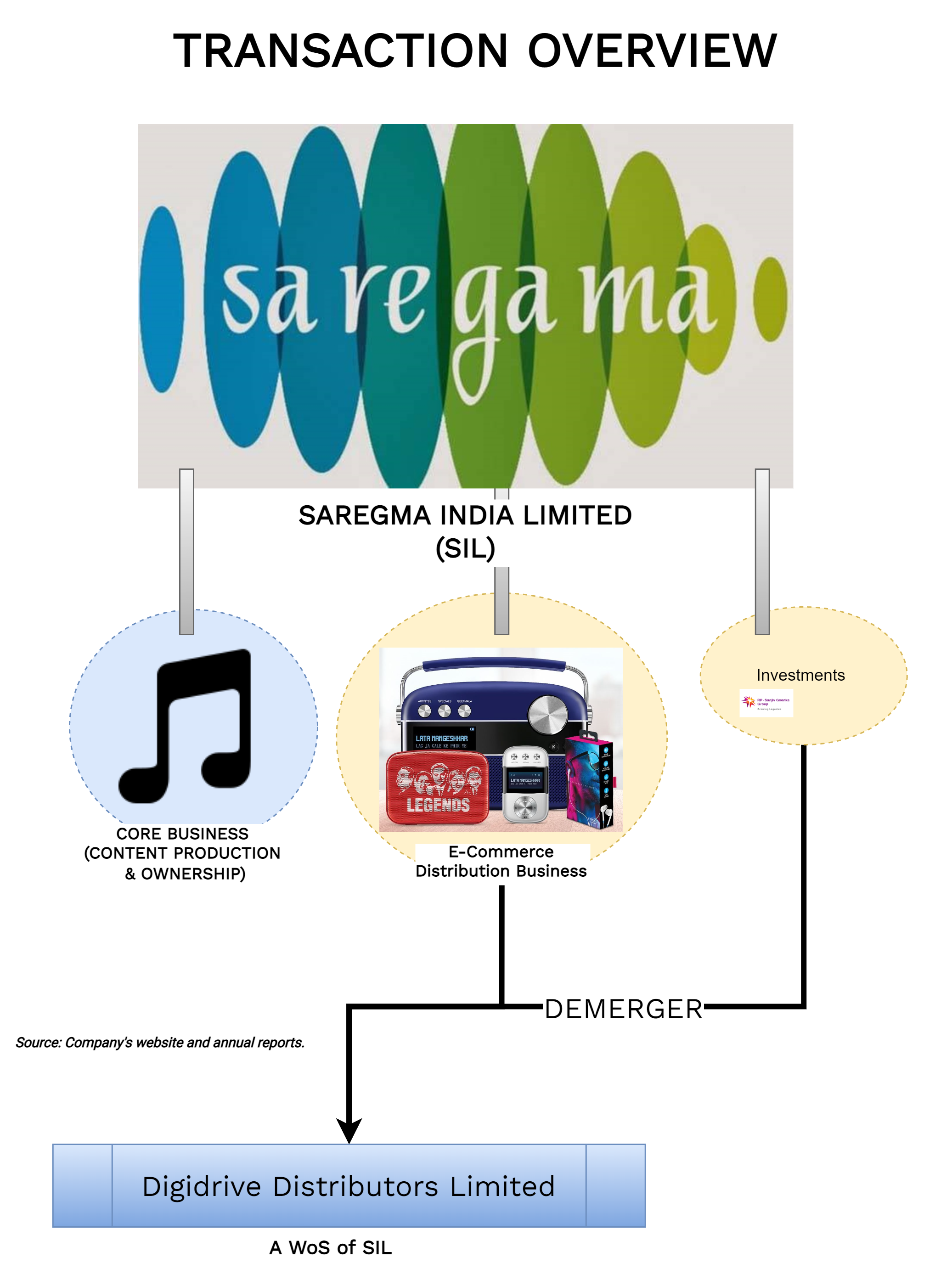

With a substantial rise of online music streaming platforms and music usage by social media’s Indian music industry is on the cusp of witnessing sea changes and in the list, Saregama India Limited is undoubtedly placed in the top quadrant. Recently, Saregama India Limited announced corporate re-structuring aiming to further streamline its operations.

Saregama India Limited (“Demerged company” or “SIL”) is engaged in the business of manufacturing and sale of music storage devices viz. Carvaan, music card, audio compact discs, digital versatile discs and dealing with related music rights. The Demerged Company is also engaged in the production and sale/ telecast/ broadcast of films, TV serials, pre-recorded programmes and dealing in film rights. Apart from this, SIL holds some stake in other RPSG companies (Group Companies) and 100% equity of Open Media Network Private Limited, a company engaged in the publication of weekly magazines. The equity shares of the Demerged Company are listed on BSE Limited and the National Stock Exchange of India Limited.

Digidrive Distributors Limited (“Resulting Company” or “DDL”) is incorporated to facilitate the proposed demerger. The main objective of the company is to create a specialised master distributor for retailing goods on all digital marketplaces. The Resulting Company is a wholly-owned subsidiary of the Demerged Company.

The Transaction

Board of Directors approved the Scheme of Arrangement between SIL & DDL which inter alia provides for the demerger, transfer and vesting of the E-commerce Distribution Business from SIL to DDL on a going concern basis. The “Appointed Date” for the proposed demerger will be opening business hours of 1 April 2022 or such other date as may be agreed between the companies.

Swap Ratio:

As a result of the demerger, DDL shall issue 1 (One) fully paid-up equity share of INR 10/- each as fully paid up, for every 5 (Five) equity share of INR 1/- each of SIL. As DDL is wholly owned subsidiary of the SIL, there will be mirror image shareholding pattern of DDL post-demerger. The existing shares held by SIL in DDL shall get cancelled.

| Particulars | SIL | DDL-Post Demerger |

| Paid-up No. of Shares | 19,28,09,490 | 3,85,61,898 |

| Face Value | 1 | 10 |

| Paid-Up Capital | 19,28,09,490 | 38,56,18,980 |

| Promoters Stake | 57.65% | 57.65% |

| Public Stake | 42.25% | 42.25% |

| Non-Promoter Non-Public | 0.10% | 0.10% |

Despite of miniscule turnover of demerged undertaking as compared to the core business of SIL, the paid-up share capital of the Resulting Company will be twice that of SIL.

Demerged Undertaking:

“E-commerce Distribution Business” means and includes the entire distribution business of the Demerged Company relating to sale of all its physical products including Carvaan on digital marketplaces along with identified non-core assets and other activities and/ or arrangements incidental or relating thereto.

As explained by the management during the con-call, SIL has developed expertise within the company of distributing Carvaan on digital platforms which can now be used to sell non-Carvaan-related products too. This expertise can be put into a new company to scale the business. The Resulting Company will become a nonexclusive distributor of Saregama Carvaan for digital distribution. It will also try getting distributorship for non-Saregama non-RPSG businesses. Along with this, all non-core investments including those in RPSG group companies & investments in magazine publishing business will also for part of the E-Commerce Distribution Undertaking which will be demerged.

Key investments of SIL in other RPSG Group Companies:

| Particulars | Circa Fair Value |

| CESC Limited | 122 |

| RPSG Ventures Limited | 15 |

| Spencer Retail Limited | 8 |

Apart from that, SIL has also invested in Open Media Network Private Limited (the company which publishes magazine) of which entire investment amount has been provided impairment in the books of SIL. Other than that, SIL also have investment property & investment in other companies on which there is no clarity whether they will for par of the demerged undertaking or continue to remain with SIL.

Financials of the demerged Undertaking:

| Particulars | Amount |

| Total Revenue FY 21 | INR 17.42 crore |

| % Of total revenue of SIL | 3.78% |

| Dividend Income FY 21 | INR 6.95 crore |

| Publication Revenue FY 21 | INR 4.38 crore |

| Publication EBIT FY 21 | INR -11.77 crore (loss) |

It looks the substantial part of the revenues of the undertaking getting demerged consist of its magazine publishing business and dividend from the investment in group companies. The magazine publishing business is running in losses and there was a long-standing demand from shareholders to separate this business from the core SIL’s operations.

Revenue & Operational Profits for the Publishing Business in the last 4 years:

INR in crore

| Particulars | Revenue (after eliminating revenue from SIL) | Revenue from SIL | EBIT |

| FY 2022 | 4.43 | NA | (11.77) |

| FY 2021 | 4.38 | 11.03 | (12.03) |

| FY 2020 | 6.88 | 10.11 | (12.92) |

| FY 2019 | 7.38 | – | (10.30) |

Apart from significant chunk of revenue from SIL, SIL was continuously providing financial support to the Open Media Network Private Limited. In FY 2020, Open Media Network Private Limited converted the loan received from SIL to equity shares of INR 69.75 crore.

Recent Qualified Institutional Placement

To grow its core business, in 2021, SIL raised INR 750 crore through Qualified Institutional Placement. The funds will be used primarily for the acquisition of content music across multiple Indian languages, inorganic growth through acquisition to plug gaps in the content line-up and for general corporate purpose including but not limited to pursuing new business opportunities, and acquisitions. Most of the allottees were global fund houses.

Conclusion:

The key rationale behind this demerger is to focus on growing the core business of SIL and fulfilling the long-standing demand of shareholders. Demerging the entire Carvaan may not be suitable as it uses the music library owned by the SIL, thus management decided to demerge only E-Commerce distribution arm.

Significant part of the demerged undertaking will constitute investment in other RPSG group companies and with insignificant revenue. In the present scenario, though apparently, it is a demerger of “E-commerce Distribution Business” and loss-making publishing business through subsidiary with huge capital, fact is it is mainly investments in other listed group entities. Going ahead, promoters may delist the resulting company or merge with other group entity. Meanwhile, SIL shareholders are cherishing the announcement. Going ahead, SIL will not provide any support to the loss-making magazine business and its return on capital employed and free cash flow will reflect its core business performance.

Such a well written article, makes it very easy to understand the demerger, the rationale behind the demerger and what consititutes the demerged entity . Thank you Aniruddha!