and & Co are legal advisors to the JSW Group.

“Ambuja and ACC are listed companies and the stock has been very volatile since the sale reports emerged. So, it’s natural for Holcim to do SPA negotiations, commercial negotiations, diligence etc., simultaneously. They are keeping their options open. Once they finalise, they will announce in 12-24 hours keeping in mind the time-sensitivity,” said a senior investment banker. “It’s unlikely they will get into deal exclusivity for prolonged negotiations.”

Holcim, UltraTech and JSW declined to comment. Adani did not respond to queries.

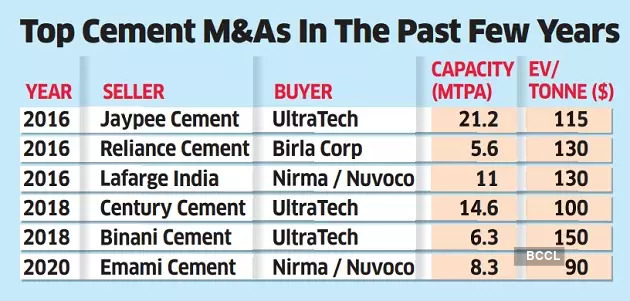

UltraTech — the leading cement player in the country — is still weighing options to join the fray and disallow any domestic rival to straightaway emerge as a strong challenger. But a bid by UltraTech will face scrutiny from India’s anti-trust watchdog, the Competition Commission of India (CCI), as reported first by ET on April 25. Of the total 540 million tonnes per annum (MTPA) of capacity in the country, UltraTech accounts for 117 MTPA while ACC and Ambuja together are at 66 MTPA.

Birla, according to sources, has therefore sent feelers to the contenders, asking if they are willing to join forces, with UltraTech divesting up to 25-30 MTPA capacity to its partner.

“CCI will take at least 1-2 years to clear the proposal if at all it does. Whoever does team up may also get dragged into it,” said a cement sector analyst on condition of anonymity. “A seller who has made up his mind would want a quick decision and move on.”

The combined market value of Ambuja Cement and ACC was Rs 1.14 lakh crore on Monday.

Billions at Stake

ET reported on May 6 that the Adani Group was looking at a Dubai-based group as the main vehicle for the buyout of the twin cement targets and has been in talks with Gulf investors including IHC that recently invested $2 billion in the group. The Ahmedabad-headquartered conglomerate is also finalising terms of promoter as well as share-backed financing from Barclays, Standard Chartered Bank and Deutsche Bank. Other group companies may be roped in as people acting in concert (PAC) during the open offer, if needed.

On the other hand, JSW Group is relying on its own balance sheet to bankroll nearly $2 billion as its equity, plus is in talks to raise nearly $1.75 billion in funding from a consortium including Carlyle, CVC, Advent and Oaktree Capital, said sources in the know. Even existing JSW Cement investor, Apollo Global Management, is expected to join the financing. If the PE funding is not tied up in time, global banks MUFG Bank, Mizuho, Credit Suisse and possibly even Standard Chartered Bank will offer bridge loan along with share financing. JSW’s own cement business is valued at an estimated $3 billion. It’s also in talks with a clutch of HNIs for funding.

Holcim under chief executive officer Jan Jenisch is keen to add new construction businesses outside cement as it seeks to move out of polluting sectors. The company agreed to take over Malarkey Roofing Products in December and Firestone Building Products in early 2021. It has been selling non-core assets to reduce debt and diversify through acquisitions. It sold its Brazilian unit for $1 billion last September and is also planning to cash out of its Zimbabwe operations.