Armed with a favourable legal opinion and regulatory precedence under the Competition Act, Aditya Birla Group is likely to bid for Holcim’s India assets – Ambuja Cements and ACC Ltd, said people in the know. It is also ready to divest voluntary assets of around 15 million tonnes per annum (MTPA) as a remedy to comply with market share norms.

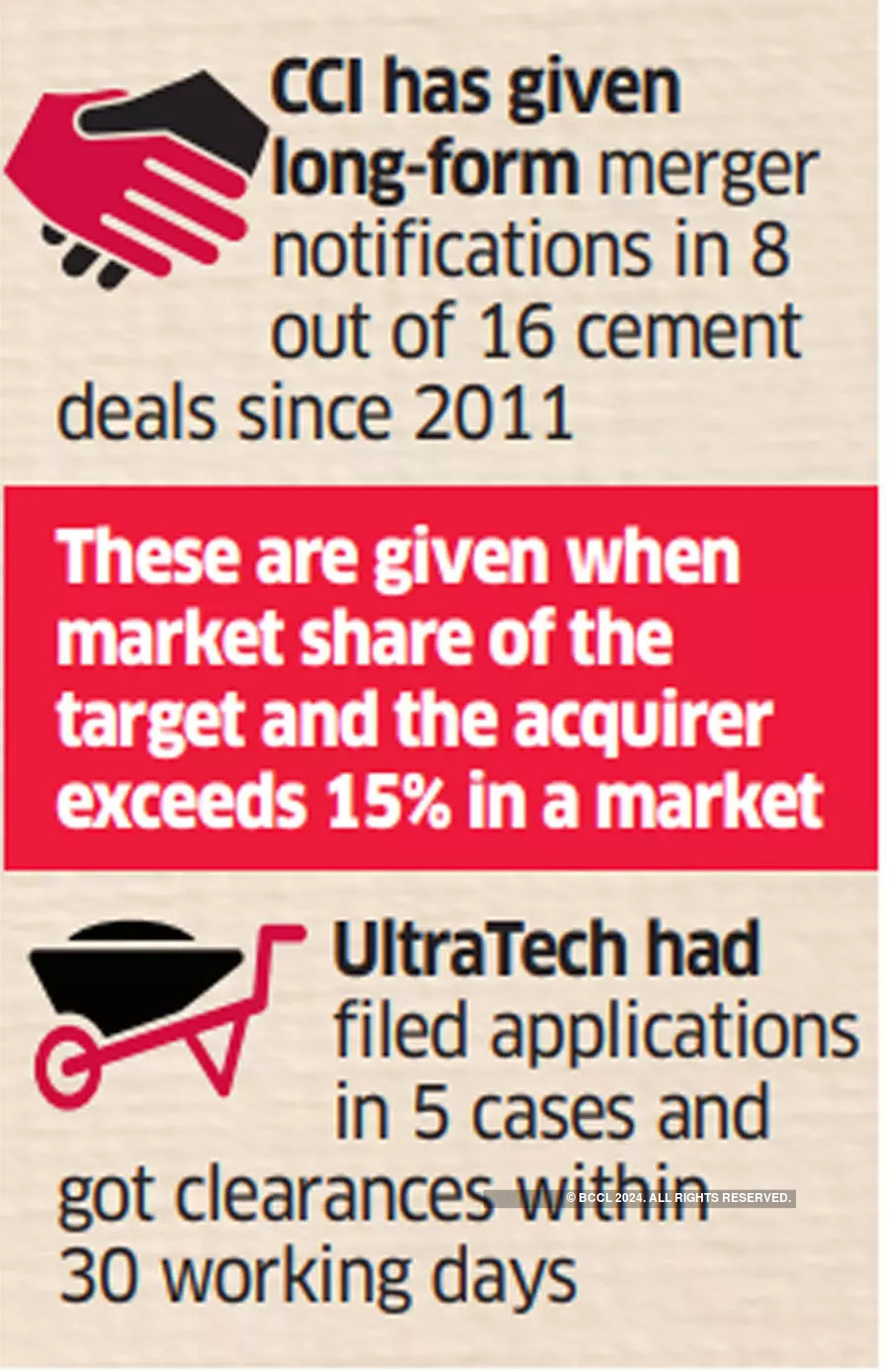

Since 2011, the Competition Commission of India has looked at 16 cement acquisitions, in eight of which it has given a “long form merger notifications”- a legalese for cases where the combined market share of the target and acquirer exceeds 15% market share in a relevant geographical market.

Of these eight, Aditya Birla Group company UltraTech alone had filed for five since 2013 with the regulator.

Remedial Plans for Swift Nod

These involved its buyout of Binani Cement, Jaypee Group’s assets and Century Cement, among others. UltraTech received unconditional clearances in these five cases within 30 working days, said a legal source close to the group.

UltraTech is the country’s largest cement maker with 117 million tonnes per annum (MTPA) capacity while ACC and Ambuja together are at 66 MTPA, making them the second largest. The total national capacity is 540 MTPA.

Adani Group and JSW are also bidding for Holcim’s India assets.

An Aditya Birla spokesperson declined to comment.

MARKET DEFINITION

In cement, CCI defines “geographic market” through a cluster analysis – a 400-500 km radius where cement can be transported profitably. This is always beyond a single state border, said a lawyer involved in the process, who spoke on condition of anonymity. For example, when UltraTech acquired Jaypee’s two assets in Gujarat with a combined capacity of 4.8 MTPA, CCI examined the relevant geographical market as being a combination of Gujarat and Rajasthan.

The watchdog also considers capacity share – current installed capacity as well as any greenfield or brownfield additions that are planned. For example, in Lakhpat, north Kutch, Gujarat, Adani has planned a 10 MTPA capacity that the legal source mentioned above said is larger than both ACC and Ambuja that together have a 6.8 MTPA capacity in the area. One of Jaypee’s assets is in Kutch.

MULTIPLE VIEWS

Given the anti-trust regulator’s track record, UltraTech was confident of receiving CCI clearance, as per the legal sources close to the Birla Group.

CCI lawyers said if companies volunteer with appropriate remedial plans, approvals can come in as early as 30 working days. All five Aditya Birla Group cement acquisitions have been approved within the 30-working day period – also called phase I approvals.

Without any upfront remedial steps provided for, however, CCI can take up to 210 calendar days from the time of receiving application to clear a proposal. These are called phase II approvals. There have been only eight instances out of the total 925 cases across sectors, where CCI has gone for phase II approvals. That’s less than 1%,” said an official mentioned above. “Birla will volunteer a remedial plan involving divesting asset for a quick phase I approval,” said an official in the know.

“Given the strong market presence of both parties coupled with the oligopolistic nature of the industry, the CCI will typically focus on the combined market shares of parties, the extent of barriers to entry in the market, and the position of their competitors in the market,” said a head of competition practice of one of the full-service law firm involved in the matter on condition of anonymity. “If after the said assessment, CCI feels that the transaction will adversely impact the competition in the market, it can ask parties to offer remedies (including divestitures) as a condition of approval.”

According to Akshayy S Nanda, Partner, competition and data privacy, at Saraf and Partners, the regulator will determine whether the proposed acquisition of Ambuja and ACC will cause an “appreciable adverse effect” on competition. “In case the acquirer already has significant market power or is likely to gain significant market power post the acquisition in a regional market, it is likely that the CCI will initiate a phase II in-depth investigation and may also require divestiture of certain plants as a condition to its approval,” said Nanda.

Under the competition law, the acquirer is mandated to obtain prior approval of the CCI before consummation of the transaction, said GR Bhatia, Partner, L&L Law Offices. “CCI can also give the go-ahead subject to the divestment of some business assets including plants etc so as to maintain the fabric of the competitive market. “In any case, acquiring dominance through the acquisition of another is not bad but abuse of a dominant position is forbidden.”